The demand for seafood is increasing across the world, driven by the numerous health benefits offered by seafood, which is an excellent source of vitamins, minerals and proteins. Although the seafood industry is a very small industry and is in a growing stage, experts expect the industry to deliver long-term gains on the path of growth.

As more and more people are becoming aware of the health benefits associated with seafood, the consumption of seafood is rising across the globe. Seafood provides vital fatty acids which contribute to vision and brain development and supports to lessen the risk of cardiovascular diseases. As per the market experts, the anticipated improvement in lifestyle and disposable income of the people are likely to drive the consumption of seafood further in the future.

Investors might be interested in betting on the expanding demand for healthy and high-protein diets. Considering this, let us discuss some seafood stocks listed on the Australian Stock Exchange (ASX) below:

Angel Seafood Holdings Ltd (ASX: AS1)

The Australian marketer, manufacturer, producer and seller of certified organic and sustainable oysters, Angel Seafood Holdings Ltd (ASX: AS1) is sustainably and organically certified company through National Association for Sustainable Agriculture, Australia and âFriends of The Seaâ organisation, respectively. The company holds nursery and oyster grow out operations in Cowell and water leases in Haslam.

The company has world leading farming practices optimising utilisation of available assets while maintaining premium product quality. It sells oysters both domestically and into premium export markets.

Angel Seafood Makes Significant Progress in FY19

Recently, Angel Seafood published its annual report for the year ended 30th June 2019 on the ASX, which highlighted the companyâs strong growth across all metrics.

Angel marked an entry into the Hong Kong export market during the fourth quarter of the financial year, achieving a significant milestone. The company commissioned Port Lincoln Export Facility in FY19, which led to the commencement of exports to Hong Kong.

The company undertook a significant investment program in FY19 that increased efficiencies, built scale in operations and substantially improved the companyâs stock profile. This included completion and commissioning of the Cowell processing facility, completion of enhancements to the Coffin Bay processing facility, the purchase of a new big vessel and multiple infrastructure refurbishments to leases.

The company reported a growth of 192 per cent in its revenue on prior year to $4.3 million in FY19, driven by oyster production of 5.3 million oysters, up from 1.9 million last year. The company acquired additional high-quality water in Cowell and Coffin Bay throughout FY19, which raised its holding capacity to 20 million oysters, with the capacity to condition more than 9 million oysters per annum.

The company also recorded a turnaround in the financial year from a loss of $1.1 million last year to a maiden net profit after tax of $305k. The profit of the company was led by the positive fair value adjustment of $1.9 million due to growth in the companyâs oyster stock profile, along with the scale benefits from the investment program.

The company had provided a guidance of 8-10 million oysters sales for the next financial year as it intends to increase oyster production and sales in FY20. It also aims to grow export channels and pursue opportunities for further growth.

AS1 traded last on 16th October 2019 at $0.2. AS1 has delivered a YTD return of 48.15 per cent and 1-year return of 29.03 per cent.

Tassal Group Limited (ASX: TGR)

The Australian-headquartered a vertically integrated Salmon grower, Tassal Group Limited (ASX: TGR) is a Salmon and Seafood processor, marketer and seller. The company manufactures and sells high quality Salmon and Seafood products for domestic Australian market and export markets. The company grows fresh, healthy and delicious Atlantic Salmon in Tasmaniaâs fresh waters and processes a broad range of seafood.

Received Major Approvals for Stage 3 Development of Proserpine Prawn Farm

In a recent update on the ASX, the company notified that it has received all major approvals from the Queensland State Government and the Whitsunday Regional Council for its Stage 3 expansion of Proserpine prawn farm.

The following approvals were received by the company:

- Aquaculture Development Approval: This approval confirms that construction and operational plans meet all necessary requirements and is issued on the advice of the Queensland Department of Agriculture and Fisheries.

- Environmental Authority: This approval specifies the environmental limits and conditions for the expanded prawn farm operation and is issued by the Queensland Department of Environment and Science.

- Development Approval: This approval enables the development of the new hatchery infrastructure and is issued by the Whitsunday Regional Council.

Tassal mentioned that it can now begin construction of Stage 3, adding the new hatchery infrastructure and 80 hectares of ponds, in readiness for stocking the extended farm in FY21. The company expects to generate $25 million EBITDA from prawns by FY21.

The company provided the total target of 270 hectares of production ponds for FY21 at Proserpine, including the 80 hectares of Stage 3 expansion. In addition, it provided a total production pond area estimate of 350 hectares with the Mission Beach and Yamba farms for FY21.

Tassal has also commenced the process for Stage 4 approvals that intends to provide the additional pond infrastructure for FY22.

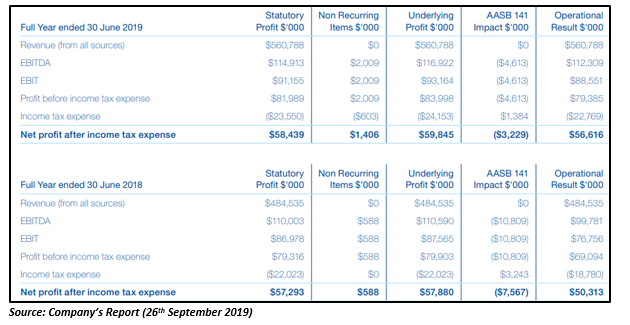

Take a look at Tassalâs financial performance in FY19 below:

TGR ended the dayâs trading at $4.19 on 18th October 2019, with a rise of 2.7 per cent relative to the last closed price. The stock has delivered negative returns of 16.22 per cent, 13.56 per cent and 3.77 per cent in the last six months, three months and one month, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.