Platinum and palladium are soaring in the international market amidst the rush for precious metals. The ASX-listed Palladium and Platinum group metals miners (PGMs) are gaining strong attention over the bull rally in the underlying real assets.

While platinum futures are currently trading at US$954.50, palladium futures are trading around US$1632.30 (as on 23 September 2019 06:12 PM AEST).

Palladium is now at a record high levels and is even expensive than gold due to its scarcity down the production line. Palladium production mainly comes from Russia as a by-product of nickel and platinum production.

While the global stance to curb the emission and transit into zero-emission has supported the prices of both platinum and palladium amid their use as a conversion catalyst, the scarcity of palladium led to the prices to skyrocket.

The Emergence of Fuel Cell

The fuel cell electric vehicles are gaining momentum in China and Japan to overcome long-distance issues with pure electric vehicle engines. The hybrid cell technology, which combines a fuel cell and a battery cell is witnessing strong support from the government of both China and Japan along with EV, as part of a multi-drivetrain solution to achieve zero on-road emissions.

To Know More, Do Read: Chinaâs Demand Is Pushing Up Palladium And Platinum

The stringent initiatives taken by these governments and high investment from the private sector is propelling the demand for both platinum and palladium; however, the increasing difference between platinum and palladium could again shift the automobile industry to substitute palladium with platinum, which has lost significant value in the past.

To Know More, Do Read: Why Did Platinum Prices Fall From $1100 Mark?

Platinum Demand and Supply Scenario

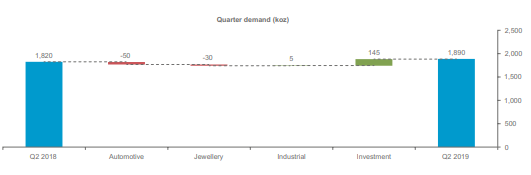

The total demand for platinum during the second quarter of the year 2019 increased by 4 per cent on a yearly basis amid higher inflows from ETFs. In 2019, the World Platinum Investment council anticipates the annual demand for platinum to grow by 9 per cent due to strong investment demand.

(Source: WPIC)

During the second quarter of the year 2019, the total supply and mine supply were 1 per cent and 2 per cent lower on a y-o-y basis.

What to Expect Ahead?

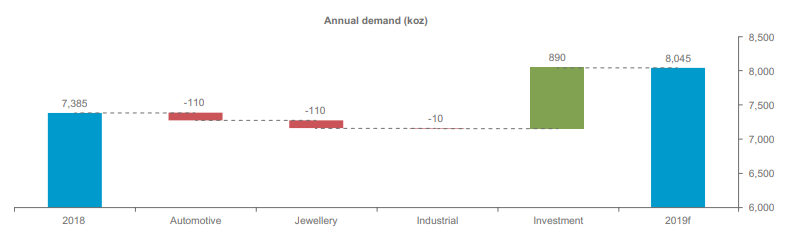

The WPIC revised the 2019 forecast to a surplus of 345 Koz, which in turn, is 30 Koz down from the previously forecasted surplus if 375 Koz amid a strong increase in investment demand.

The total demand for platinum is anticipated to increase by 9 per cent against the previous year demand, and WPIC mentioned that the first half (2019) investment demand of 855 Koz (720 Koz from ETFs and 135 Koz from bar and coins) supports a conservative investment demand forecast for 2019 of 905 Koz.

However, the total supply is also anticipated to increase by 4 per cent over 2018 with an increase in both mining supply and recycling.

The refined production is estimated to inch up by 5 per cent, and the recycling production is forecasted to increase by 3 per cent.

(Source: WPIC)

ASX-Listed PGMs Miners

Panoramic Resources Limited (ASX: PAN)

