In recent years, Buy now pay later (BNPL) industry in Australia has grown tremendously, retail finance provides the service of stage payments or credit facilities to the creditworthy consumers. This service helps the consumers to purchase expensive goods or services immediately and process the payment for the bought services over the time. Most of the BNPL users are regular in availing this service because of its easy payment method. According to one survey, there have been approximately four in five consumers, who used BNPL services within the last 12 months, and they are planning to use these arrangements again. Many consumers believe that by using buy now pay later arrangement, they can buy more expensive items, make more unplanned purchases and spend more than in the regular purchases.

With the vigorous growth of the BNPL industry, the number of merchants providing these services in Australia has increased. As per one survey conducted by Australian Securities and Investments Commission (AISC), the number of partnerships with merchants has increased 50 times and 45 times with Zip Co Limited (ASX:Z1P) previously known as ZipMoney and Afterpay (ASX:APT) respectively, by 30 June 2018 as compared to June 2016.

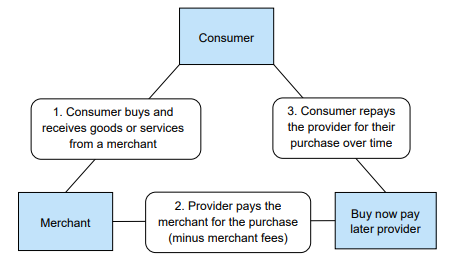

Buy now pay later (BNPL) arrangement-

A BNPL arrangement is a contract between a consumer and merchant, a contract between the merchant and buy now pay later provider and a contract between buy now pay later provider and the consumer.

Relationship between the consumer, merchant and buy now pay later provider-

Source: ASIC Report

Buy now pay later arrangement can be used for any services the consumers want to purchase, it is not restricted to the low-value purchases, the consumers can use BNPL arrangement for health care services, electronics, solar power products and also for travel. These arrangements are also available groceries at retailers such as Kmart, Big W, Target and Harris Scarfe.

Among the Australian population, BNPL service is most popular with the young adults of 21st century (60% of BNPL users were between 18 and 34 years of age group), and millennials find it as an excellent alternative option to a credit card.

According to AISC data, the number of BNPL users who used at least one service from a provider has increased to more than 2 million consumers for FY 2017-18, which was nearly 400,000 consumers in the 2015â2016 financial year.

In Australian market, there are many financial technology companies who are providing buy now pay later services. Some of the key service providers in this industry are Afterpay Touch Group Limited (ASX:APT), Flexigroup Limited (ASX:FXL), Splitit Payments Ltd (ASX:SPT) and Zip Co Limited (ASX:Z1P).

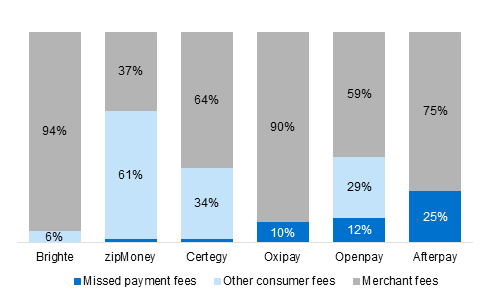

According to AISC report, the total revenue for six BNPL stocks increased to $78 million for the quarter ended 30 June 2018 from $32 million (quarter ended 30 June 2016).

Revenue of Buy now pay later providers for FY 2017-18 (Source: ASIC Report)

In this article, we are highlighting one of the Australian financial technology companies, which has recently entered in partnership with eBay Australia, the largest shopping site in the country.

Letâs zoom the lens for Afterpayâs recent highlights-

Afterpay Touch Group Limited (ASX:APT)

An ASX listed technology-driven payments company Afterpay Touch Group Limited (ASX:APT) is headquartered in Melbourne and has its operations in the US, United Kingdom and New Zealand. Afterpay Touch Group is formed after the merger of Afterpay and Touchcorp in June 2017, and after this merger, the company has become a leader in BNPL industry with more than 6 million active customers and approximately 39,000 active retail merchants.

