Nobody wants to keep all eggs in one basket, and this applies to building one’s portfolio also. When one of the sectors is booming, generally all stocks that are included within the sector also rise, but what if the sector is not performing well. Here comes the significance of the term which many fund managers use- Diversification. Diversification is a common technique a fund manager uses to hedge against losses in a bear market. It is a fund management strategy that mixes different investments in a single portfolio in order to diversify the portfolio and yield a higher return. It also reduces the risk one could carry by holding one type of stock in his portfolio.

Let’s look at five stocks to watch out for.

Cimic Group Limited (ASX:CIM)

The company is into mineral processing, infrastructure construction, mining, maintenance, operations and other services. It is engaged in construction and engineering services.

Appointment of CEO

The company has promoted Juan Santamaria to CEO and MD. This transition was from Managing Director of CPB Contractors and became applicable from 5 February 2020. The current CEO, Michael Wright, has assumed a new leadership role within the company, which will be announced soon.

CIMIC Reports its FY19 Performance

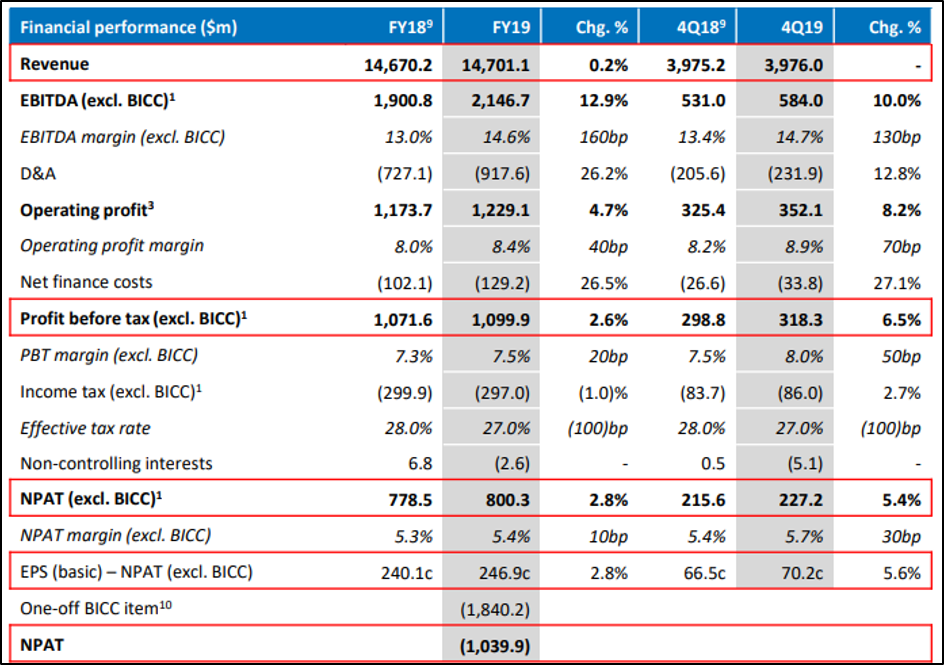

The company reported statutory NPAT of $(1.0) billion and NPAT (excl. BICC) of $800 million, up 3% YoY. Revenue stood at $14.7 billion with stable operating profit, PBT and NPAT margins of 8.4%, 7.5% and 5.4% respectively (excl. BICC).

Other key highlights:

- Operating cash flow of $1.7 billion, no variation in factoring, 80% EBITDA cash conversion (excl. BICC);

- Operating cash flow increased by more than $1.0 billion on a YOY basis, prior to factoring;

- Net cash were at $832 million with additional $3.0 billion in undrawn facilities.

The company has guided for NPAT for FY 20 in between $810 million to $850 million. The company’s focus in FY20 will be on sustainable growth and returns.

Financial Performance (Source: Company Reports)

Stock Performance

The stock of CIM closed the day’s trading at $30.01 per share on 06 February 2020, down by 2.974% from its previous closing price. The company has a market capitalisation of $10.01 billion as on 06 February 2020. The total outstanding shares of the company stood at 323.73 million, and its 52-week low and high prices are $27.800 and $51.500, respectively.

Genworth Mortgage Insurance Australia Limited (ASX: GMA)

Genworth Mortgage Insurance Australia Limited is the leading LMI provider in the Australian LMI market and a provider of capital and risk management solutions in the Australian residential mortgage market.

Appointment of New CEO and Managing Director

The company has appointed Ms. Pauline Blight-Johnston as Chief Executive Officer and Managing Director after the completion of an extensive Australian and international executive search. She assumes charge from Mr. Duncan West who was acting CEO from 1 January 2020. Mr. West will serve as non-executive director after this management reshuffle. Ms. Johnston has more than 25 years’ experience in wealth management and life insurance, at various financial services and professional firms.

Stock Performance

The stock of GMA closed the day’s trading at $3.870 per share on 6 February 2020, up by 1.842% from its previous closing price. The company has a market capitalisation of $1.57 billion as on 06 February 2020. The total outstanding shares of the company stood at 412.51 million, and its 52-week low and high prices are $1.947 and $4.125, respectively.

