Resources Sector is one of the leading income generators in Australia, contributing to the development of the Australian economy. The resources sector consists of those companies that have their businesses generally in the exploration and production of minerals.

In this article, we would be digging deeper into the four ASX- listed resources sector companies. During the time of writing the report, on 31 October 2019, the S&P/ASX 200 Resources index last traded in red zone at 4,625.1 points, with a decline of 0.29% or 13.5 points compared to its previous close.

Letâs have a look at the four stocks with their recent updates:

Silver Lake Resources Limited (ASX: SLR)

Silver Lake Resources Limited (ASX: SLR) is involved with the exploration, development and operation of mines, as well as the sale of gold and gold/copper concentrate in Australia.

Change in Substantial Holding and Issue of Shares

- The company recently announced that it has made a change in its substantial holding of Egan Street Resources Limited on 28th October 2019, and the current voting power of the company stands at 31.53% as compared to the previous voting power of 30.43%.

- On 25th October 2019, the company issued 859,899 fully paid ordinary shares. The purpose of the issue was to exercise FY17 Performance Rights issued under the 2015 Employee Incentive Plan.

Extension of Egan Street Takeover Offer

SLR through a release dated 25th October 2019 announced extension of off-market takeover bid for all the fully paid ordinary shares in Egan Street Resources Limited and outlined the advantages of the companyâs all scrip Offer for the shareholders of Egan Street.

- It stated that Silver Lakeâs all scrip Offer gives the shareholders of Egan Street a decrease in funding along with project execution risks;

- The shareholders of Egan Street Resources Limited would get advantage through maintaining the level of exposure. It further added that rise in share price might be generated via the integration of the Rothsay project into an organisation with well-established proximal infrastructure as well as demonstrated exploration success in developing the Mineral Resource base of narrow, high-grade gold deposits.

On financial front, the company has recently updated the market with results for the September 2019 quarter. To know more about it, Click Here

The stock of SLR last traded at $1.160, with a rise of 1.754% from its previous close, as on 31st October 2019. The stock has provided return of -21.11% and 45.22% in the last three-month and six-month timeframe, respectively.

Alacer Gold Corp (ASX: AQG)

Alacer Gold Corp (ASX: AQG) is engaged into exploration and production of gold. The market capitalisation of the company stood at $1.89 billion as on 31st October 2019.

A Look at Third Quarter 2019

Alacer Gold Corp, through a release dated 29th October 2019 updated the market with its operational and financial results for the third quarter 2019.

- The company stated that its operations were robust in its oxide and sulfide plants, however, its YTD production stood at 290,127 ounces at consolidated AISC or All-in-sustained-cost standing at $714/ounce.

- AQG added that the strong production has caused substantial free cash flow generation amounting to $138 million, as well as have had led to a fast decrease in its net debt amounting to $110 million at the close of Q3 FY19 period.

- The companyâs current Ãöpler in-pit and near-mine exploration success continues to add incremental oxide ounces to this yearâs production, which is allowing AQG to further increase its oxide production guidance range to 150,000 to 160,000 ounces from 125,000 to 145,000 ounces.

- It reported lost-time injury, which occurred on 26th August 2019 post exceeding 22 million man-hours and more than 1,000 days LTI free. However, the total recordable injury frequency rate through 30th September 2019 was 2.0.

- The company provided no change to its 2019 sulfide plant gold production range, which stood at 230,000 to 270,000 ounces.

The stock of AQG last traded at $6.81, with a rise of 7.924% from its last close, as on 31st October 2019. The stock has given return of 13.08% and 70.54% during the last 3 months and 6 months period, respectively.

Sundance Energy Australia Limited (ASX: SEA)

Sundance Energy Australia Limited (ASX: SEA) is involved with the exploration for and development work as well as with the production of oil and natural gas in the USA region.

Sale of Dimmit County Assets

- The company through a release dated 2nd October 2019 notified that it has completed on the transaction of its assets in TX (Dimmit County).

- It added that at closing SEA received US$17.8 million.

- However, the company also mentioned that it further anticipated to receive the pending proceeds of the sale at the end of the 120-day post-close period.

Approval of First Court

- As per the release dated 1st October 2019, SEA announced that it received an approval from the Federal Court of Australia in order to conduct a shareholders meeting to consider and vote on the company's proposed re-domiciliation from Australia to the United States through a Scheme of Arrangement.

- It was added that post implementation of the Scheme âHoldcoâ, which is a newly formed US corporation, would become the parent company of the SEA group of companies.

- As per the terms of the scheme, the shareholders of SEA would be eligible to receive 1 share in Holdco in lieu of one hundred Sundance shares held by the shareholders of SEA on the record date of Scheme.

The stock of SEA last traded at $0.130, with a rise of 4% compared to its last closing price as on 31st October 2019. The stock has provided return of -37.50% and -73.40% in the past 3 months and 6 monthsâ timeframe, respectively.

Galaxy Resources Limited (ASX: GXY)

Galaxy Resources Limited (ASX: GXY) produces lithium concentrate and is involved in the exploration for minerals in Australia, Canada and Argentina.

Change in Directors Interest

- The company recently announced that on 28th October 2019, that one of its directors, John Turner has acquired 50,000 fully paid ordinary shares at the consideration of $42,142.

- Post change, John Turner possesses 115,000 fully paid ordinary shares and 500,000 unlisted options, which will be exercisable at $2.78 on or before 14th June 2020.

A Quick Check on first Quarter of FY20

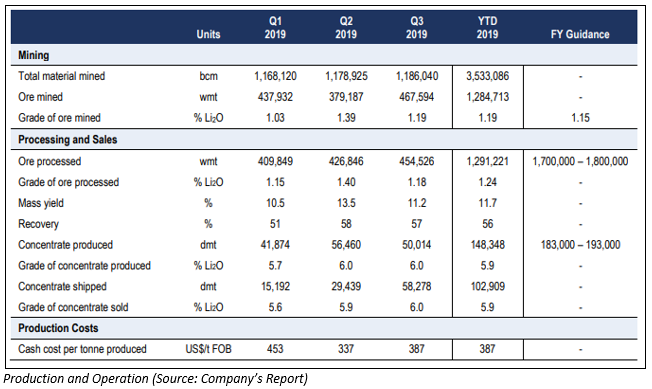

- With respect to Mt Cattlin, the company reported lithium concentrate production volume of 50,014 dry metric tonnes, grading 6.0% Li2O, and reached at the midpoint of production guidance range of 45,000 â 55,000 dmt.

- The production unit cash cost stood at US$387 per dmt, which were produced free-on-board, strengthening the Mt Cattlin as one of the low-cost lithium concentrate operations worldwide.

- However, the total shipment volume stood marginally lower from the guidance of 60,000 â 70,000 dmt to 58,278 dmt of lithium concentrate.

- GXY concluded a deal with a group of lenders in order to obtain the senior secured loan facility, which was given to Alita Resources, previously known as Alliance Mineral Assets Limited.

- As of 30th September 2019, the closing cash and debt balance stood at US$169 million and US$32 million, respectively.

The stock of GXY last traded at $0.935, with a rise of 0.538% compared to its previous close, as on 31st October 2019. The stock has given return of -28.19 percent and -36.30 percent in the past 3- and 6-months timeframe, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.