With multiple innovations and changes occurring in the payments system, Australia is rapidly turning towards a digital economy. From cash and cheques to smart cards, mobile wallets, point of sale machines and Peer to Peer (P2P) applications, there has been a considerable transformation in the Australian payment system over the last few years.

Australians are increasingly opting for more convenient and newer payment solutions over traditional modes of payments, backed by the introduction of numerous technology-focused firms in the banking and financial services sector.

The RBA has recently declared a submission on financial technology and regulatory technology to the Senate Select Committee, discussing different changes taking place in the country’s payments system. Let’s discuss some of the key highlights of the submission below:

Technological Innovation Transitioning the Payment System

Australia has observed a significant growth in electronic payments to date, with a rising use of credit and debit cards for lower-value payments. The evolution of new technologies has enabled an extensive acceptance of ‘tap and go’ card payments, accounting for about 80 per cent of consumer card transactions at the point of sale currently.

In comparison to the other countries, the per person card usage is relatively higher in Australia, which is well-supported by the growth of the e-commerce industry.

Some of the recent technological innovations observed by the nation are as follows:

Digital Wallets or Mobile Payment Platforms: The introduction of digital wallets has made the nation’s payment system more simplified by offering greater security and convenience to the cardholders. The digital wallet applications offered by Samsung, Google and Apple, have gained immense popularity, enabling contactless payments at the point of sale. Moreover, these wallets have provided an extra layer of security with biometrics.

‘Buy now, pay later’ (BNPL) Services: Another mode of payment which is commonly used by Australians are ‘Buy now, pay later’ (BNPL) services. It enables the customers to buy goods and services without paying at the same point of time via zero- or low-interest instalments to the BNPL provider, usually over 1–2 months.

Afterpay Limited (ASX:APT) is the most famous BNPL service provider in the nation, followed by ZIP Co Limited (ASX:Z1P). Some new entrants in the country’s BNPL space include Splitit Payments Ltd (ASX:SPT), Openpay Group Ltd (ASX:OPY) and Sezzle Inc (ASX:SZL), which has recently received approval for its California lending license.

In-app Payments: Australians are also commonly using in-app payments for meal delivery and ride-hailing services, which embed the payment in a transaction, attaining customer details once and then eliminating the requirement for authorisation of the following individual transactions.

Online Providers of International Money Transfers: Another mode of payment widely accepted by the countrymen is the online transfer of money across the world. Such facility eliminates conventional correspondent banking processes by accumulating and dispersing funds throughout countries via local bank accounts, providing faster and cheaper money transfers than several banks.

Australia’s Fast Retail Payments System - New Payments Platform (NPP)

The introduction of NPP or New Payments Platform in early 2018 has allowed the Australians to send and receive electronic account-to-account transfers on a 24/7 basis, with cash accessibility in real time.

Operated and owned by NPP Australia Limited, the NPP offers the clearing and settlement infrastructure via which financial organisations can offer their business, government and household customers with the power to make versatile, data-rich and fast payments.

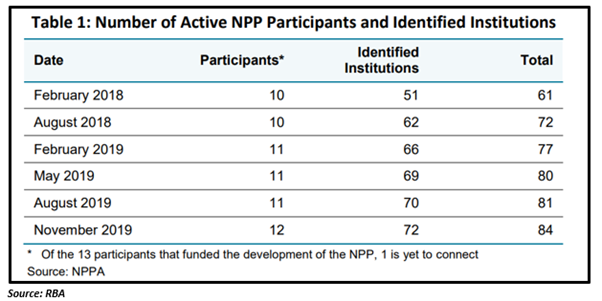

As in January 2020, about 80 financial institutions provide NPP payment services to end users, which is higher than around 60 recorded at launch. These institutions comprise many smaller financial institutions, institutions that take part directly in the NPP and a small number of non-bank payment providers that approach the platform indirectly as recognised institutions using the services of other sponsoring direct participant or a wholesale aggregator.

It is worth noting that on an annualised basis, around 16 NPP transactions per person were recorded in November 2019, relative to about 120 transactions per person for the former direct entry system.

This might be because many new players still have confidence in the existing payments system participants and payment system infrastructure to facilitate payments.

As per the RBA, though the NPP transaction volumes are yet very less relative to other retail payment systems in the nation, the adoption of the NPP is progressing at least as fast as occurred for some similar fast payment systems that were introduced in other countries.

Australian Payment System - Well Regulated by the RBA

The RBA, the principal regulator of the nation’s payment system creates the payments system policy in such a way that:

- The risk in the financial system is controlled,

- The efficiency of the payments system is promoted, and

- The competition in the market for payment services is encouraged.

It is imperative to note that though the nation’s payment system is subject to the RBA’s regulation, the central bank has placed some reliance on industry self-regulation, imposing regulations only where it finds it necessary for the public and where the industry has been unwilling or unable to address the central bank’s concerns.

Moreover, the nation’s central bank does not impose any authorisation or licensing requirements for a payment service provider. Due to this, a fintech desiring to offer retail payment services in the nation is not required to acquire any authorisation or licence from the RBA to operate, while it may have some requirements with other financial regulators, like ASIC.

Should RBA Issue a Digital Currency?

A key question that has remained under discussion with the evolution of technology is that whether central banks should introduce central bank digital currency (CBDC) as a new form of electronic money or not.

The RBA’s recent submission mentioned the following potential benefits of issuing a CBDC fully integrated within a blockchain platform:

- It can facilitate payments between the participants 24/7 and in real time without depending on external payment systems. This will enable the speed, cost and robustness of payments.

- It can allow ‘atomic’ transactions more easily. Such kind of transaction involves the execution of either all parts of the transaction or none at all. This can also help to lessen settlement risk as the asset, and its corresponding payment can be exchanged simultaneously.

- It can enable new kinds of ‘programmable money’, which involves the ability to add conditions to how income can be transferred or spent, which could be automatically performed, without the necessity for a trusted third party.

Besides mentioning these benefits, the central bank noted that issuing a CBDC for households might not result in a positive outcome. This is so because households already have decent access to digital money by way of commercial bank deposits that offer payment services, which can result in lesser demand for CBDC.

Also, the bank recognised that even if CBDC attains greater demand, it might facilitate bank runs. The RBA intends to carefully consider the implications of CBDC for the structure of the financial system.

Though these developments are still under discussion, one cannot overlook that the payment banking services are broadly defining the feature of a financial institution in Australia, which is set to observe a drastically changed landscape in the near future.

In a nutshell, the numerous technological innovations and changes occurring in the nation’s payments system holds the potential to foster productivity in the larger economy, supporting the nation’s switch to becoming a digital economy.