The equity market of Australia is one of the country’s most high-profile and largest financial markets. Australia’s Central Bank, Reserve Bank of Australia (RBA) proclaims that on a daily basis, approximately $5 billion in shares are traded in the Australian equity market. Moreover, the overall market capitalisation of companies listed in the country is close to a massive $2 trillion. Large well-known companies, major banks, vital resources businesses- name them, and they are easily available on the Australian Securities Exchange (ASX), Australia's primary securities exchange.

Australian Stocks Trading at Record Valuations

Of late, Australian stocks have been having a gala time. For example, on 15 January 2020, the S&P/ASX 200 climbed to a fresh high nearing 7000 points, with most sectors gaining, led by the industrial. Industrial stocks, it should be noted, have been trading at high price-to-earnings multiples and a slight increase in their earnings per share in expected in FY20.

Experts believe that the S&P/ASX 200 is on an ongoing bull run, hinted by strong gains from blue chip companies like CSL Limited (ASX: CSL), which last traded at $297.74, up by 0.418 percent from its previous close, on 15 January 2020.

The Australian market has been primarily lifted by the approaching US-China trade deal, due to be signed by 16 January 2020. We would understand factors that are propelling these records in the Australian share market, but prior to this, let’s go back to history- during the period that is being compared to the current records- 1960’s.

Why Do We Need to Discuss 1960’s Today?

1960’s in the Australian business is renowned for the mining boom. Given the industrial stocks currently are trading at their richest valuations since this mining boon period, the era does need a special mention.

The RBA states that resources stocks in Australia easily outperformed the remainder of the market in the later part of the 1960s. This was the period when the sector expanded much more rapidly, where it reached a pinnacle of more than 65 per cent of the entire market. Post the 1960’s the industrial sector, particularly the resources stocks did quite poorly, a phase which came to be known as the Poseidon Bubble.

This stock market bubble was catalysed by the discovery by Poseidon Nickel, which was in high demand for the Vietnam war, but there was a supply crunch due to supplier issues. Consequently, the price of nickel was at record levels and eventually, the price of Poseidon shares became too high for many investors, causing the bubble.

In 2020 as well, market experts opine that industrials sector could hold a few gems in the best gains on the ASX. There are emerging green shoots of a cyclical recovery after heavy headwinds throughout 2019.

What’s Propelling ASX to Record Highs?

The Australian share market is running hot and saw stocks climbing to fresh highs throughout this week. Possible factors that have maintained this momentum are as follows-

- Continued optimism towards the upcoming US corporate earnings season and improved relations between the US and China. Moreover, the phase one trade agreement pertaining to the protracted trade war is also expected shortly;

- Receding fears of consequences of the Iranian retaliation strike on Iraqi military bases;

- The Australian Bureau of Statistics (ABS) recently released the retail trade figures for November 2019, wherein retail turnover rose 0.9 per cent after a rise of 0.1 per cent in October 2019, building investor sentiment optimistically;

- According to the ABS, number of dwellings approved rose 0.8 per cent in November 2019;

- The balance on goods and services was a surplus of $5,392 million in November 2019, giving more room for the government to spend on contingent needs, which consequently propels consumer spending power;

- Moreover, rate cut expectations are finally going down, which might help the market have a better slice of consumer confidence in the days to come with more investment activity.

ASX’s Performance Today

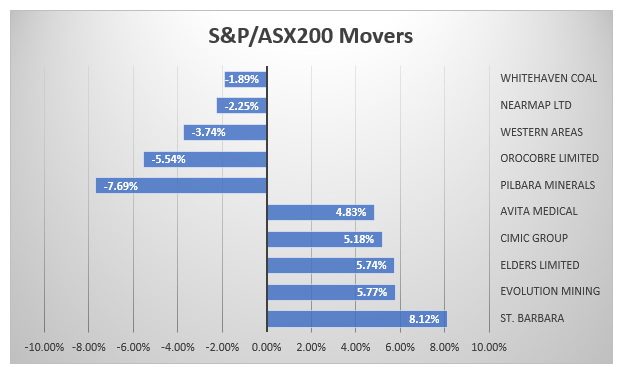

Source: ASX, Kalkine

On 15 January 2020, the benchmark S&P/ASX 200 was up by 32.6 points, or 0.5 per cent, marginally shy of the much-anticipated 7000 mark, at 6994.8. This has set a new record, as the index extends its rally over 4 per cent (so far in 2020). The above image highlights the top market movers (gains as well as declines).

With premium valuations seen across the equites in Australia, companies thriving to ramp up in a competitive space and a pertinent announcement with regards to US-China trade hovering over us, more records can be expected on the ASX in the coming days.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.