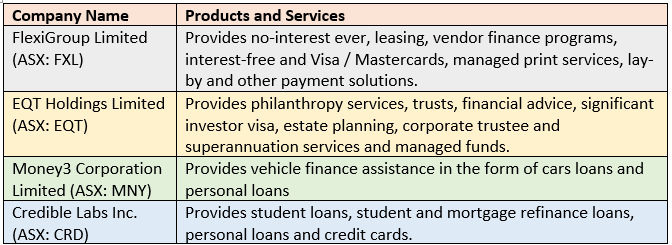

Financial companies and institutions have remained to be vital components of Australiaâs economy, and have maintained their credibility since over a century. Acknowledging this fact, let us browse through the updates of four ASX-listed financial players and study their stock behaviour: FlexiGroup Limited (ASX:FXL), EQT Holdings Limited (ASX:EQT), Money3 Corporation Limited (ASX:MNY) and Credible Labs Inc. (ASX:CRD):

FlexiGroupâs FY19 Results

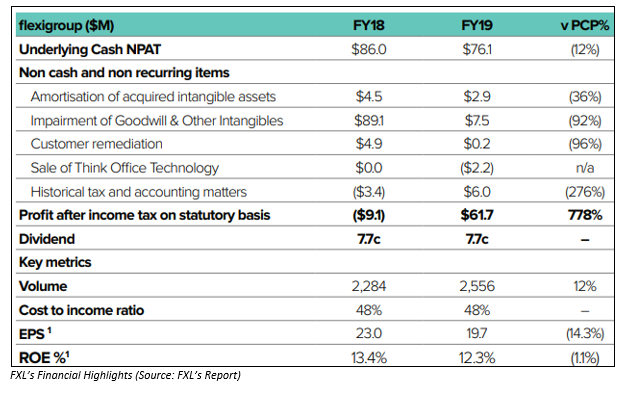

On 27 August 2019, FlexiGroup Limited (ASX:FXL) released its FY19 results, stating that it had 1.76 million active customers, up 8% on pcp and 65,000 retail partners, up 8% on pcp. The transaction volume increased 12% to $2.56 billion, with total receivables of $2.64 billion, up 11% on pcp. FXL reported an NPAT of $76.1 million, in sync with the guidance. FXL had a wholesale debt of $2.79 billion.

The Board declared a fully franked final dividend, which would be payable on 11 October 2019, of 3.85 cps, bringing the FY19 total dividend to 7.70 cps.

The company announced three products- bundll, wiired lease and wiired money. The Group had released humm: a âBuy Now Pay Laterâ product in April 2019, which was a revolutionary step towardâs FXLâs digital payments sphere. humm volumes were up 11% since launch with 1,200 app downloads per day.

The company is currently focussed on three key market segments: Buy Now Pay Later; Credit Cards; and Leasing. As an outlook, FXL aims to accelerate growth with cost reduction and deliver a robust digital platform while investing in loved brands. The volume is likely to be up 15%, catalysed by new product launches.

EQT Holdingâs FY19 Results

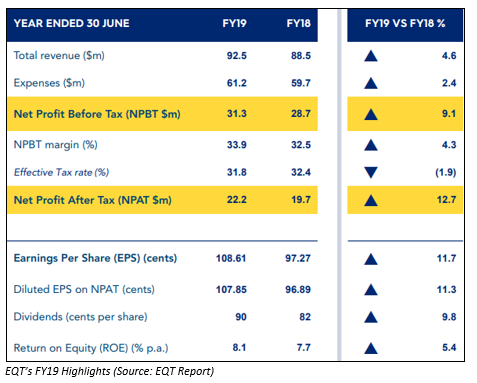

On 21 August 2019, EQT Holdings Limited (ASX: EQT), the holding company for Equity Trustees, announced its FY19 results, stating that there was a 12.7% increase in net profit to $22.2 million. The EPS was up 11% to 108.6 cents. However, FUM, administration and supervision were slightly lower to pcp and amounted to $84.9 billion. The revenue was up 4.6% to $92.5 million, expenses grew 2.4%, and the Disciplined expense management was up 2.4%. EQT had Negligible bad debts, the Debt to equity being 4.6% and the Pre-tax operating cash flow was up 12% on pcp.

The total dividend for the year was 90 cents, up 9.8% on pcp, and the Dividend payout ratio was 82.9%. The payment date for dividends is 8 October 2019.

As an outlook, the company believes that FY20 would be positive and EQT held attractive industry fundamentals with a solid pipeline of opportunities in its kitty. The earnings growth would be weighted towards 2H20. There is an aim to tap distributed ledger technology and artificial intelligence to enhance the client experience and implement superannuation trustee data warehouse along with Self-service online portals for both private clients and B2B partners. The company stated that it is well-positioned for any Brexit outcome.

Money3 Corporationâs FY19 Results

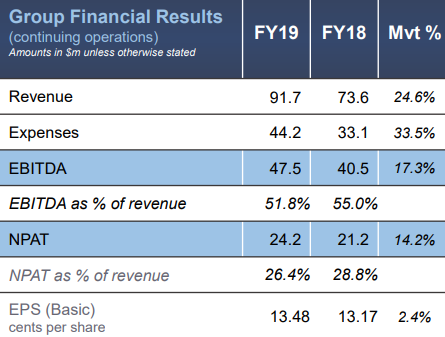

On 20 August 2019, Money3 Corporation Limited (ASX:MNY) pleasingly announced its full-year results for the year ended 30 June 2019 and tagged the year to be the year of transformation. The Groupâs normalised NPAT was $35 million, up 9.4% to pcp. Gross Loan Book valued $374 million, up 48.1%. Revenue recorded was $91.7 million, up 24.6% and Group EBITDA amounted to $47.5 million, up 17.3%.

The company had acquired New Zealand-based Go Car Finance, which enhanced its Geographical and product spread. $63.6m was added through the acquisition of Go Car Finance in MNYâs loan book.

FY19 Financial Highlights (Source: MNYâs Report)

MNY sold and exited the Small Amount Credit Contracts loans business and maintained its credit quality during the year, with ~$100 million worth capital available to fund growth in FY20. The company has a high-quality loan book with over 47k active accounts. The cash collections during FY19 were up 32.1%.

Along with these results, the company declared a final, fully franked dividend of 5 cps, taking the full-year dividend to 10 cps, which would be paid to the shareholders on 22 October 2019.

MNY is aimed at enhancing its vehicle receivables portfolio and has launched a new suite of products. It is further targeting ~30% growth in the loan book for FY20.

Credible Labsâ HSR Act Clearance

On 26 August 2019, San Francisco based Credible Labs Inc. (ASX:CRD) announced that along with Fox Corporation, it had received the notification of early termination of the waiting span under the Hart?Scott?Rodino Antitrust Improvements Act of 1976.

The notification was regarding the companyâs proposed acquisition by Fox Corporation. The notification received fulfils one of the conditions to the closing of the transactions contemplated by the Merger Agreement and Plan of Merger.

Earlier in August, CRD had announced the definitive merger agreement to be acquired by a subsidiary of Fox Corporation in a diluted equity value of almost A$585mm.

Read more about the acquisition HERE.

Shareholders are awaiting a more detailed explanation of the proposed merger transaction which would likely be addressed the notice of meeting in September with the vote on the transactions to occur in October.

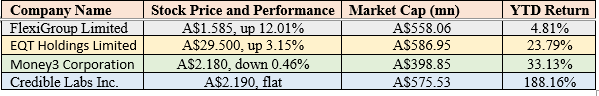

Let us now look at the stock performances of the discussed companies by the close of market trading on 27 August 2019:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.