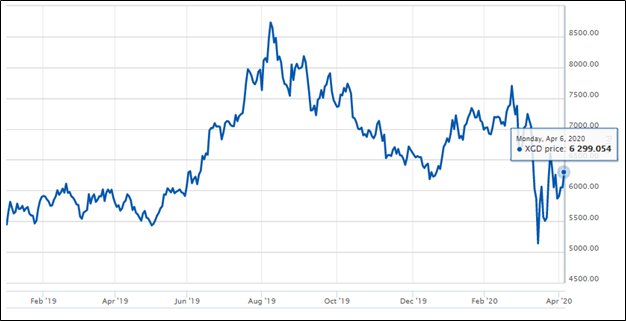

The beginning of 2020 witnessed more fluctuation in gold prices than the previous year. Last year, S&P/ASX All Ordinaries Gold index price rallied 60% higher from 5447.9932 in January 2019 to 8730.165 points, as on 8 August 2019. Later, it fell to the lowest during the year, i.e. 6185.674, by 29% from its maximum in 127 days. However, in the ongoing year, index price dropped by 33% from its maximum A$7700.201 on 24 February 2020 to lowest A$5140.916 on 16 March 2020, i.e. in mere 21 days.

Post reaching its lowest in 2020, the index price rippled between 6608.798 on 25 March and 5907.418 points on 1 April 2020. The recent S&P/ASX All Ordinaries Gold index price was 6299.054 points, as on 6 April 2020.

Source: Australian Stock Exchange

The surge of 13% in the index price to 7700.201 at the start of the year was due to the impact of COVID-19 between 2 January to 24 February 2020. Having said that, it seems that the price of gold is likely to be fluctuating in near term post the COVID-19 eradication, correcting the economy. However, the market rebound is subject to other economic factors creating global turmoil for example relation between the US and China, due to the presence of racism and Chinese reciprocation in the US because of Coronavirus or the US Presidential election to mention a few.

Interesting Read: Glittery are not always Gold, Time to Muse Over This.

In the milieu of which it is quintessential to glance through the gold stocks which can be watched in 2020. For the same, stocks have been selected on a random basis, keeping in focus that COVID-19 has not affected the business operations of a Company.

Saracen Mineral Holdings Limited (ASX: SAR): Saracen is an ASX listed gold mining company with its assets in Kalgoorlie. The production guidance in this crisis has been notified by SAR as 500koz in FY20 and 600koz in FY21.

In the last three months and five days stock returned 14.08% and 10.35% respectively. The share price in 2020 increased by 36% from A$3.32 on 2 January 2020 to maximum A$4.5 on 24 February 2020, however, the stock price later fell by 35% from its maximum to A$2.91 on 16 March 2020. The price later fluctuated between A$3.66 to A$2.97 on 18-23 March 2020, and later increased by 36% to A$4.05 on 6 April 2020.

The stock last traded at A$4.15 on 07 April 2020, up by 2.469 percent from its last close, with a P/E ratio of 29.18x and EPS of A$0.139. Its 52 weeks high and 52 weeks low stands at A$4.659 and A$2.423, respectively, and has a market cap of A$4.47 billion. The total outstanding share of the Company is 1.1 billion.

Silver Lake Resources Limited (ASX: SLR): Silver Lake has two operating assets the Mount Monger and Deflector in WA. On 3 April 2020, the Company updated its shareholder that there was no material impact on its operations due to COVID-19. Also, its FY20 guidance remains the same as announced previously, i.e. 230,000 – 240,000oz of gold and 2,500 of copper sales in FY20.

In the last three months and five day, SLR stock returned 3.6% and 4.35% respectively. The share price in 2020 increased by 34% from A$1.34 on 2 January 2020 to maximum A$1.795 on 27 February 2020; however, the price later fell by 45% from its maximum to A$1.045 on 16 March 2020. The price then increased to A$1.52 on 25 March 2020, and after that fluctuated to land at A$1.44 on 6 April 2020.

The stock last traded at A$1.510 on 07 April 2020, moving up by 4.861% compared to its last close, with a P/E ratio of 25.09 and EPS of A$0.057. Its 52 weeks high and 52 weeks low stand at A$1.795 and A$0.715, respectively, and has a market cap of A$1.27 billion. The total outstanding share of the Company is 879.84 million.

St Barbara Limited (ASX: SBM): St Barbara is an Australian listed gold producer and explorer. The Company has Leonora operations in WA, Simberi in PNG and Atlantic operations in Canada. SBM on 31 March 2020 announced that all the three regions have been able to operate, produce and even transported gold at the time of global crisis caused by COVID-19.

In the last three months and five days duration, SBM stock returned (22.54%) and 3.29% respectively. The share price in 2020 increased by 10% from A$2.73 on 2 January 2020 to maximum A$3 on 24 February 2020; though the price later fell by 45% from its maximum to A$1.665 on 16 March 2020. The price later rebounded to A$2.27 as noted on 30 March 2020, and then fell to A$2.2 on 6 April 2020.

The stock last traded at A$2.36 on 07 April 2020, rising up by 7.273 % from its previous close, with a P/E ratio of 13.18x and EPS of A$0.167. Its 52 weeks high and 52 weeks low stand at A$4.055 and A$1.615, respectively, and has a market cap of A$1.55 billion. The total outstanding share of the Company is 703.09 million.

Evolution Mining Limited (ASX: EVN): Evolution Mining is the third-largest ASX listed gold mining company. It has five operations, three in QLD, one in NSW and the last one located in WA. EVN updated the market that there has not been a material impact on the Company's activities due to COVID-19 or any cross-border travel restrictions since Evolution's 97% workforce of Cracow resides in QLD only. The production guidance for FY20 stands at 725koz.

In the last three months and five days stock returned 8.67% and 11.52% respectively. The share price in 2020 increased by 22% from A$3.75 on 2 January 2020 to maximum A$4.56 on 24 February 2020; later, the price fell by 26% from its maximum to A$3.36 on 16 March 2020. The price later rebounded rippling to A$4.39 as on 25 March 2020, and later fluctuated to land at A$4.26 on 6 April 2020.

The stock last traded at A$4.400 on 07 April 2020, moving up by 3.286% compared its previous close, with a P/E ratio of 26.38x and EPS of A$0.162. Its 52 weeks high and 52 weeks low stand at A$5.585 and A$3.040, respectively, and has a market cap of A$7.26 billion. The total outstanding share of the Company is 1.7 billion.

Resolute Mining Limited (ASX: RSG): Resolute Mining is an ASX listed gold mining company with its assets present in West Africa. On 26 Mach 2020, Resolute updated the market that there was an impact on the Company's processing facility caused by COVID-19 spread and government’s restriction. The production guidance for 2020 has been noted at 430,000oz of gold at an AISC of US$980/oz.

In the last three months and five days of stock returned (33.59%) and 4.94% respectively. The share price in 2020 remain almost constant by showing an increment of only 1% from A$1.235 on 2 January 2020 to A$1.25 on 24 February 2020; the price later fell by 50% from its maximum to A$0.62 on 16 March 2020. The later price rebounds rippling to A$0.925 as on 30 March 2020 and later fluctuated to land at A$0.85 on 6 April 2020.

The stock traded at A$0.88 on 07 April 2020, up by 3.529% compared to its previous close and has negative EPS of A$0.070. Its 52 weeks high and 52 weeks low stand at A$2.12 and A$0.605, respectively, and has a market cap of A$898.53 million. The total outstanding share of the Company is 1.06 billion.

Must Read: Stance for Metals Post COVID-19 Shock.