As per lithium outlook, with the growing demand for lithium carbonate and hydroxide, used in lithium-ion batteries, demand for lithium is expected to triple by 2025. Price for lithium carbonate and lithium hydroxide as on October 31, 2019 were reported at US$10 per kilogram and US$12 per kilogram, respectively. The decline in lithium price can be mainly attributed to maro-economic concerns and changes to EV subsidies in China. With vehicle electrification, annual sales of EVs are expected to jump to over 40 Mn by 2028. Two important Australian lithium miners are Orocobre Limited and Pilbara Minerals Limited.

Orocobre Limited (ASX:ORE)

Orocobre Limited (ASX:ORE) is involved in the development, exploration and production of lithium at the Olaroz Lithium facility. Recently, the company announced that Advantage Lithium Corp. released a summary of a Pre-Feasibility Study (PFS) on the Cauchari Lithium Project to the TSXV, as per Canadian standards. This summary would be supplemented with a detailed report within 45 days. The detailed report is expected to include necessary supporting information to allow Orocobre to publish results of the PFS on the Australian Stock Exchange, compliant with the guidance provided by ASX and ASIC. The Cauchari Lithium project comprises 75% interest from Advantage and rest 25% from Orocobre.

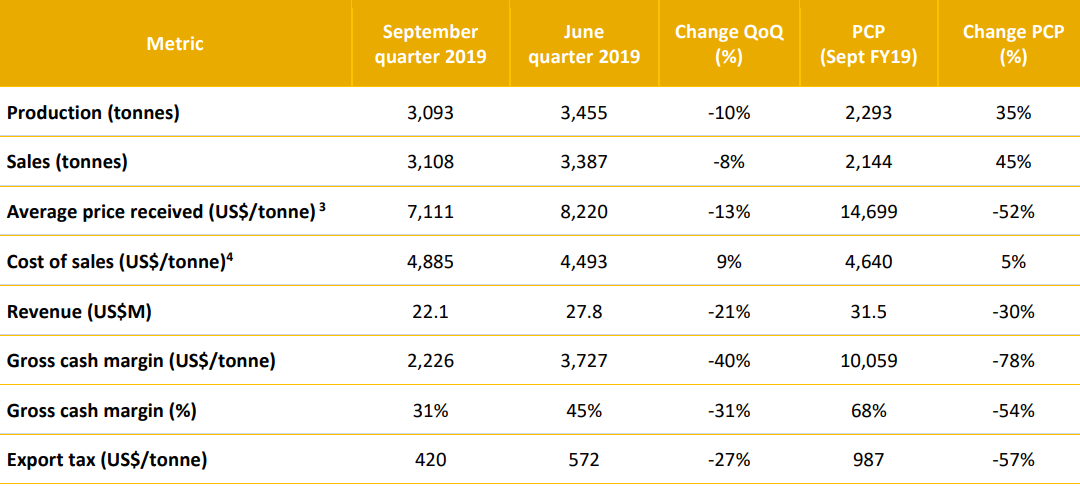

Septemberâ19 Quarter Key Highlights: Sales revenue for the period decreased by 21% (on q-o-q basis) to US$22.1 Mn, with a realised average price of US$7,111/tonne on a Free-On-Board basis (FOB). Product pricing for the quarter was below the price in the previous quarter, mainly due to current market softness. Sales volume for the quarter was reported at 3,108 tonnes, an 8% decline on quarter-on-quarter basis. Gross cash margins (excluding export tax) declined by 40% (on quarter-on-quarter basis) to US$2,226/tonne, mainly due to lower average price received, representing 31% of the revenue. Costs incurred on cash basis in the quarter was up 9% (on q-o-q basis) to US$4,885/tonne (on cost of goods sold basis). The export tax applicable since September of 2018 was excluded in the above calculation.

At the end of the period, the company held cash of US$223.5 Mn. This is after corporate costs and Cauchari Joint Venture expenditure and funding of Olaroz expansion activities. Net group cash as on September 30, 2019, was reported at US$151.2 Mn, inclusive of Sales de Jujuy S.A. (SDJ) and Borax Argentina S.A. (Borax) cash, project debt and working capital facilities.

Production for the quarter increased by 35% to 3,093 tonnes as compared to previous corresponding period. This was over and above extended maintenance activity during August 2019 at Olaroz. This shutdown involved a full five-day plant shutdown and one of the two reactor units remaining offline for the month. This record production can be attributed to strategy of new pond preparation, managing brine quality, and tailoring of production according to seasonal conditions.

