The ASIC, on a regular interval, publishes a report that includes the list of ASX-listed companies that are targeted by short sellers in the market. In case there is an increase in short interest, there might an alert sign created amongst the market players about those specific companies. Short sellers essentially borrow a security for a period, sell them in the market, and repurchase them at a later stage and at a lower price to make money.

In this article, we have filtered the eight most shorted stocks and tried to figure out the possible reason for the same. Let us look at these stocks one by one.

Orocobre Limited (ASX:ORE)

Orocobre Limited is into the exploration and production of minerals. The company focuses on developing Lithium/Potash resources in Argentina.

The shares of Orocobre, since 24 February 2020, started falling and continued till 14 May 2020. In the past three months, the stocks have delivered a return of -43.41%. As per the report generated by ASIC on 12 May 2020, 31,834,723 shares were shorted.

Orocobre’s Q3FY2020 Highlights; Production stopped at Olaroz Lithium Facility

- During the quarter, the company’s Olaroz Lithium Facility production was stopped temporarily because of the COVID-19 quarantine restrictions imposed by the Argentine government. Quarantine restriction, along with planned maintenance resulted in 21 days of lost production.

- Despite lower plant availability, cash cost of sales reduced by 3% quarter on quarter.

- Market conditions and product pricing are challenging for the company. However, operational cash flow remained positive.

- Naraha Lithium Hydroxide Plant is operational while site operations at the Olaroz Stage 2 Expansion stopped because of quarantine restrictions.

Stock Information:

On 18 May 2020, ORE shares ended the day’s trade at $2.07, Up 9.524% from the previous close.

Pilbara Minerals Limited (ASX:PLS)

Pilbara Minerals Limited is engaged in Lithium & tantalum exploration and mine development.

In the past three months, the shares of Pilbara Minerals, which closed at $0.310 on 21 February, dropped and reached $0.245 on 15 May 2020. As per the report generated by ASIC on 12 May 2020, 209,899,317 shares were shorted.

During the March 2020 quarter the company did not face any material operational influence on its Pilgangoora Lithium-Tantalum Project due to coronavirus. For the period, spodumene concentrate shipments stood at 33,729 dmt. However, average SC6.0 market reference price decayed during the March 2020 quarter due to softness in lithium raw material markets.

Stock Information:

On 18 May 2020, PLS shares ended the day’s trade at $0.245, in line with the previous close.

Galaxy Resources Limited (ASX:GXY)

Galaxy Resources Limited is engaged in the production of lithium concentrate and exploration for minerals in Australia, Canada, and Argentina.

The shares of Galaxy Resources, which closed at $1 on 26 February 2020 reached $0.785 on 15 May 2020. As per the report generated by ASIC on 12 May 2020, 53,161,372 shares were shorted.

Galaxy Resources reported its production volume of 14,306 dry metric tonnes (dmt) lithium concentrate. The numbers achieved was within the production guidance. It shipped 32,512 dmt of the lithium concentrate which helped in the generation of positive free cash flow.

However, the company noted a decline in the pricing because of the weakening of the current demand. The company expects its purchasing volumes and pricing to drop in the future.

Stock Information:

On 18 May 2020, GXY shares ended the day’s trade at $0.770, down 1.911% from the previous close.

Clinuvel Pharmaceuticals Limited (ASX:CUV)

Clinuvel Pharmaceuticals Limited is a global biopharmaceutical company that focuses on developing as well as delivering treatments for patients with numerous severe genetic as well as skin disorders.

The shares of Clinuvel Pharmaceuticals which closed at $29 on 23 January 2020, reached $21.57 on 15 May 2020. As per the report generated by ASIC on 12 May 2020, 4,635,819 shares were shorted.

The company, in its Q3FY2020 activity report, highlighted that during COVID-19, it continued to focus on expanding its business activities.

- It continued supply of SCENESSE® in Europe.

- Launched SCENESSE® in the US after Prior Authorization by US insurers.

- Worked on the expansion of in-house R&D competences, the Singaporean government provides financial incentives.

