Summary

- Nongfu Spring, the bottled-water company, is in news ever since it launched its IPO in Hong Kong, as its listing became a huge success.

- The pandemic year 2020 has been lucky for Nongfu Spring Chairman Zhong Shanshan, who is now amongst the wealthiest people in China.

- Nongfu Spring shares surged 85 per cent during its debut trading session on 8 September 2020.

- Hong Kong is growing fast as a business hub, and Chinese companies’ IPOs have always dominated the market.

- Recently, Hong Kong exchange activities have boomed as Chinese companies are focusing more on the stock exchange amid the escalating US-China tensions.

Technology is an ever-evolving space. With improving and ever-changing features, every time something or other new thing keeps coming.

Consequently, we have multiple stories of founders creating fortunes through such businesses. For instance, Zoom Video Communications Founder and CEO, Eric Yuan emerged as one of the wealthiest people amid the pandemic, as businesses, educational institutions and others became dependent on the Zoom video calling.

Also read: Lens Through Zoom’s Growth Story Amidst Growing Digitisation Trend

That said, here comes a different story where a traditional business based on water bottle is doing so impressively that it is creating fortunes for Chinese businessman Zhong Shanshan.

The Pandemic-Stricken Year Has Been Lucky for Zhong Shanshan

In April 2020, Zhong Shanshan ranked at No. 1,063 on the 2020 Forbes Billionaires List with a fortune of USD 2 billion, primarily due to his holding in Nongfu Spring.

Mr Shanshan is the Chairman of Nongfu Spring, which is the largest packaging water supplier in China. The company boasts a strict quality assurance system, as well as strong supply chain management, advanced equipment level and manufacturing capabilities. Nongfu Spring has expanded to produce energy drinks and vitamin waters, and its slogan is quite famous in China, which means Nongfu Spring tastes a bit sweet.

Recently, Chinese bottled water giant Nongfu Spring went public in Hong Kong with a bang. After its initial public offering in Hong Kong, surge in the share price of Nongfu Spring on 08 September 2020 made Zhong Shanshan one of the wealthiest people in China after Tencent Holdings Ltd (TCEHY) Founder Pony Ma and Alibaba Group (BABA) founder Jack Ma.

Mr Shanshan founded the firm in 1996, and he holds Nongfu Spring shares worth USD 40 billion. Adding in his shareholdings in pharmacy company, Beijing Wantai Biological Pharmacy Enterprise Company, Mr Shanshan is reportedly now worth about USD 50 billion.

Nongfu Spring IPO A Smash Hit in Hong Kong

Nongfu Spring's initial public offering emerged as a massive success in the market. The company entered the market with a roar, and the retail portion was oversubscribed by over 1,100 times. After the price surge, the company increased the number of shares allocated to the public.

The share price spiked by 85 per cent during the company’s debut trading session and closed up by 54 per cent on the Hong Kong Stock Exchange.

Hong Kong is Growing Fast as Business Hub

While the global market sentiment remained affected due to Covid-19 pandemic in 1H20, the Hong Kong Stock Exchange proved more resilient when compared with other exchanges amid the crisis.

As per a KPMG analysis, proceeds from global initial public offerings (IPOs) in the first half of 2020 registered a year-on-year decline of 8 per cent. Majority of the decline was attributed to a fall in funds raised in major American and European stock exchanges; however, this decline was partly offset by some rises in Asia.

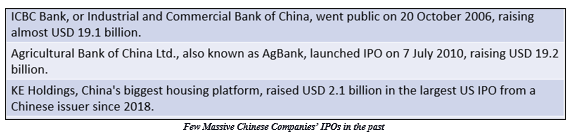

The Chinese market is doing great in terms of companies doing well with IPOs. If we talk about other popular IPOs, the first name that pops in everyone's memory is Alibaba Group's massive initial public offering (IPO) of USD 25 billion that broke all records and became the biggest IPO ever.

Hong Kong Stock Exchange Rising Amid Escalating Tensions Between the US and China

The pandemic has completely changed the dynamics of global relations. Of late, the world has witnessed growing tensions between the two biggest economies, the US and China.

The relation began to sour with the spreading of coronavirus from Wuhan, the sprawling capital of Central China’s Hubei province, to the other parts of the world. It shattered the US health system and the economy of once superpower America. America and other countries are not convinced with the way China handled the crisis in its initial days. Moreover, the US government has strongly objected to the enforcement of the new laws on Hong Kong.

In the backdrop of the souring relations between Beijing and Washington, Chinese companies are diverting their attention from overseas exchanges to the Hong Kong Stock Exchange.

So far in 2020, after the tech-heavy NASDAQ, Hong Kong has been the second-most popular listing venue on a global level.