During the last one-year, S&P/ASX 200 Industrials has generated stellar return of 20.56% irrespective of the macro slowdown and degrowth across the major sectors. Industrial sector includes companies from mining, construction activities, manufacturing etc. It is considered a recurring sector, there's less demand for them if the economy is facing downturn. On a three year and five-year perspective Industrial sector has given a return of 10.23% and 11.49% respectively. We will be discussing about the fundamentals and recent updates of few companies which are categorized under the industrial sector. These companies have decent financials with good dividend yield ratio on annualized basis.

Brambles Limited (ASX: BXB)

Brambles Limited is a leading logistics player which primarily connect people with lifeâs essentials. It provides services to the fast-moving consumer goods segments like dry food, grocery, and health and extended services to beverage, personal care, fresh produce, general manufacturing industries etc. On 23 October 2019, BXB has announced that it has issued 323,738 ordinary fully paid shares in respect of the share awards issued under the various Brambles Employee Share Plans.

Recently, on 21 October 2019, the company informed that it has bought back 111,173 number of shares at a price consideration of $1,330,084.89 under its share buy-back program. The company till date has already purchased back 3,419,897 shares and may add a maximum of 236,580,103 more shares.

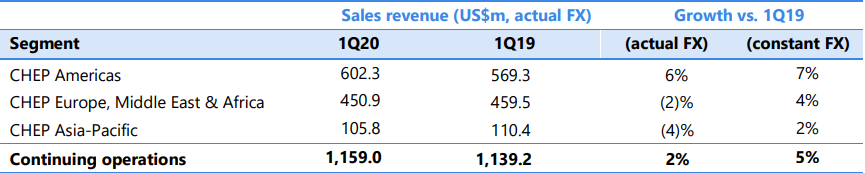

Q1FY20 Operating Highlights for the period ended on 30 September 2019: BXB declared its Q1FY20 three-months results wherein the company reported sales revenue from continues operations at US$ 1,159 million, up 2% at actual FX rates. CHEP Americas reported sales at US$ 602.3 million as compared to US$ 569.3 million on pcp on actual FX terms. The higher sales were driven by higher price realisation across the region particularly in South America due to the rollover benefit from the region. During the quarter the company reported good progress with the US automation and procurement programs. CHEP Europe, Middle East & Africa reported revenue of US$ 450.9 million, down 2% y-o-y on actual FX terms. This segment witnessed modest price realization while the volumes remained flat due to flat economic conditions in Europe. CHEP Asia-Pacific posted revenues at US$ 105.8 million as compared to US$ 110.4 million in Q1FY19 and the segment witnessed lower RPC volumes following a contract loss in Australia.

Q1FY20 Segment Performance (Source: Companyâs Reports)

Outlook: The company expects ~1% margin improvement in each of FY20, FY21 and FY22 from US automation. The management guided that the FY20 margin is expected to remain like FY19 while they are expecting sales growth at the lower end of our mid-single digit and underlying profit is expected in line with, or marginally higher than the sales growth, taking the impact of the new leasing standard, AASB 16.

Stock Update: The Stock of BXB ended the day at $12.230, up 0.991% as on 25 October 2019. The stock has a market capitalisation of $18.96 billion and a dividend yield of 2.39%. The stock is available at a price to earnings (P/E) multiples of 9.24x.

Transurban Group (ASX: TCL)

Transurban Group owns, builds and operates toll roads and intelligent transport systems across several geographies such as Australia and North America. Recently the company informed change of directorâs interest wherein one of its directors named Louis Scott Charlton has acquired 257,502 number of shares.

Q1FY20 Operating Highlights for the period ending 30 September 2019: TCL announced its first quarter results for FY20 wherein the company reported ~1.8% increase in average daily traffic (ADT) depicting growth achieved across all markets. During the quarter, the company reported Sydney average daily trips (ADT) at 838,000 trips, increased by 2.1% while average workday traffic grew by 1.5% followed by 2.8% growth in average weekend/public holiday traffic. TCL posted 2.8% growth in car traffic while large vehicle traffic witnessed a decrease by 4.5% during the quarter. In the Melbourne segment, ADT came in at 860,000 transactions, increased by 0.6% on account of weaker growth in overall traffic on CityLink. The traffic in the region remain weak primarily due to the tapering of the ramp-up associated with the widening of Western Link followed by the disruption associated with the West Gate Tunnel and congestion on Southern Link and softer economic conditions. Brisbane reported ADT at 425,000 trips, grew 2.7% where car traffic was up by 2.7% on y-o-y and large vehicle traffic grew by 2.8% during the quarter. In the North America segment, the company reported ADT at 156,000 trips, grew 4.5% on y-o-y basis. The segment witnessed 11.5% increase in average dynamic toll price at US$ 9.37 on the 95 Express Lanes while in the 495 Express Lanes average dynamic toll price came in at US$ 5.52 depicting 3% y-o-y increase.

