Australiaâs economic conditions continued to expand but at a slower than anticipated pace in the Pre-election Economic and financial outlook amid weak momentum in the global economic conditions as well as the domestic challenges of rapid climate change.

The anticipated fall in iron ore prices has led the government to reduce the nominal (without adjusting for inflation) GDP forecast by 1½ percentage points to 2¼ per cent in 2020-21; however, the mid-year budget report predicts Nominal GDP to grow by 3¼ per cent in 2019-20.

The GDP growth during the first three quarters of the year 2019 remained relatively strong as compared to the second half of the year 2018, and the budget report anticipates the Real GDP to be 2¼ per cent in 2019-20 before strengthening to 2¾ per cent in 2020-21.

Iron ore, which is a key commodity that is exported, is anticipated to hamper the domestic economic conditions if the prices reach the estimated mark of USD 55 a tonne by the end of the June 2020 quarter.

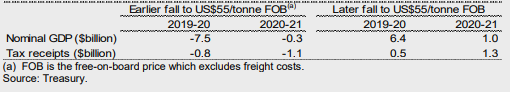

Sensitivity Analysis for Iron Ore Prices

The budget report mentions that if the prices immediately fall to USD 55 a tonne, the nominal GDP would lose around $7.5 billion in 2019-20 and $0.3 billion in 2020-21, which would further negatively impact the flow-on the company tax receipts, anticipated to drop by $0.8 billion in 2019-20 and $1.1 billion in 2020-21.

Source: MYEFO

While the mid-year budget report predicts, the iron ore prices to fall during the second quarter of the year 2020, the prices are currently gaining momentum over robust demand across the steel mills in China.

To Understand the Background, Do Read: Iron Ore Comes to a Halt as Steel Mills Recalibrate Inventory

Steel prices are hovering around the observed prices at the beginning of the year, which is prompting the Chinese steel mills to secure the supply of iron ore proactively. The recently reported iron ore inventory across the 35 significant Chinese ports stood 0.15 per cent less, as compared to the previously reported period, at 113.33 million tonnes (as on 13 December 2019).

The drop in iron ore inventory coupled with robust demand supported the iron ore prices, and in the status quo, the environmental curbs across the steel hubs in China is relatively lowering the steel inventory to support the steel prices.

As on 13 December 2019, the steel inventory in China fell by 0.65 per cent to stand at 8.69 million tonnes, which supported the steel prices, which reached the level of USD 456 a tonne (steel rebar as on 13 December 2019) again.

Whatâs Ahead? And Impact of Chinese Lunar Holidays

The market participants believe that the high operational profitability provided by the high steel prices in the global market, coupled with the approaching holiday seasons could support the iron ore prices, as the mills are anticipated to restock raw material to ramp up the production.

However, the current bans across the steel-making provinces in China is a potential risk to the market projections of an increase in iron ore prices, and investors should monitor the stance of the local government, as an ease in pollution curb, could support the iron ore prices and vice-versa.

Australian Miners and Iron Ore Long-Term Trend

Domestic iron ore mining companies are the direct beneficiaries of the spiked iron ore prices in China, as China is the primary consumer of the Australian supply chain. Iron ore prices initially spiked due to the sudden disruption in the supply chain caused by the suspension of Vale- a Brazilian iron ore behemoth and tropical cyclone Veronica in Australia, which disrupted operations at the Pilbara Region- a hub for iron ore supply.

The spiked prices coupled with IMO 2020, provided huge benefit to the iron ore mining companies. However, the restoration of the supply chain- with Vale back in operations and Pilbara Region up and running, could diminish the realised prices of iron ore for the iron ore mining companies.

Benefits of IMO 2020 to Australian Miners- Iron ore hits 5-year high as exports slump; IMO 2020 beneficial for the Australian Miners

Shareholders Value Growth

Fortescue Metals Group Limited (ASX:FMG)

The company realised an average price of USD 65 per dry metric tonne in FY2019 (year ended 30 June 2019), which in turn, supported the revenue, which stood at USD 9,965 million, up by around 44.70 per cent against the revenue of USD 6,887 in FY2018.

The higher iron ore prices supported the balance sheet despite a 1 per cent decline in the shipments. FMG shipped 167.7 million wet metric tonnes of iron ore in FY2019 as compared to the shipment of 169.8 million wet metric tonnes in FY2018.

The spike in iron ore prices improved the profitability of the company, and FMG decided to reward the shareholders. FMG distributed a total dividend of $1.14 a share in FY2019, up by almost 400 per cent against its FY2018 dividend of $0.23 a share.

Likewise, the share price of the company appreciated significantly from the low of $4.360 (in June 2018) to $9.180 (high in June 2019), which underpinned a price appreciation of over 110 per cent in a year. Further, the share price has appreciated by over 27 per cent in the past 6 months to currently trade at $10.830 (as on 17 December 2019).

To conclude, the iron ore prices largely impact the pure-play iron ore miners, and the single-commodity (iron ore) mining companies could witness a large impact of anticipated average price of USD 55 a tonne; however, depending upon the production capabilities, the iron ore mining companies could become the upcoming cash cows for the dividend investors, a case currently being presented by the coal mining companies on ASX.

To Know More, Do Read: Need Dividend from Mining Stocks? Coal Miners Well Positioned to meet your Dividend needs

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.