The below-mentioned stocks have come up with significant updates today, pulling the prices up on ASX. Letâs take a closer look at each of them.

Angel Seafood Holdings Ltd (ASX:AS1)

Australia-based aquaculture company, Angel Seafood Holdings Ltd (ASX: AS1) mainly produces organic and sustainable Pacific oysters in Australia. Oysters are currently in strong demand, and the estimated value of the worldâs oyster production is approximately US$3.7 billion per year. However, Australiaâs oyster production only accounts for 0.3% of the worldâs production. The global oyster production has shown year-on-year growth since 2008.

Key factors driving growth are:

- Domestic market with record oyster prices

- Traditional domestic markets transitioning towards clean green demand

- Proven modern farming methods in nutrient-rich waters

- Key customers experiencing strong growth and soaking up additional supply

- Broader market demand for oysters means supply is the only constraint

- Alliances with export channels still in their infancy, only limited by production expansion.

Angel Seafood Holdings Limited recently received a Research and Development (R&D) Tax Incentive refund of $231,358, as announced on 21st June 2019.

The tax incentive refund is mainly for R&D activities related to the oyster nursery operations undertaken during the year ended 30th June 2018. The company has assured that it is maintaining its focus on innovation and R&D to position itself as a leader in the oyster industry. The company has also undertaken additional qualifying R&D activities during the current financial year (FY19).

Furthermore, the company also received approval for a $350,000 asset finance facility under a Hire purchase agreement with the NAB (National Australia Bank) for its newest and recently commissioned big vessel, Angel VI. The company will repay the Hire Purchase facility in 60 equal monthly instalments of $6,480.

In an operational update provided on 21st June 2019, the company has assured that its operations are progressing well for Q$ FY19, with record quarterly sales and positive operating cash flows are expected to be achieved. Moreover, the company has confirmed that its stock levels are at near capacity levels with more than 20 million healthy oysters in the water, positioning Angel for further growth in sales heading into FY20.

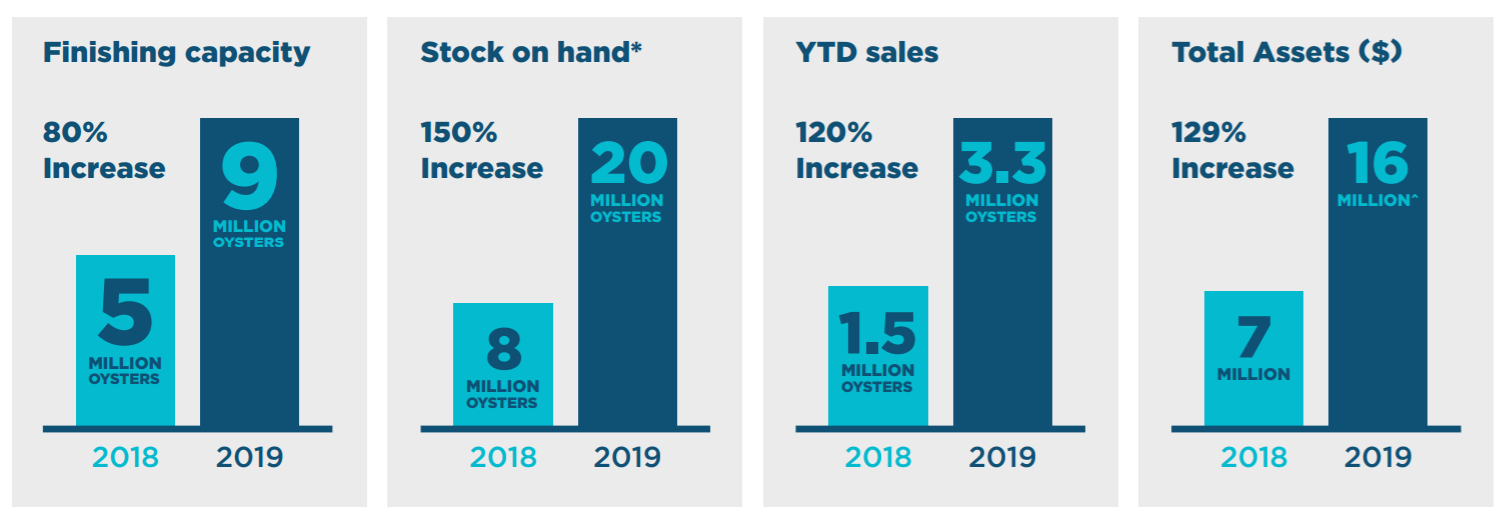

In the last one year, the company has witnessed substantial growth in its operations, sales and total assets.

