The Australian benchmark index S&P/ASX200 was trading at 6724.6, up by 0.1 percent (AEST 11: 48 AM). In this article, we would discuss two popular stocks FMG from Metals & Mining sector and TWE from Consumer Staples sector.

Letâs know about the 2 popular stocks in detail:

Fortescue Metal Group Limited (ASX: FMG)

Counted among the largest iron ore producers in the world, Fortescue Metal Group has been actively tapping debt markets amid a low rate regime. Fortescue having an industry-leading cost position is also a sustainable low-cost producer.

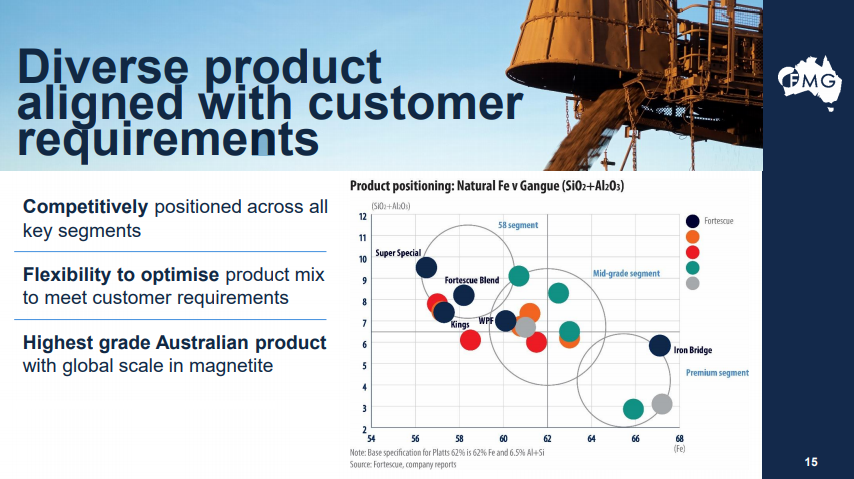

Recently, the company presented at the CISA Conference. Accordingly, it has a fully integrated supply chain underpinned by a culture of innovation. Fortescue has been emphasising on sales channel offering, and it intends to have direct customer engagement. In this regard, in April 2019, the company provided the Chinese customers with greater choices, including smaller lot sizes, expedited delivery, multiple regional ports and local currency transaction.

Source: FMG CISA Presentation

In its growth projects â Eliwana project reportedly has USD 1.275 billion capital investment, and the project is progressing on schedule and budget. Iron Bridge Magnetite Project is the other growth project of the company with USD 2.6 billion investment delivering expanded product suite to customers.

On 26 September 2019, the company announced the completion of term loan refinancing and repayment. It had completed the refinancing and repayment of USD 1.4 billion 2022 Syndicated Term Loan Facility.

Reportedly, Fortescue had repaid USD 800 million using proceeds from the issue of USD 600 million Senior Secured Notes announced on 6 September 2019 and USD 200 million from available cash.

Meanwhile, the company had also extended the USD 600 million Term Loan balance to 2025 on the same terms and conditions. It also allows the company to repay the principal early at no cost.

On 6 September 2019, the company had announced the successful completion of USD 600 million High Yield Bond offering. The offering was of Senior Unsecured Notes at an interest rate of 4.5 per cent, maturing on 15 September 2027.

In its full-year report for the period ended 30 June 2019, the company had witnessed a blockbuster year amid supply shocks in the iron ore markets. FMG has capitalised in a broader way, delivering record dividends to the shareholders.

In FY2019, the company posted revenue of USD 9.97 billion, up by 45% from USD 6.89 billion the previous year. It also trimmed its finance cost to USD 279 million from USD 652 million a year ago.

Fortescue reported a net profit after tax of USD 3.19 billion for the period, up by 263% from USD 0.88 billion in FY2018. During FY2019, the demand for the companyâs product remained strong with 167.7 mt of iron ore shipped to the customers.

Further, the Platts 62% CFR index averaged USD 80/dmt in the FY2019, representing an increase of 16 per cent over the previous year â USD 69/dmt. The company was able to integrate operations and marketing strategy that improved the volume for better margin products. In addition, the steel production also helped the company, which grew 9.9% in the H1 CY 2019 (calendar year) compared to the prior year.