Gross cash margins for the period (excluding export tax) stood at 31% or US$2,226/tonne, which is a decline of 40% on q-o-q basis and 78% on previous corresponding period (pcp). Cost of goods sold, excluding export tax, for the period was reported at US$4,885/tonne, which is an increase of 9% on q-o-q basis and 5% on pcp. This negative impact on cost can be attributed to higher cost of carried inventory sold in Q1FY20, lower production and sales volume.

Quarterly Production and Sales Update (Source: Company Reports)

FY20 Guidance: ORE expects full year production for FY20 to be at least 5% higher than FY19. The average sale price in the December quarter has been estimated to be in the range of US$6,200 - US$6,500/tonne.

Stock price performance:

On November 11, 2019 (AEST 01:20 PM), the ORE stock was trading at $2.750 with a market cap of ~$730.08 Mn. Its current PE multiple is at 9.360x. It has generated an absolute return of -40.64% for the last one year, -19.13% for the last six months, and 2.20% for the last three months.

Pilbara Minerals Limited (ASX:PLS)

Pilbara Minerals Limited (ASX:PLS) is involved in the development, operation and exploration of the Pilgangoora Lithium-Tantlum project. Recently, the company published its Septemberâ19 quarterly report, where it highlighted that as part of A$111.5 Mn equity raising to support long-term growth strategy, it secured strategic investment from Chinaâs largest EV battery manufacturer, CATL.

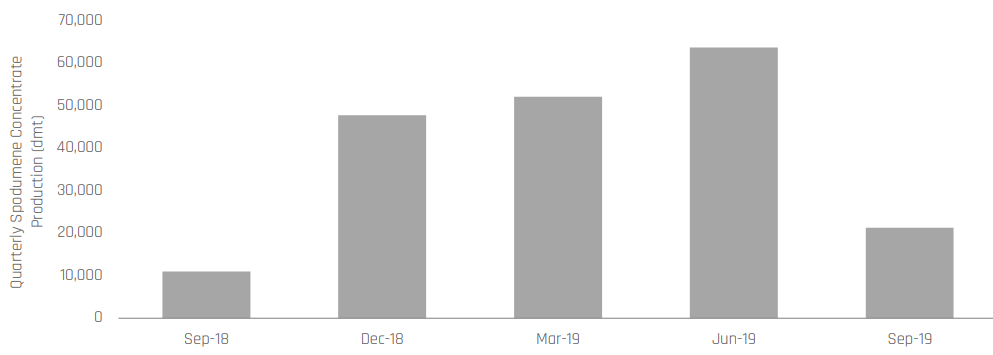

During the quarter, in response to customer requirements and current market conditions, companyâs production was moderated at the Pilgangoora project. Production of spodumene concentrate stood at 21,322 dry metric tonnes (dmt) at 6.06% Li2O as compared to 63,782 dmt in the previous quarter. Shipment of spodumene concentrate stood at 20,044 dmt including parcels of both SC6 (6% Li2O) and SC5.5 (5.5% Li2O), as compared to 43,214 dmt in the previous quarter. Tantalite concentrate sales for the quarter stood at 12,171 lbs, as compared to 38,856 lbs in the previous quarter. Subsequent to the quarter-end, first sales contract for secondary tantalite concentrate was signed for 36,500 lbs (nominally 30% Ta2O5), with delivery to occur in October 2019. As per the new offtake agreement for 20,000 dmt per annum over a period of around six years, Pilbara Minerals Limited completed its first shipment to Chinaâs Great Wall Motor Company in August 2019.

As per the ongoing project developments, PLS finished its technical studies to support an optimised and incremental expansion production capacity of Stage 2. This production capacity has a final target of 5 Mtpa, over time. Moreover, study for the revised stage 2 is expected to get completed in January 2020, which would be crucial in making investment decision in early 2020 subject to customer requirements.

The company reached to an agreement with South Korean giant, POSCO, to form an incorporated joint venture in South Korea to build and operate a 40 ktpa LCE primary lithium hydroxide downstream chemical processing facility.

Cash balance as on September 30, 2019 was reported at A$60.9 Mn, as compared to A$63.6 Mn on June 30, 2019.

Quarterly Spodumene Concentrate Production Data (Source: Company Reports)

On the stock price front

On November 11, 2019 (AEST 01:22 PM), the PLS stock was trading at $0.325 with a market cap of ~$744.94 Mn. It has generated an absolute return of -60.82% for the last one year, -55.63% for the last six months, and -27.17% for the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.