News Corporation (ASX: NWS)

News Corporation is a worldwide media and information services company. It is focussed on producing and distributing reliable and appealing content and new products and services.

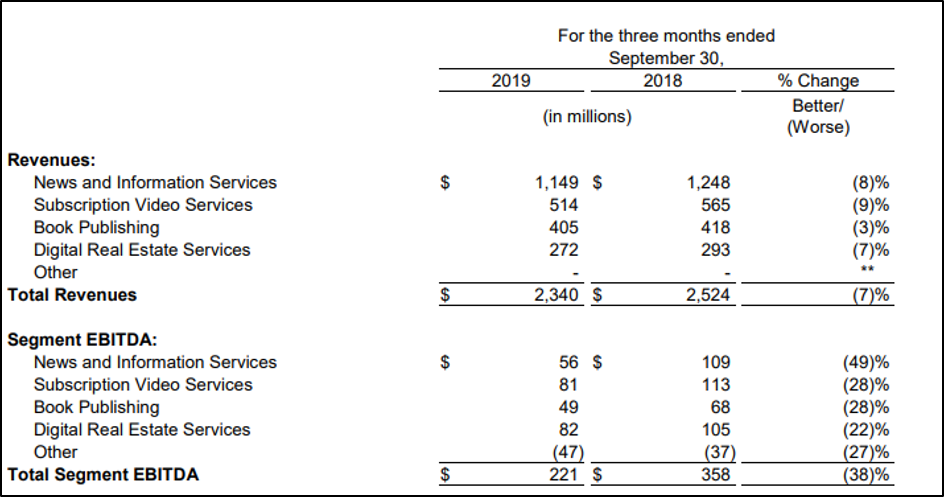

In the first quarter of FY20, the company reported revenues of $2.34 billion, down by 7% compared to $2.52 billion in the prior year, which indicates the adverse impact from currency headwinds and the lack of a one-time gain in the previous year concerning to the exit from Sun Bets.

- The company reported first quarter total segment EBITDA of $221 million, a 38% decline compared to $358 million in the prior year;

- Net loss for the quarter was ($211) million compared to net income of $128 million in the prior year;

- This reflected $273 million of non-cash impairment charges, primarily at News America Marketing;

- Adjusted EPS were $0.04 compared to $0.17 in the prior year.

Segment Review (Source: Company Reports)

Stock Performance

The stock of NWS closed the day’s trading at $21.150 per share on 06 February 2020, up by 1.293% from its previous closing price. The company has a market capitalisation of $12.29 billion as on 06 February 2020. The total outstanding shares of the company stood at 588.45 million, and its 52-week low and high prices are $16.400 and $22.320, respectively.

Dexus (ASX: DXS)

Dexus is Australia’s top real estate groups, running a great-quality Australian estate portfolio valued at $33.8 billion.

GIC increases its ownership in Dexus Australian Logistics Trust

The second tranche rights were exercised for GIC to acquire an additional 24% interest in the Dexus Australian Logistics Trust (DALT) core portfolio, increasing GIC’s total investment in DALT to 49%.

- Settlement is expected to occur on 1 April 2020, with proceeds from the sale initially being used to reduce debt and provide capacity for future funding commitments, including the company’s development pipeline;

- DALT is an open-ended private trust with an effective acquisition and development mandate, seeded with assets from the company’s existing industrial portfolio and a development landbank.

Stock Performance

The stock of DXS closed the day’s trading at $12.880 per share on 06 February 2020, down by 0.078% from its previous closing price. The company has a market capitalisation of $14.13 billion as on 06 February 2020. The total outstanding shares of the company stood at 1.1 billion, and its 52-week low and high prices are $11.360 and $13.960, respectively.

Mirvac Group (ASX: MGR)

Mirvac Group is Australia’s diversified and leading property group, with a unified expansion and asset management expertise, with 45 years of knowledge in the property business and has an unparalleled status for providing superior services and products throughout businesses.

Appointment of Company Secretary

The company has appointed Ms. Michelle Favelle as Group Company Secretary.

She was appointed in the company in February 2018 as Deputy Group Company Secretary. Her permanent appointment as Group Company Secretary is consequent to the statement on 10 December 2019 that she would be taking care of the role on a provisional basis to enable completion of a recruitment programme.

The company secures new development opportunity in Melbourne

The company has exchanged contracts to buy 7-23 Spencer Street in VIC for a total amount of $200 million, which will be paid in instalments. The company’s dream is to convert the site into a lively mixed-use urban area, including an office tower of roughly 40,000 square metres and a build-to-rent (BTR) residence tower of roughly 430 apartments and extra commercial space. Both towers will be supplemented with high-quality conveniences and retail spaces.

The purchase is in line with the company’s expansion return requirements, and agreement is anticipated to reached between March 2020 and August 2021.

Stock Performance

The stock of MGR closed the day’s trading at $3.330 per share on 06 February 2020, down by 3.198% from its previous closing price. The company has a market capitalisation of $13.53 billion as on 06 February 2020. The total outstanding shares of the company stood at 3.93 billion, and its 52-week low and high prices are $2.390 and $3.525, respectively.