Business Key highlights-

- The company continue its growth across the globe and the underlying global sales in the four months to 31 October 2019 was $2.7 billion, up 110% as compared to the previous corresponding period.

- At the end of October there were over 6 million customers, which is 137% up on the last corresponding period.

- Customers purchasing frequency, lifetime and the loss rate are improved, in Australian and New Zealand market customers who used Afterpayâs service in the financial year 2015-17 are now buying approximately 22x per year.

- The company has signed an agreement with Mastercard in New Zealand and Australia which would underpin the companyâs mid-term growth.

Partnership with eBay Australia-

- Afterpay has unveiled about an agreement with eBay Australiaâs marketplace, which is the largest shopping site in Australia. The services are expected to go live in the financial year 2020.

- Approximately 40,000 Australian SMBs would be able to access the Afterpay service in eBay Australia.

- With this agreement, Afterpay will be the largest online arrangement which gives rights to both companies to line up on a mutual approach which will add value to merchants.

Source: CEOâs Presentation

ANZ Market Update

- The companyâs underlying sales in the four months to 31 October 2019 was $1.9 billion.

- The key driver for the growth is in-store, which represent 23 per cent of total underlying sales in the financial year 2020 YTD which has increased from 18% in FY 2019.

- Approximately 29,000 shopfronts have Afterpay in-store, which was 23,600 for the fiscal year 2019.

- In ANZ market more than 3 million customers and 33,000 merchants are reported as at 31 October 2019.

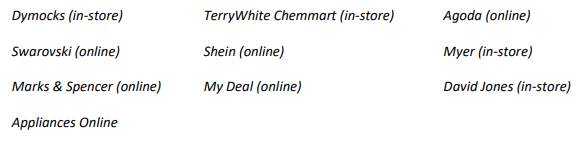

- The merchants who have recently signed with Afterpay are-

- The company has recently signed an agreement with Bupa Dental, which is Australiaâs largest corporate dental group. With this partnership, Afterpay services will be availed by >500,000 patients across over 200 dental practices around Australia.

- APT is presently offered in over 2.5k practices in both the dental and optical in the past 12 months after the launch of health care services.

United States Market Update-

- In the United States, the reported underlying merchant sales were $0.7 billion in the first four months to 31 October 2019.

- The companyâs current annualised underlying sales is noted at over $2.5 billion, which is based on October.

- Afterpay has 2.6 mn active consumers, (as recorded on 31 October this year), which is up by 51 percent from June this year.

- The highest customer acquisition on a monthly basis was recorded in the USA in October, with above 9k new consumers acquisition/day (on an average).

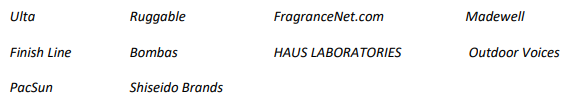

- The number of merchants is approximately 9,000 which includes of active or currently integrating merchants recorded at 31 October 2019, with some new brands such as-

UK Market Update-

- The companyâs underlying sales was more than $100 million in the four months to 31 October 2019, and the current annualised underlying sales based on October is in excess of $0.4 billion.

- In UK market, Afterpay has more than 400,000 active customers.

- Afterpay was launched in the UK market in May 2019 and though being in its nascent phase, merchant revenue margins and loss (performance) has trended positively in the YTD period.

- After the Clearpay app was introduced to the market in October, the lead generation has increased by above 0.5 mn referrals across the Clearpay website and app in the month of October.

- The company recently commenced a partnership with Mark & Spencer (M&S) which is a UK-based multinational retailer. This is one of Afterpayâs biggest merchant partnerships, and APT anticipates it to contribute substantially to its UK performance across the time period.

Stock performance-

The companyâs stock was trading at $31.400 on 14 November 2019, up by 6.912 per cent (at AEST 12:42 PM), with a daily volume of approximately 2,010,125 and a market cap of nearly $7.42 billion. The stock has a 52 weeks high price of $37.410 and a 52 weeks low price of $10.360. The company has delivered a good return of 144.75% on year to date basis and 12.23% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.