Many stocks are known for following the cycles of the economy through recession, recovery, peak and expansion. The prices of such stocks are usually affected by the systematic or macroeconomic variations in the overall economy. These stocks are referred to as âcyclical stocksâ, as their performance tends to correlate with the economy.

Below are some of the industries that are significantly affected by economic movements:

- Automobile

- Airline

- Resources

- Apparel

- Furniture Retail

- Media and Entertainment

Let us discuss each of these industries, along with relevant examples:

Automobile Industry

Car, one of the luxury good, is generally purchased by consumers during periods of economic prosperity. On the other hand, people tend to hold off on buying cars during the economic downturn (low disposable income and high unemployment).

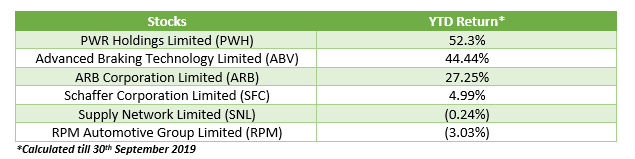

The table below summarises the list of some of the ASX-listed stocks associated with the automobile industry:

It can be seen that PWH and ABV have delivered substantial returns on a YTD basis. Both these companies have recently released their consolidated financials for the year ended 30th June 2019.

Let us take a look at the key financial highlights of these companies below:

PWR Holdings Limited (PWH)

Australian-headquartered producer and designer of vehicle cooling solutions, PWR Holdings Limited reported a revenue growth of 26 per cent in FY19 relative to the prior corresponding period. The revenue growth was majorly driven by an increase of 40 per cent in sales out of Europe. The company also recorded a Net profit after tax of $14.21 million during the period.

Advanced Braking Technology Limited (ABV)

Advanced Braking Technology Limited is a company engaged in the development, manufacture, research and commercialisation of Terra Dura Brakes, ABT Failsafe Emergency Driveline Brakes and ABT Failsafe Brakes and associated braking systems.

The company delivered an operating revenue of $6.847 million in FY19, and a revenue of $583k from other activities. The company also reported a loss after income tax of $1.713 million from continuing activities.

Airline Industry

Another industry that is classified under cyclical category is airlines. The business of the airline industry majorly depends on the economic growth of a country. It has been seen that a growing economy allows individuals to spend more on air travel and other discretionary goods.

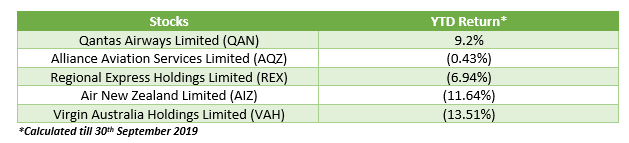

The table below summarises the list of some of the ASX-listed stocks associated with the airline industry:

One can deduce that all the companies in the table have delivered negative YTD returns except Qantas Airways Limited (QAN), the flag carrier of Australia.

Qantas reported its consolidated financials for the 12 months ended 30th June 2019 in August this year. The company recorded an Underlying PBT of $1,302 million during the period, which was $263 million less than the record set in 2017/18. The companyâs Statutory PBT was also $87 million less than the previous year, at $1,265 million.

Resources Industry

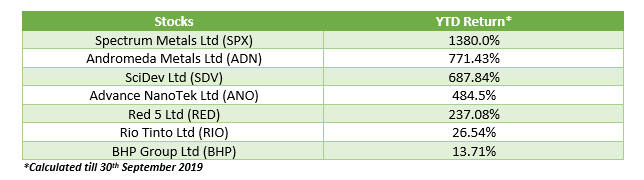

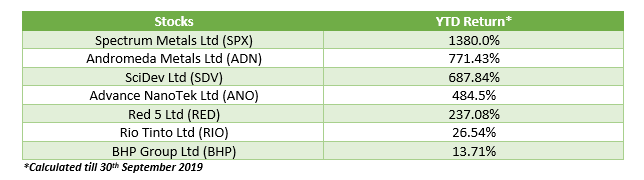

As prices of metals and minerals also move in line with the economic transitions, the stocks associated with the resources industry are also considered cyclical. The table below summarises the list of some of the ASX-listed stocks associated with the resources industry:

SPX has delivered substantial YTD return of more than 1350 per cent so far in 2019. The company announced its full year statutory accounts for the year ended 30th June 2019 in September this year. It recorded a net loss of $1.56 million in FY19 against the loss of $952k reported in the last financial year. The cash balance of the company stood at $1.46 million.

Apparel Industry

The high-end apparel stores can also be categorised under the cyclical group. During times of economic downturn, consumers usually prefer to buy clothing at discount stores. While the rich section of the people may not do so, but they do cut back on their spending.

The table below summarises the list of some of the ASX-listed stocks associated with high-end apparel industry:

Almost all the companies cited in the above table have generated negative returns on a YTD basis except City Chic Collective Limited (CCX).

The leading fashion group of Australia, City Chic reported its full year financial results for the year ended 30th June 2019 in August. The company announced a sales revenue of $148.4 million, representing a rise of 12.6 per cent on the prior corresponding period. The EBITDA of the company was 15.5 per cent up on pcp, at $24.9 million. The company recorded gross profit and PBT of $85.9 million and $21.3 million, respectively.

Furniture Retail Industry

The sale of furniture usually goes up during periods of economic expansion, as it is classified as ânon-essential goodâ. There are many companies listed on the ASX that are indulged in furniture retailing services.

The table below summarises the list of some of the ASX-listed stocks associated with furniture retailing industry:

Temple & Webster Group Ltd (TPW), that has delivered a substantial return of 87 per cent on a YTD basis, is Australiaâs largest e?commerce company in the homewares and furniture market.

The company reported solid financial results for the period ended 30th June 2019 recently. The revenue of the company was 41 per cent up on pcp, at $101.6 million. The company recorded an EBITDA of $1.1 million in FY19 against a loss of $0.7 million noted in the pcp. The gross margin of the company improved significantly to 44.6 per cent. The companyâs cash balance at the end of June 2019, was at $13.5 million.

Media and Entertainment

Being a part of the consumer discretionary sector, media and entertainment services are considered cyclical. These services are affected considerably by the peaks and troughs of business cycles.

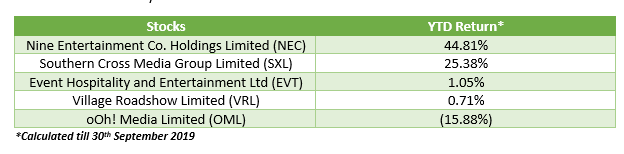

The table below summarises the list of some of the ASX-listed stocks associated with media and entertainment industry:

It can be seen that the performance of Nine Entertainment Co (NEC) has been strong so far in 2019. The company also delivered strong financial results for the year ended 30 June 2019 in August this year. The companyâs reported a 12 per cent rise on pcp in its statutory NPAT, at $234 million. The company also recorded a rise of 10 per cent in its EBITDA to $424 million on a Pro Forma basis.

It can be seen that the performance of Nine Entertainment Co (NEC) has been strong so far in 2019. The company also delivered strong financial results for the year ended 30 June 2019 in August this year. The companyâs reported a 12 per cent rise on pcp in its statutory NPAT, at $234 million. The company also recorded a rise of 10 per cent in its EBITDA to $424 million on a Pro Forma basis.

One can deduce that there are several industries, besides the one discussed in the article, that can be classified under the cyclical category. Though cyclical, the stocks of companies associated with these industries have performed differently so far in 2019. It can be seen that most of the stocks of resources sector have delivered strong performance.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)