About Penny Stocks: The stocks that have very low market capitalisation and trades for less than $1 on the ASX are generally considered penny stocks. Penny stocks can offer a huge upside if invested in with vigilance. These stocks are generally considered high risk and high return stocks because of their low price and very less liquidity in the market.

Letâs have a look at two diverse penny stocks listed on the ASX:

Fluence Corporation Limited

About the Company: Fluence Corporation Limited (ASX: FLC) is one of the top players in the wastewater, decentralised water and re-use treatment markets and it has an integrated series of services across the complete water cycle, from early-stage assessment, through design and delivery to continuing support and optimisation of water-related assets, as well as Build Own Operate Transfer (BOOT) and other repeated revenue solutions.

The company has a market capitalisation of $271.41 million as on 27 September 2019.

Source: Companyâs Website

Investment Cooperation Agreement: Fluence Corporation Limited has recently signed an agreement with The Peopleâs Government of Xinglongtai District and Liaoning Huahong New Energy Co. Limited for:

- a volume commitment by Liaoning Huahong to purchase AspiralTM and SUBRE products with a capacity of 52,500 m3/day through the end of 2021 and minimum revenue targets for 2019 and 2020;

- the establishment of a final assembly facility for its proprietary MABR products.

After this Agreement, FLC would become Liaoning Huahongâs major supplier of wastewater treatment equipment.

Fluence Receives Order for NIROBOXTM: FLC announced that it received an emergency order for five NIROBOXTM from a customer in the Middle East for drinking water. These units would be used for seawater desalination in a region with limited access to fresh and portable water. The revenue from these units would be recognised in the fourth quarter of 2019.

FLC signed an LOI with Yiyang High-Tech: FLC has signed an LOI (Letter of Intent) with the Yiyang High-tech Industrial District Management Committee aimed for building a final assembly facility for its branded aerated biofilm reactor (MABR) products. The assembly facility of NIROBOXTM will be in the Yiyang City, Hunan province.

FLC Signs First Commercial SUBRE Order in China: FLC has declared that it has implemented a contract for the transfer of a 3,000 m3/day SUBRE system in Panjin, China. In China, it is FLCâs first order created by its partner Liaoning Huahong and the companyâs first commercial SUBRE order, these units would be constructed by the Panjin City Government and will be installed in greenfield wastewater treatment plant.

Half-Yearly Performance Review: The first half of 2019 saw booking momentum and positive outlook for MABR products:

- The commercial launch of SUBRE and first commercial orders secured in Jamaica.

- 64 cumulative MABR project wins in China;

- Expect 2019 revenue from MABR products of approximately US$20 million, an increase from US$3 million in 2018;

- The commercial launch of SUBRE and first commercial orders secured in Jamaica;

- Largest individual order of 40 AspiralTM units in China from ITEST.

Guidance for Full Year:

- Secured annual recurring revenue still expected to continue to increase in 2019;

- Smart Product Solutions revenue now expected to be US$26 million, representing 18% growth over 2018;

- Sustainable EBITDA profitability still expected to occur by Q4 2019.

Stock Performance: On 27 September 2019, the FLC stock, quoted $0.490, down by 2.97 per cent from the prior close. In the last six months, the stock has generated a positive return of 12.22 percent.

DigitalX Limited

About the Company: DigitalX Limited (ASX: DCC) is a digital and blockchain asset company with offices in New York, Perth and Sydeney. The company has a wide range of services and offers asset management focused on technology, advisory services including blockchain and digital assets, blockchain consulting and development and media services.

The market capitalisation of the company stood at $17.29 million as on 27 September 2019.

Resignation and Re-appointment of Previous Directors: The companyâs Board has made significant changes in the Board of Directors team as the previous Directors resigned and Mr Toby Hicks was re-appointment to the Board as the Chair. DCC has been implementing various actions to assess and strengthen its structures to make use of its assets and technical knowledge and ensure the best outcomes for shareholders.

Key Highlights of the June Quarter:

- Acquisition of equity interest and services agreement secured with âxbullionâ, the gold-backed stable coin from Bullion Asset Management Pte Ltd;

- Legal proceedings finalised;

- Successfully raised a capital of $3.75 million underpinning strong cash and digital asset position of over US$10.5 million at quarter-end.

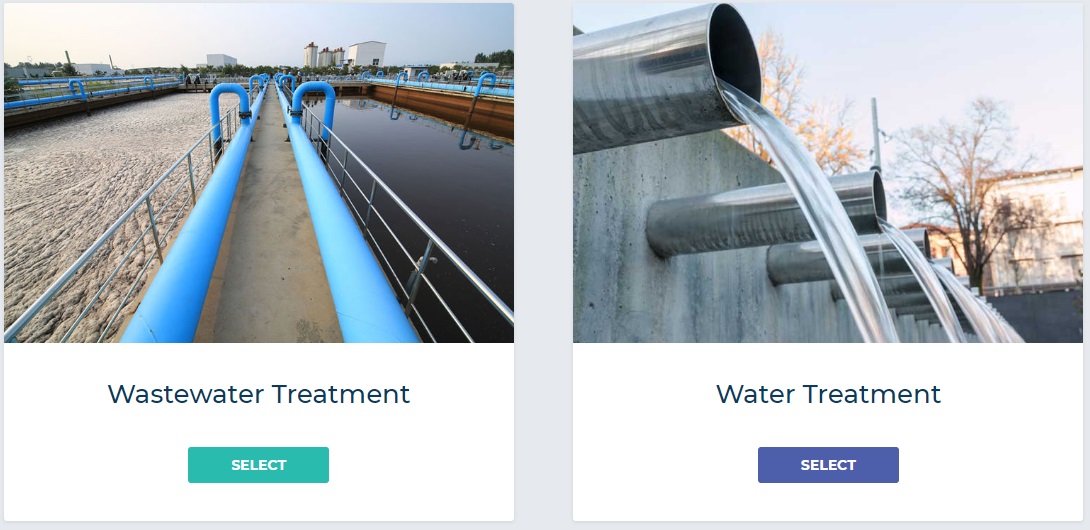

Working capital Position of the Company Source: Companyâs Report

Business Activities During the Quarter:

- Token Advisory: DigitalX continued its advisory services during the quarter. In the month of April, the company declared that it was counselling Bullion Asset Management for the launch of their gold backed stable coin, xbullion. xbullion token issuance and redemptions are recorded on the blockchain and the operation will be audited for compliance;

- Blockchain Consulting: As part of the Companyâs consulting services, the Company is engaged with several leading professional services firms and high-quality research and development companies to provide a springboard for growth in the September quarter;

- DigitalX Asset Management: The Companyâs asset management division has been in the process of completing preparations for the launch of new products based on the work of its portfolio management team. The division is close to its completion stage of an overall distribution strategy, whose primary focus is on growing its current Digital Asset Fund, as well as the new fundamental research driven products;

- Media and Education- âCoincast Mediaâ: Coincast Media provides education, public relations and content creation to the blockchain and cryptoasset market

Outlook for FY20: DigitalX expects to retain its focus on blockchain technologies with respect to the regulatory & banking environment and the ASX, and expects to have less reliance on the digital asset market in the future. DCC has started a strategic review on its strategy, which would combine all four business lines and the process for obtaining new blockchain and technology opportunities.

Stock Performance: On 27 September 2019, the DCC stock, quoted $0.029, trading flat. In the last six months period, the stock has generated a negative return of 35.56 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.