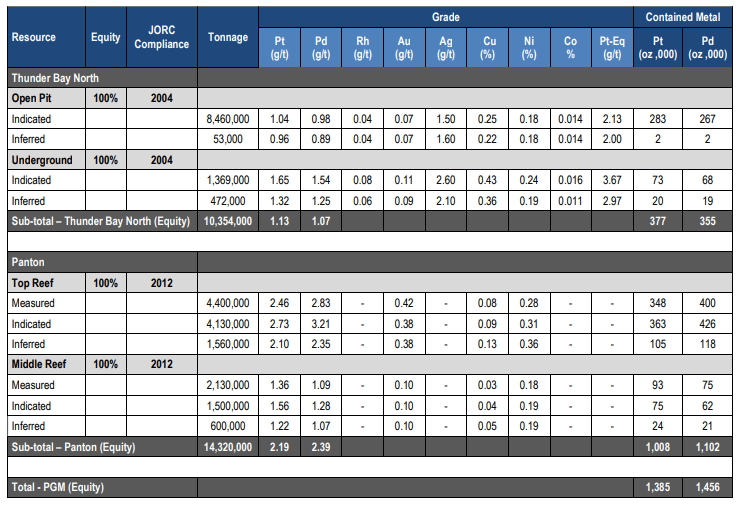

Panoramic is a diversified miner with exposure to nickel, gold and PGMs. The company holds two PGMs projects, namely, Panton PGM and Thunder Bay North PGM.

Panton PGM Project

The project of the company is 60km north to the Halls Creek, East Kimberley Region, Western Australia. The project contains a resource of 14.32 million tonnes with an average grade of 2.19 g/t of platinum, 2.39 g/t of palladium, and 0.31 g/t of gold on granted mining leases.

The Top Reef tenement of the project contains 4.40 million tonnes of Measured Resources, 4.13 million tonnes of Indicated Resources, and 1.56 million tonnes of Inferred Resources.

The Middle Reef tenement of the project contains 2.13 million tonnes of Measured resources, 1.50 million tonnes of Indicated Resources, and 0.6 million tonnes of Inferred Resources.

The overall resources account for ~ 2 million ounces of platinum and palladium.

To Know the Significance of the Mineral Resources, Do Read: Smart Ways To Invest In A Commodity Stock

Thunder Bay North PGM Project

The Thunder Bay North PGM project of the company is about 50km north-northeast of Thunder Bay in north-west Ontario, Canada.

The project contains a resource of 10.35 million tonnes with an average grade of 1.13 g/t of platinum, 1.07 g/t of palladium.

The open-pit of the project contains 8.46 million tonnes of Indicated Resources and 53,000 tonnes of Inferred Resources.

The Underground of the project contains over 1.36 million tonnes of Indicated Resources and 0.47 million tonnes of Inferred Resources.

The detailed resource profile of the companyâs PGMs tenements are as below:

(Source: Companyâs Report)

The shares of the company last traded at A$0.315 (as on 23 September 2019), up by 3.28 per cent against previous close on ASX.

Platina Resources Limited (ASX: PGM)

The company is into the core exploration and development of precious metals resource including gold, platinum and palladium. The PGMs prospect of the company includes:

- Skaergaard gold and PGM project

- Qialivarteerpik multi-element project

- Munni Munni PGM and gold project

Munni Munni PGM and gold project

The PGM and gold project of the company is in the Pilbara region, Western Australia, and is among one of Australiaâs most substantial PGM occurrences. The prospect includes a total resource of 23.6 million tonnes with an average grade of 1.1 g/t of gold and 1.5 g/t of platinum.

The company entered into a binding agreement with Artemis Resources (ASX: ARV) in 2015 and provided Karratha Metals Pty Ltd (a subsidiary of ARV) an opportunity to earn a 70 per cent interest in the Mining Leases held by the company via expending A$750,000 in exploration over a three-year period.

Skaergaard gold and PGM project

Skaergaard, which is on the east coast of Greenland which contains the worldâs largest undeveloped palladium and gold resources with an Indicated and Inferred Mineral Resource estimate of 203 Mt with an average grade of 1.33 g/t of palladium and 0.88 g/t gold.

The share of the company last traded at A$0.029 (as on 23 September 2019), unchanged against its previous close on ASX.

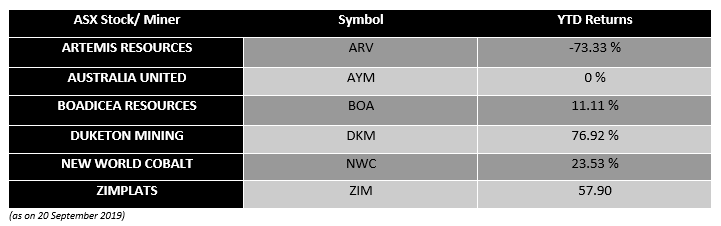

From many other ASX-listed players with exposure to platinum and palladium, the few are as below:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.