The iron ore prices inched up today after few Chinese mills rushed up to take advantage of the previous drop in steelmaking raw material price.

The 62% graded iron ore on Chicago Mercantile Exchange rose 0.21% to trade at US$ 98.59 (as on 30th May 2019 AEST 6:27 PM), as compared to its previous close of US$ 98.38.

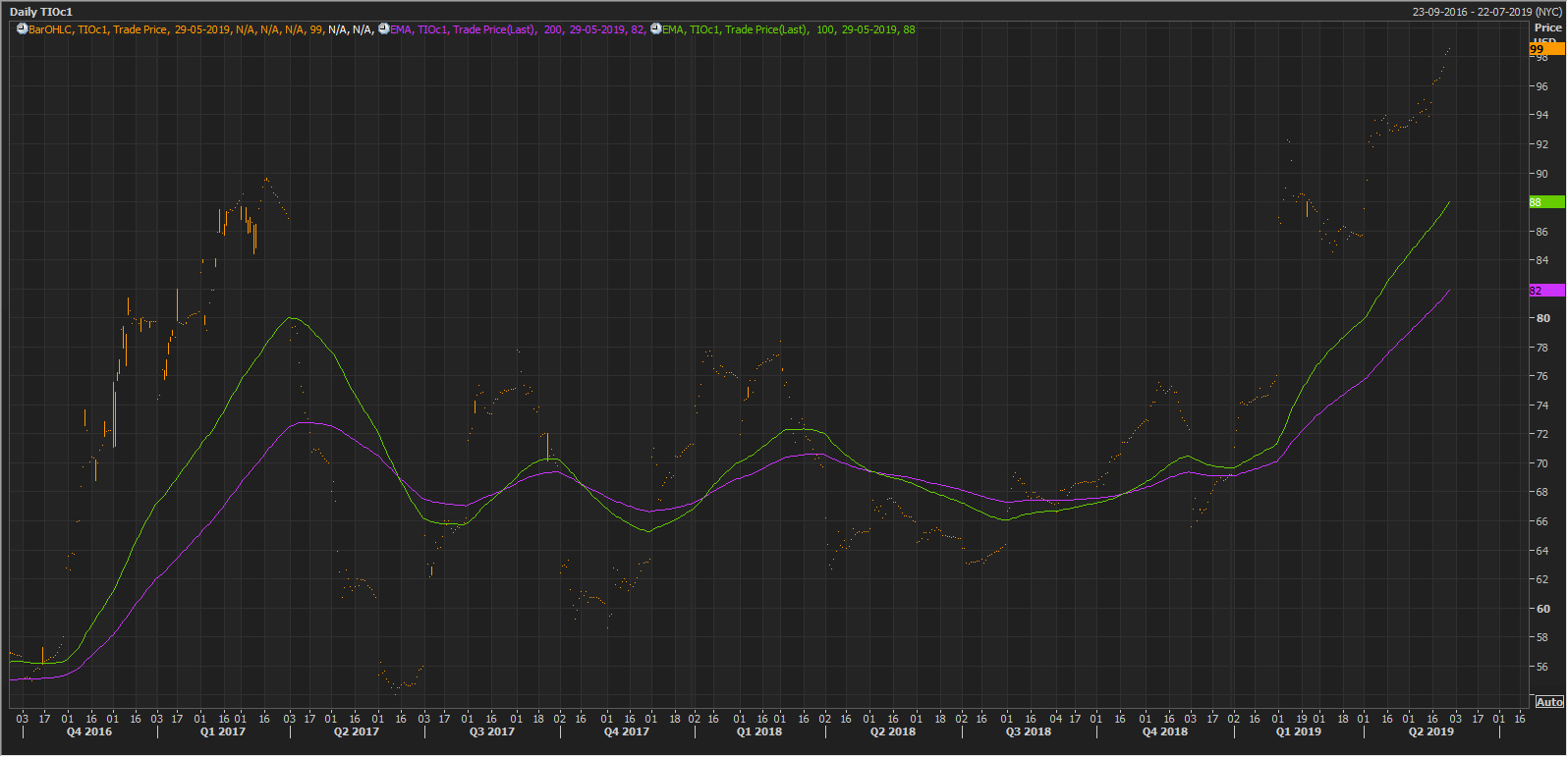

Tioc1 Daily Chart (Source: Thomson Reuters)

Tioc1 Daily Chart (Source: Thomson Reuters)

The market participants are expecting the iron ore prices to inch up further amid supply shortage in the global market and a decline in steel inventory in the domestic market of China.

As per the data, the steel inventory in China declined to 12.66 million tonnes (as on 24th May 2019), down by 3.83% as compared to its previously reported level.

Apart from a decline in inventory, few mills in China entered the period of maintenance. Hunan Valin Iron & Steel, a state-owned mill in China has decided to put the production of all lines of the cold-rolled coil into maintenance from 1st June to 10th June. The production loss due to upcoming maintenance is expected by the market to be at 50,000 metric tonnes of the cold-rolled coil and an estimated production loss of 50,000 metric tonnes of rebar steel.

The share prices of significant Australian miners such as Rio Tinto, BHP Billiton, Fortescue Metals, witnessed a drop in the share prices today.

The share prices of Rio Tinto (ASX: RIO), which were previously hovering around its 52-week high dropped significantly from the level of A$104.530 (Dayâs close on 29th May 2019) to the level of A$101.050 (Dayâs low today). The shares ended the dayâs session at the low of the day at A$101.050, down by 3.329 per cent as compared to its previous close.

Another mammoth miner, BHP Billiton (ASX: BHP), a company with high ESG consideration, followed the same trajectory, and the share prices dropped from the level of A$38.560 (Dayâs close on 29th May 2019) to the level of A$37.650 (Dayâs low today). The shares ended the dayâs session on a negative note at A$37.700, down by 1.721% as compared to its previous close.

The share prices of Fortescue Metals Group Limited (ASX: FMG), dropped from the level of A$8.520 (Dayâs close on 29th May 2019) to the level of A$7.970 (Dayâs low today). The share prices of the company ended the dayâs session at A$7.980, down by 3.739% as compared to its previous close.

However, the prices of few miners traded higher on ASX

The share prices of companies such as Mount Gibson, Champion Iron traded on a positive note.

Mount Gibson Iron Limited (ASX:MGX): The shares prices of the company started the dayâs session at A$1.24, higher than its previous close of A$1.235. The shares made a high of A$1.260, before settling at A$1.250, up by 1.22% as compared to its previous close.

Champion Iron Limited (ASX:CIA) : The share prices of the company started the dayâs session higher from its previous close of A$3.06 at A$3.18. The prices surged on ASX to mark a high of A$3.250, before closing at A$3.200, up by 4.58% as compared to its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.