Report released by a company in every three months highlighting its activities during the period, financial position and upcoming plans along with other key details is termed as quarterly report.

In this article, we would be discussing four stocks that have recently released their quarterly reports.

Wingara AG Limited

Wingara AG Limited (ASX:WNR), which is a developer as well as operator of key infrastructure assets in the food supply chain, released its quarterly results for the period ended 30 June 2019 on 30 July 2019. WNR owns as well as operates value-add, mid-stream assets for the processing, storage and marketing of premium agriculture produce for exporting through JC Tanloden (JCT) and Austco Polar Cold Storage (APCS).

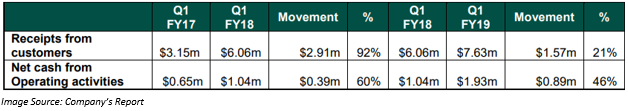

During the reported quarter, the company registered strong growth in customer receipts. In Q1 FY2019, receipts from customers increased by 21% to $ 7.63 million as compared to the previous corresponding period. At the Epsom production site, JCT started upgrades. On the other hand, APCS completed stage 1 of the energy efficiency program.

The net cash inflow from the operating activities of the company was $ 1.927 million in the quarter. The major cash inflow was through the receipts from customers, while the major cash outflow from the operating activities was in the form of product manufacturing & operating costs, Hay purchases as well as staff costs.

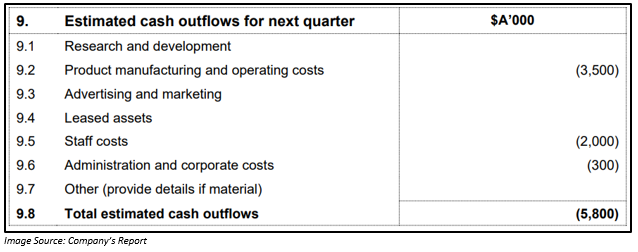

Its net cash outflow due to investing activities stood at $ 0.425 million. Through the financing activities of the company, there was a net cash outflow of $ 0.908 million, which was due to the repayment of the borrowings. By the end of the Q1 FY2019, Wingara AG had net cash and cash equivalents worth $ 1.247 million. Estimated cash outflow in the next quarter is $ 5.8 million.

Stock Information: The price of the shares of WNR, by the end of the dayâs trading on 31 July 2019 was $ 0.300. It has a market cap of $ 31.53 million and 105.11 million outstanding shares.

Grange Resources Limited

Magnetite producer, Grange Resources Limited (ASX: GRR), on 29 July 2019, released its quarterly report for the period ended 30 June 2019. As highlighted in the past, the second quarter remained challenging for the company with low production, followed by low product sales. The operations team had commenced opportune maintenance work on time and focused on the reduction on the west wall, which would offer the subsequent area of access to the Main Ore Zone in the near-term.

The underground feasibility study is progressing well, while the Exploration Decline development is also being carried out as per the plan, according to the market update.

Production:

Total concentrate produced in the June 2019 quarter was 373,347 tonnes, while weight recovery reached 26.8%. The Pellet production which was 453kt in the March 2019 quarter declined in the June 2019 quarter to 402kt.

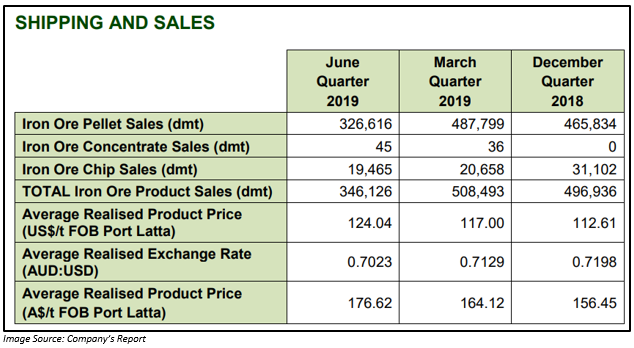

Shipping and Sales:

There was also a fall in the sale of Iron Ore Pellet from 487,799 dmt in the March quarter to 326,616 dmt in the June quarter. There was a significant fall in the total iron ore product sales from 508,493 dmt in Q1 2019 to 346,126 dmt in Q2 2019. The average price of the product that was realised during the quarter was US$124.04/t (FOB Port Latta), up by 6.02% as compared to the March 2019 quarter.

The cash and liquid investments during the reported quarter were $ 149.63 million ($ 207.01 million in Q1 2019) and trade receivables of $ 24.88 ($ 17.50 million in Q1 2019). Significant outlays of $ 18.30 million was made during the quarter on capital projects. Income tax payment of $ 24.95 million was made for FY2018. The company expects an improved cash balance in the upcoming quarter as a result of improved shipment and production.

