In this article, we will discuss two stocks from the financial sector on ASX. These companies include Sezzle and Fiducian Group. Sezzle is a young US-based BNPL company while Fiducian Group is an established financial service company based in Australia.

Sezzle Inc. (ASX:SZL)

US-based Sezzle has reported that the State of California Department of Business Oversight approved the company’s application for a lending licence in California.

Lending Licence Solidifies SZL Position

The approval enables the alternative payments provider to operate in California, adding to the firm’s status as the leading US-based instalment payment platform. Prior to this approval, the company was operating through a retail instalment structure in the state.

In the previous set-up, the retailers used to initiate the instalment loan and transferred the loan to the company for service. With the licence in place, the company could transition to a direct lending structure.

Escrow Release

On 30 January 2020, approximately 11.3 million SZL shares would be released from voluntary escrow; it means that free-float shares would be increased by the same number.

Bumper Sales Season

In December 2019, the company updated on the Black Friday and Cyber Monday sales period. This period marks the start of the traditional shopping season, which falls a day after Thanksgiving Day in the US.

During this period, the company added over 36k new customers, which was significantly higher than 8k new customers in 2018. And, the underlying merchant sales increased by just over 400% as against 2018 to USD 11.3 million, while underlying merchant sales for the 12 months to September 2019 were USD 157.5 million.

The key tailwind for the business of the company is the declining application of credit cards in the retail shopping that was strongly evident over the Black Friday and Cyber Monday sales period.

It said, according to a survey of 2k customers by a firm, the credit cards usage by shoppers on retail purchases declined from 50.2 per cent in 2018 to 49.3 in the last year.

Also, the use of cash for purchases declined from 39.3 per cent to 36.3 per cent, while the decline of the usage of credit cards in online purchases plunged from 66.4 per cent in 2018 to 54.3 per cent in 2019.

Secured USD 100 Million in Debt Funding

In early December 2019, the company reported that it secured a USD 100 million debt funding through a consortium of lenders.

The business model of the firm requires to pay the retailers full amount of the purchases executed by an end customer in advance, which is re-paid by the customers in instalments. Thus, the company requires capital to fund the purchases done by the customers.

The company funds its customer spending via its sources of funding, which includes equity capital, client merchant accounts payable and debt financing. SZL has a view that the growth prospects presented by the buy-now-pay-later industry are attractive in North America.

Therefore, the company undertook the debt funding from three US credit providers, specialising in consumer and alternative lending, and the funding would allow SZL to capitalise on arising opportunities.

The term for the funding is a two-year revolving line of credit at an interest rate of three-month libor + applicable margin.

On 17 January 2020, SZL last traded at $2.01, up by 13.55 per cent from the last close. Since listing, the stock has delivered a return of -19.55 per cent.

Fiducian Group Limited (ASX:FID)

Specialist financial services business, Fiducian Group was founded in 1996. Its business verticals include financial planning, investment funds management, superannuation, investment platform administration and IT solutions.

2019 Annual General Meeting

Mr Indy Singh gave his maiden appearance as the Chairman of the group after Mr Bob Bucknell stepped down from the role last year, who had chaired the company since its inception in 1996.

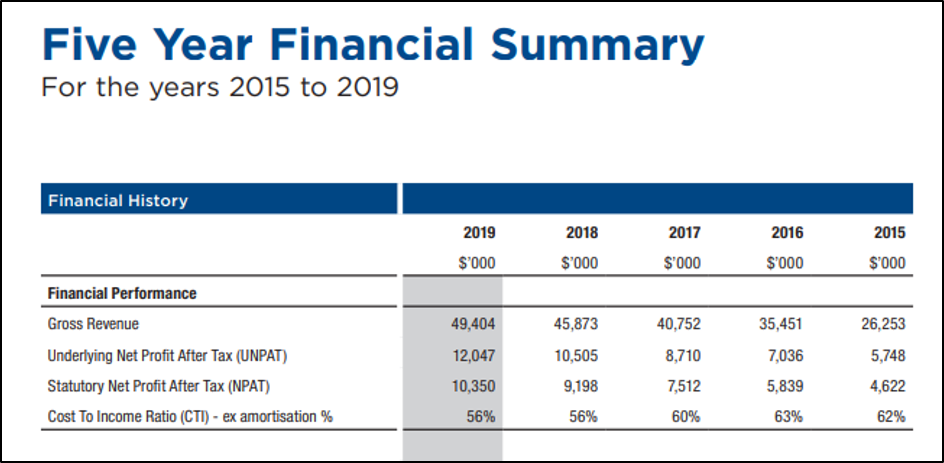

Source: FID Annual Report 2019

The strategy of the Board remains to grow the business organically and inorganically, resulting in the delivery of positive earnings growth over the years while they look to improve earnings through various revenue generating businesses in the group.

Sailing the Royal Commission with ~15 per cent growth in UNPAT

The foundation and principles of the group had defied the headwinds caused by the Haynes Royal Commission in the financial services industry that has damaged a significant reputation of leading businesses in the space.

And, this has led to multiple restructuring of businesses, divestments, strategic review, Board shake-ups and surmounting customer remediation costs, which has plagued earnings, and in turn, shareholder returns.

However, amid such industry-wide massacre of stakeholder management ethics, the group has navigated this phase without modification. In the meantime, the group has increased its headcount and delivered an increase in underlying net profit after tax of around 15 per cent during the previous financial year.

On Outlook

It was reported that the Board remains conservative and confident on delivering its strategy to post double-digit earnings growth, which is subject to improving financial market environment and economic conditions domestically as well as internationally.

Further, the group is debt-free with positive working capital and operating cash flows. And, considering the first-quarter numbers and potential consistency through the year, the group’s profit growth expectation could be met.

First Quarter Cash Flows

For the quarter ended 30 September 2019, receipts from customers stood at around $14.9 million, and significant outflows in operating activities included approx. $6.68 million in administration and corporate costs and around $4.13 million in staff costs. As a result, net cash from operating cash flows was ~$2.32 million.

Further, the group made a small acquisition for $646k of Various Financial Planning Practices, among other activities on the investing side. Consequently, net cash used in investing activities was around ~$1.06 million.

Also, the group paid dividends that resulted in an outflow of around $3.55 million in the financing activities. The group had a cash and cash equivalents of approximately $9.5 million by the end of the first quarter.

On 17 January 2020, FID last traded at $5.73, up by 2.13 per cent from the last close. Ove the past one year, the stock has delivered a return of +40.25 per cent. And, it is available at 16.98 times its last annual earnings per share (FY 2019).