- Receipt from the customers during the quarter was $5.369 million and net cash for the quarter ended 31 March 2020 was $62.329 million.

Despite the positive result, the possible reason for shorting could be that the stock is appearing overvalued to the market players. Comparing the PE ratio of the company (68.91x) to the industry PE ratio (which is 42.73x), it seems that the stock at present is overvalued.

Stock Information:

On 18 May 2020, CUV shares ended the day’s trade at $21.840, up 1.252% from the previous close.

Myer Holdings Limited (ASX:MYR)

Myer Holdings Limited operates a portfolio of 66 department stores across Australia.

The shares of Myer Holdings, which closed at $0.48 on 20 January 2020, reached $0.225 on 15 May 2020. As per the report generated by ASIC on 12 May 2020, 119,717,130 shares were shorted.

In the previous business update on 22 April 2020, the company decided to extend the period of the temporary closure of its stores till 11 May 2020. However, it continued with its online business. It also clarified that it would open the stores after monitoring the government measures and would happen on a staged basis. It might be the reason for the short-selling of the MYR shares.

Stock Information:

On 18 May 2020, MYR shares ended the day’s trade at $0.250, in line with the previous close.

JB Hi-Fi Limited (ASX:JBH)

JB Hi-Fi Limited is a specialty retailer of home consumer products.

The shares of JB Hi-Fi, which closed at $41.60 on 19 February 2020, reached $34.29 on 15 May 2020. As per the report generated by ASIC on 12 May 2020, 10,614,341 shares were shorted.

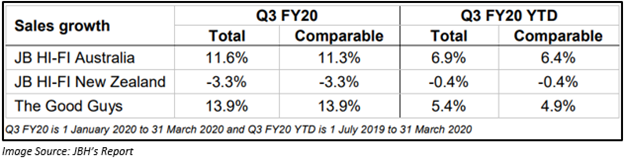

JBH in late March reported an acceleration in sales.

The Group withdrew its FY20 sales and earnings guidance due to ambiguity occurring from coronavirus. It also highlighted in its Q3FY2020 sales update that it would not be able to provide FY20 guidance.

Stock Information:

On 18 May 2020, JBH shares ended the day’s trade at $34.010, down 0.817% from the previous close.

Super Retail Group Limited (ASX:SUL)

ASX-listed Super Retail Group Limited is one of the Top 10 retailers in Australasia.

The shares of Super Retail Group, which closed at $10.30 on 07 January 2020, reached $6.73 on 15 May 2020. As per the report generated by ASIC on 12 May 2020, 17,942,471 shares were shorted.

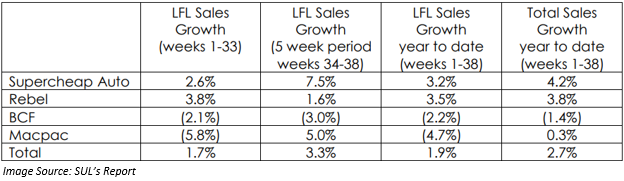

As per the market announcement of the company on 26 March 2020, the Group like-for-like trading update, week ended 21 March 2020 was as below.

The Group was able to maintain positive sales momentum in its two largest brands and has benefitted from a diversified portfolio of businesses. The stores are in metropolitan as well as regional areas across Australia & New Zealand. Less than 20% of the stores were in the large shopping malls where a significant drop in the footfall was noted.

Stock Information:

On 18 May 2020, SUL shares ended the day’s trade at $6.91, up 2.675% from the previous close.

Zip Co Limited (ASX:Z1P)

The shares of BNPL player, Zip Co Limited which closed at $3.550 on 24 February 2020 reached $3.09 on 15 May 2020. As per the report generated by ASIC on 12 May 2020, 32,877,175 shares were shorted.

Although the performance of the company remained strong during April 2020, it appears that the short sellers are targeting these companies.

Stock Information:

On 18 May 2020, Z1P shares ended the day’s trade at $3.090, in line with the previous close.

NOTE: All figures are reported in Australian Dollars unless stated otherwise

_07_02_2025_00_23_12_199043.jpg)