On 30 July 2019, the company made an announcement, under which it provided a production update on the Savage River magnetite iron ore mine in Tasmania. The company was successful in establishing access to the Main Ore Zone from the west wall of North Pit and started the mining process of high-grade ore. It would lead to full production rates, expected to run for 2H 2019. The Exploration Decline is continuing as per the plan and is expected to complete by the end of 2019. The prefeasibility study for the underground project is under progress.

Stock Information: The price of the shares of GRR, by the end of the dayâs trading on 31 July 2019, was $ 0.250, up 2.041% as compared to its previous closing price. It has a market cap of $ 283.55 million and 1.16 billion outstanding shares.

Horizon Oil Limited

Horizon Oil Limited (ASX: HZN), an ASX-listed oil & gas exploration, development and production company, on 30 July 2019, released its quarterly results for the period ended 30 June 2019. The companyâs revenue for FY2019 was US$ 126.7 million, up by 19.4% as compared to FY2018. In the June 2019 quarter, the company generated revenue worth US$ 30.3 million. The net operating cash flow increased by 23% to US$ 92.6 million in the financial year 2019 as compared to FY2018.

Assets (Source: Companyâs Website)

The company made a repayment of the senior debt facility worth US$ 35.2 million during the June 2019 quarter. The position of the companyâs net debt as at 30 June 2019 was US$ 28 million, which represented a 68% fall from 30 June 2018. Horizon Oil also finalised recovery of outstanding insurance claims related to repair works at Maari. Its cash position as at 30 June 2019 stood at US$ 21.5 million.

The annual sales of 1.87 million barrels for FY2019 was up by 13% when compared with the same period a year ago. The average realised oil price was US$ 67.90/bbl, which was exclusive of hedge settlements. In the June 2019 quarter, there were sales of total 432,493 bbls at an average realised oil price of US$ 73.41/bbl, which was inclusive of hedge settlements. The production of 1.6 million barrels during FY2019 represented a 22% increase in the production from FY2018. The June quarterly production was up by 3.1% to 407,453 bbls. The operating cost of the company during the June 2019 quarter was below US$ 20/bbl.

Stock Information: The price of the shares of HZN, by the end of the dayâs trading on 31 July 2019, was $ 0.120. It has a market cap of $ 156.24 million and 1.3 billion outstanding shares.

Argosy Minerals Limited

Argosy Minerals Limited (ASX: AGY), an ASX listed company that holds 77.5% stake in Rincon Lithium Project in Argentina, on 30 July 2019 released its quarterly results for the period ended 30 June 2019.

The company during the period, continued with its fast-track development strategy at its flagship project, Rincon and was able to attain a substantial milestones which include the beginning of the lithium carbonate (Li2CO3) production operations from the industrial scale pilot plant, in order to supply high-value product into executed Sales Agreement. With this, the company was able to join the exclusive list of international lithium carbonate producers.

With the chemical process being tested, it was proven that AGY could produce Li2CO3 product with more than 99.5% grade. The company, at present is working proactively to evaluate and contemplating new projects under the lithium sector, where it could use its experience as well as its expertise. For this purpose, AGY is currently going through the evaluation process and is amid the process of related discussions.

Other than this, the company is awaiting approvals on the progress of approximately 2,000tpa commercial operation module Li2CO3 processing plant as well as related operational works at its Rincon project. Also, the company is in the process of preparing applications for the approval of full-scale 10,000tpa operation project development.

The company also conducted the processing work related to the high purity lithium hydroxide (LiOH) at the pilot plant, as well as an internal laboratory for the sample testing. Based on the laboratory analysis, it was found that 56.84% LiOH content value has 99.61% purity of lithium hydroxide monohydrate.

Financial Highlights:

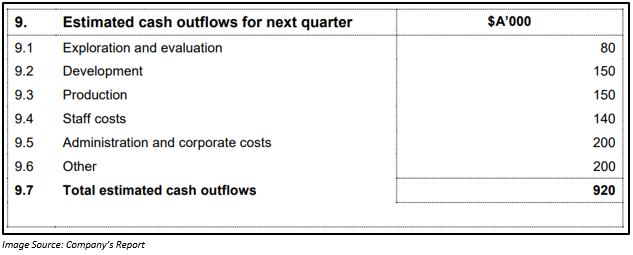

On the financial front, for the quarter ended 30 June 2019, the company used A$0.620 million in operating activities and A$0.546 in investing activities. The net cash inflow through the financing activities of the company was A$8.276 million. The cash inflow was from the issue of shares. Some of which was held in the trust in the previous quarter. By the end of the June 2019 quarter, the company had a cash balance of A$7.625 million. Estimated cash outflow in the September 2019 quarter would be A$0.920 million.

Stock Information: The price of the shares of AGY, by the end of the trading session, on 31 July 2019 was A$0.11, down by 4.348% as compared to its previous closing price.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.