Introduction

Australia's insurance market has three broad segments, that includes the life insurance, general insurance and health insurance. The market for life insurance in Australia is approximately $44.5 billion. The customers take most of the life and related insurance through the superannuation funds. The Australian Prudential Regulation Authority (APRA) is the regulator for life insurance companies which are registered under the Life Insurance Act in Australia. Australian Securities and Investments Commission (ASIC) governs the matters related to the advice or disclosure of insurance products sold. Another regulator in the insurance industry is The Australian Competition and Consumer Commission (ACCC).

Moreover, where the general insurance market is concerned, four companies form three-quarters of the segment. These are Insurance Australia Group (IAG), Suncorp Group, QBE and Allianz. Additionally, in health insurance, the Australian Government offers the basic universal health cover, which it does through the Medicare scheme. Medicare scheme is funded partly through a 2% Medicare levy, which are paid by the taxpayers.

Suncorp Group Ltd (ASX: SUN)

- 2% fall in the profit after tax from ongoing functions & fall of 11.6% in the cash earnings in 1H 2020 ended on December 31st, 2019: Suncorp Group Ltd (ASX:SUN), is a leading provider of general insurance of motor, marine, travel, commercial property, industrial special risk, loan protection, equity and cash benefit, in Australia and New Zealand. The company operates through segments such as Insurance, Banking & Wealth, and Suncorp New Zealand.

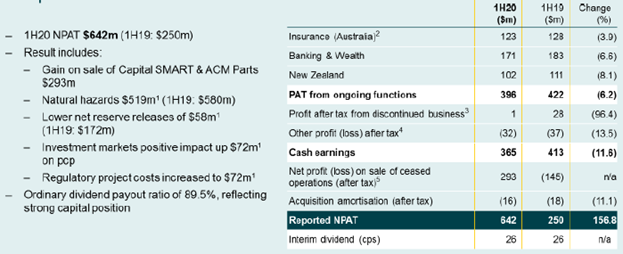

- The company stock rose 0.57% on February 12th, 2020 after the company posted the performance of the first half of FY 2020. The company has reported 156.8% increase in the group net profit after tax to $642m, up 156.8% on the pcp driven by inclusion of the $293m profit after tax from the sale of Capital S.M.A.R.T and ACM Parts. However, there has been 6.2% fall in the profit after tax from ongoing functions on the back of low reserve releases, increase in the regulatory project costs, the low yield environment affects, the timing of natural hazards events compared to pcp and rise in competitive mortgage market.

- During 1H 2020, there has been fall of 11.6% in the cash earnings. Further, the company has declared an interim ordinary dividend of 26 cents per share fully franked, which is flat on the pcp. This shows that company has a cash earnings payout ratio of 89.5%. SUN has maintained a strong capital position with the proforma excess CET1 position after the adjustment for the interim dividend stood at $691m.

- Moreover, for fiscal 2020,

- the company expects limiting the full year natural hazard costs to be $820m allowance.

- NIM expected to be between the operating range of 1.85% & 1.95% and

- Group reserve releases projected to be more than 1.5% of NEP.

Therefore, SUN stock has fallen by 7.11% in three months as on February 13th, 2020 and is trading at $12.355 (AEDT:2:20 pm) having a dividend yield of 5.64%.

1H Group Financial Performance (source: Company Reports)

Insurance Australia Group Ltd (ASX: IAG)

- Net profit after tax declined by 43.4% in 1H 2020 ended on December 31st, 2019: Insurance Australia Group Ltd (ASX:IAG), is a leading Australian company that operates in general insurance domain, having operations in Australia, New Zealand, and Asia. The Group offers multiple personal and commercial insurance products, mainly related to motor vehicle and home insurance. IAG stock rose 0.15% on February 12th, 2020 after the company posted the first half 2020 results.

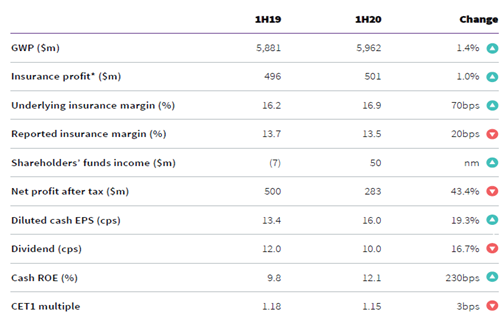

- The company reported 1.4% increase in GWP to $5,962 million, 70 basis points increase in Underlying insurance margin to 16.9% but 20 basis points contraction in reported insurance margin to 13.5%.

- Net profit after tax declined by 43.4% to $283 million.

- Moreover, for fiscal 2020,

- The company expects GWP growth to be of ‘low single digit’

- Reported insurance margin to be in the range of 12.5-14.5%.

- The company assumes net losses from natural perils to be of $850m and reserve releases to be of around 0.5% of NEP.

Meanwhile IAG stock has fallen 12.47% in three months as on February 13th, 2020 and is trading at $6.785 (AEDT: 2:20 pm) having a dividend yield of 4.36% and a P/E of 18.48x.

1H FY 20 Financial Performance (source: Company Reports)

Steadfast Group Ltd (ASX: SDF)

- Outlook for FY 20: Steadfast Group Ltd (ASX:SDF), has the largest network of general insurance broker and comprises of the largest group of underwriting agencies in Australia. The company along with Australia is growing its operations in Asia and Europe. SDF’s final PSF Rebate Acquisition reception throughout the Network stood at 70%.

- For fiscal 2020,

- The company expects underlying EBITA is to be of $8.4 million, including the underlying NPAT impact of $5.9 million.

- Steadfast has reconfirmed that it intends to deliver an underlying result towards the top end of the FY20 guidance range of $215 million and $225 million.

- Statutory NPAT is anticipated to be adversely affected by the PSF Rebate Acquisition. The company was anticipating underlying NPAT to be in the range of $100 million and $110 million for fiscal 2020.

Meanwhile SDF stock has risen 12.64% in three months as on February 13th, 2020 and is trading at $3.950 (AEDT: 2:20 pm) having a dividend yield of 2.12% and a P/E of 30.47x.

.jpg)