Stock Update: The stock of TCL ended 25 October 2019 at $14.710 with a market capitalization of $40.34 billion. The stock is available at P/E of 219.240x while the stock has an annualized dividend yield of 4.08%.

Sydney Airport (ASX: SYD)

Sydney Airport is engaged in cross operating activities attached to the Airport and related services.

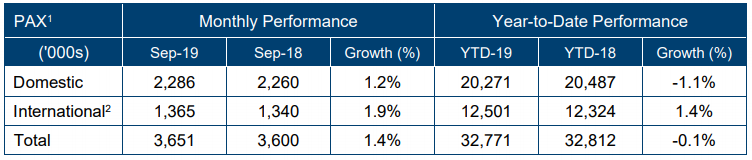

Traffic Performance for September 2019: SYD released its traffic performance figures for the month of September 2019 wherein the company showed traffic at 3.65 million, grew 1.4% from September 2018. The international segment reported number at 1.365 million as compared to 1.340 million from September 2018. During the month, SYD reported domestic traffic at 2.286 million, grew 1.2% from prior corresponding month. The Company reported double digit growth (11.2%) from September 2018 in flights coming from India aided by strong tourism growth from India. The company will focus on the growth potential from the tourism segment. One of the major highlights of the quarter was the air services agreement between Australia and Nepal where, the business witnessed strong passenger growth during the month. In the Indonesia segment, the business reported a stellar growth of 16.1% from September 2018. On a year to date performance basis, SYD reported traffic at 32.771 million, depicting a slowdown of 0.1%.

Air Traffic performance for September 2019 (Source: Companyâs Reports)

Stock Update: The stock of SYD ended 25 October 2019 at $8.850 with a market capitalization of $19.72 billion. The stock is available at P/E of 48.02x while the stock has an annualized dividend yield of 4.54%. The stock has delivered decent returns of 6.27% and 14.29% during the last three-months and six-months, respectively.

Aurizon Holdings Limited (ASX: AZJ)

Aurizon Holdings Limited operates as a rail transporter and focuses on heavy haul freight. It operates as the worldâs biggest coal rail network linking the mines to ports for export markets. The company is also engaged in business activities like general and containerized freight businesses. On 23 October 2019, AZJ has reported that it has purchased 1,069,025 ordinary shares at a price consideration between $5.770 to $5.880 under the buy back.

Recently, AZJ reported 1% growth in Coal volumes at 52.8 mt during the September 2019 quarter. Coal NTK during the quarter remained at 12.4 billion with no change from its previous corresponding quarter. Bulk volumes during the quarter came in at 11.6 mt, grew 1% on pcp terms. The company reported Bulk NTK at 2.4 billion as compared to 2.3 billion in September 2018 quarter driven by stronger demand in Bulk West, offset in part by lower iron ore volumes with the cessation of the Mt Gibson contract. The company reported Total Rail Volumes at 64.4 mt, grew 1% form precious corresponding quarter on account of increased volumes in both coal and bulk.

Guidance: As per the Management guidance, coal volume is expected to remain in between 220-230 mt.

Stock Update: The stock of SYD ended 25 October 2019 at $5.870 with a market capitalization of $11.71 billion. The stock is quoting at P/E of 24.48x and the stock has an annualized dividend yield of 4.06%. The stock has delivered decent returns of 6.35% and 23.11% during the last three-months and six-months, respectively.

Cimic Group Limited (ASX: CIM)

Cimic Group Limited is engaged in project development and contracting services across Australia and also focuses on construction, mining and maintenance services. Queensland Government selected Broad Construction along with CIM to develop stages 1 and 2 of the new Inner-City South State Secondary College in Dutton Park, Brisbane. CIM also updated that the above project will add approx. $110 million of revenues.

Operating Highlights for the 9 months ended on 30 September 2019: CIM reported NPAT at $573 million, up by 2% y-o-y, PBT margin of 7.3% and EBIT margin at 8.2%. The company also reported stable revenue of $10.7 billion. It has operating cash flow of $811 million and holds a strong financial position with net cash of $826 million.

Stock Update: The stock of CIM ended 25 October 2019 at $34.260 with a market capitalization of $10.55 billion. The stock is quoting at P/E of 13.46x while the annualized dividend yield stands at 4.06%. The stock has delivered returns of -8.72% and -34.27% during the last three-months and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.