Substantial growth achieved - March 2018 vs March 2019

The company achieved 120% growth in sales to Q3 YTD, with sufficient stock for additional growth for the full year. The company is currently focused on optimising oyster production to maximise sales with a relatively fixed cost base.

In the first half of FY19, the company achieved sales of $2.48 million, up 184% over the previous corresponding period.

In the half year period, the company achieved a normalised EBITDA of $271,545. The company believes that it is on track to be operationally cash flow positive for the 2019 financial year.

In the past six months, Angel Seafood Holdings Ltdâs stock has provided a return of 40.74% as on 20th June 2019. At market close on 21st June 2019, the companyâs stock was trading at a price of $0.195, up 2.632% during the intraday trade, with a market capitalisation of $25.05 million. Its 52 weeks high price stands at $0.210 and 52 weeks low price at $0.125, with an average volume of ~136,338.

Roots Sustainable Agricultural Technologies Ltd (ASX:ROO)

The stock of Roots Sustainable Agricultural Technologies Ltd (ASX: ROO) skyrocketed 30% during todayâs trading session. The company today announced that it has delivered another Root Zone Temperature Optimisation (RZTO) sale in North America for a total value of $43,450 (US$30,000). As per the release, organic producer, PRO will pay $43,450 to ROO for installing Rootsâ proprietary RZTO cooling and heating technology in growbags and pots within hoop houses of varying sizes. This marks the companyâs fourth sale in North America since March and is a testament to the companyâs success in that region. The companyâs CEO has assured that the company is keeping a close eye on increasing sales activity in North America, capitalising on the trend for outdoor and hoop house crop cultivation.

Through its disruptive, modular, cutting-edge technologies, ROO has established itself as a significant player in the Agricultural Technologies space. Since listing on ASX in 2017, the company has initiated sales in three additional territories in addition to Israel, those being China, the USA and South Korea. In two other jurisdictions Spain and Australia, the company installed "first deployments" of its root zone cooling and heating systems. Orders for heating and cooling systems in 2018 (the first year in which these sales were made) totalled $471,000 and total orders from 1st January 2019 until the date of this Prospectus (17 June 2019) totalled $528,000.

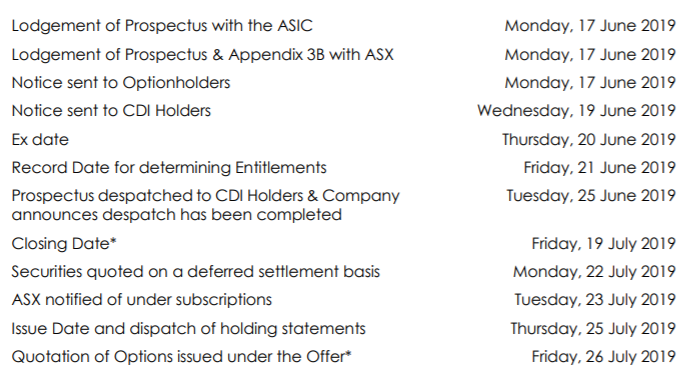

Recently, the company invited its shareholders to participate in a pro-rata non-renounceable entitlement issue of One option for every two CDIs at an issue price of $0.04 per option to raise up to approximately $1,700,752.

Timetable for the Offer (Source: Company Reports)

The funds raised from the offer will be used to expand the companyâs cannabis growers marketing and sales activity in North America as well as to broaden the companyâs sales in China and South Korea. Further, the funds will also be used towards the development of the companyâs Spanish and Australian markets and towards upgrading the system components, including smart pipes, coils, communications and agronomic field test and monitoring as well as working capital.

In the past six months, Roots Sustainable Agricultural Technologies Ltdâs stock has provided a negative return of 46.81% as on 20th June 2019. At market close on 21st June 2019, the companyâs stock was trading at a price of $0.065, with a market capitalisation of $4.25 million. Its 52 weeks high price is set at $0.365 and 52 weeks low price is set at $0.047, with an average volume of ~210,741.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.