On 30 September 2019, FMGâs stock was trading at $8.83, up by 0.113 percent (AEST 12: 34PM). In the year-to-date basis, the stock has delivered a return of 131.70%. In the past one-month, the return of the stock is +16.82%.

Treasury Wine Estates Limited (ASX: TWE)

Recently, the winemaker held its Investor Day and released a presentation on the same. Accordingly, the company has made significant progress since 2017 Investor Day. Treasury Wine is now a brand led company from an Agri led company.

The companyâs strategic priority is to build a focused portfolio of priority brands, drive multi-regional sourcing, continue to drive premiumisation, strengthen its business model, and to improve market share.

It intends to deliver 25% market share target in Australia & NZ, and achieve a 25% EBITS margin in Americas. Also, attain #1 leadership position in imported wine in Asia, and maintain mid-teens EBITS margin in EMEA.

In digital transformation, the company intends to utilise the power of digital to enhance consumer engagement and drive transactions. Innovation through Living Wine Labels platform that is now available globally, and evolving Living Wine Labels to beyond AR to enhance customer engagement and utility and brand experiences.

Further, it would improve consumer enhancement through refining the e-commerce platform and DTC customer experiences, and adapt to rapidly introduce new products, services and experiences. The company also wants to increase conversion through personalised content, offers, and leverage consumer data to drive efficient and effective digital campaigns.

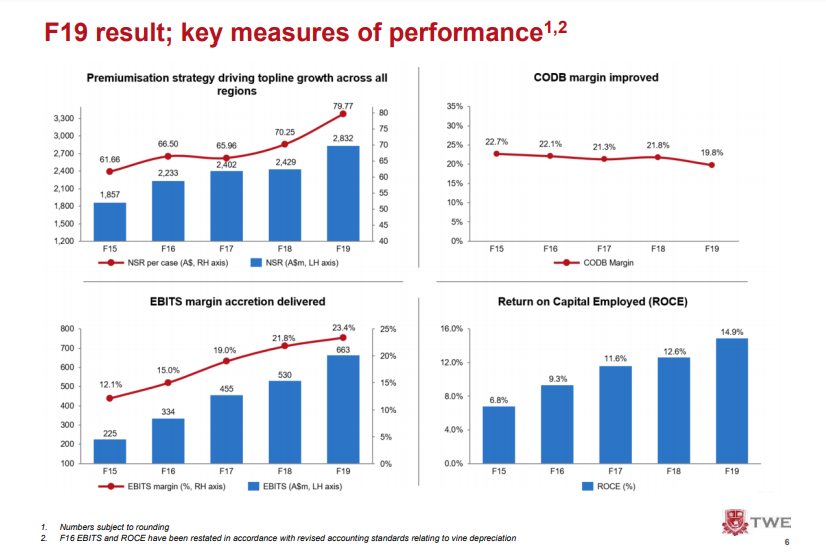

In its full-year ended 30 June 2019, the company had depicted a growth of 15.5% in revenue to $2,883 million from $2,496.4 million in FY2018. Net profit after tax for the period was $419.5 million, up by 16.4% from $360.3 million in FY2018.

In Asia, the company improved the composition of Luxury and Masstige wine. It achieved stellar growth in the region through successfully executing the competitive advantage business model in the region.

In the US, the company successfully fixed the changes in route-to-market. It is now emphasising on achieving better performance and improved margin in FY20 and beyond via its new operating model.

Source: TWE Investor and Analyst Presentation

In addition, the company had announced the completion of production and vineyard assets in Bordeaux, France. It also intends to expand the luxury winemaking assets in South Australia.

The company believes it is adequately placed to execute the premiumisation strategy in FY20 and ahead. In the US & Asia, the company intends to improve its competitive advantage in the route-to-market strategy.

Asia and the US remain attractive markets for the company for premium wine consumption, and the company is of the view that these markets as a significant opportunity in growing its focused portfolio of brands.

On 30 September 2019, TWE stock was trading at $18.57, up by 1.309% (AEST 12:32 PM). In the year-to-date basis, the stock has delivered a return of 24.86%. In the past six months, the return of the stock is +22.53%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.