âBuy Now Pay Laterâ (BNPL) Industry is currently booming in Australia. Letâs take a quick look at 3 popular BNPL stocks and their recent updates.

Afterpay Touch Group Limited (ASX:APT)

Afterpay Pty Limited, a subsidiary of a technology-driven payments company, Afterpay Touch Group Limited (ASX:APT), was recently given notice by AUSTRAC, an Australian government financial intelligence agency, to carry out an audit in respect of its AML/CTF compliance.

In terms of this notice, the company now submitted details of 3 candidates to AUSTRAC to conduct the external audit, as announced on Wednesday, 26th June 2019. In addition, the company has put in place a dedicated Sub-Committee, which will assist and report to the Afterpay Board with regards to the oversight and management of the external audit process.

On AUSTRAC notice, the company has assured that it recognises the importance of work undertaken by AUSTRAC and reiterated that it welcomes the opportunity to continue to work in tandem and constructively with AUSTRAC. The company sees this process as an opportunity to make sure that it is in compliance with AML/CTF.

Following the AUSTRAC Notice, the company has now decided to defer its recently announced share purchase plan until the final audit report and its recommendations are being considered by the company.

It is to be noted that the Record Date of 7th June 2019 for SPP will continue to be the same and SPP will be capped at $30 million. Furthermore, the company is planning to issue shares at the lower end of $23.00, being the Placement price, and the 5-day VWAP (volume weighted average price) of the companyâs shares up to the Closing Date of SPP.

Today, the company also announced its Co-Foundersâ intentions related to the Future Share Sales. As per the companyâs release, both the Co-Founders Anthony Eisen and Nick Molnar are excited about the potential to build an Australian-listed global technology company and in addition, the company has assured that Anthony and Nick do not intend to sell any further shares during the next financial year.

At the time of receiving AUSTRAC notice, Afterpay assured that it has undertaken various measures to strengthen Afterpayâs AML/CTF framework, including in focus areas identified in the Notice. In parallel, the company has informed that it is continuing to invest in further AML/CTF compliance enhancements and do not expect any impact in a way the customers and merchants are currently experiencing the Afterpay service.

The company understands that the Buy Now Pay Later industry is new to the regulators, which is why the company intends to work closely with AUSTRAC for developing appropriate compliance regime, which will be specific to the companyâs business.

In a business update provided on 6th June 2019, the company highlighted that it is planning to put in place a leading professional services firm responsible for conducting an independent review of the design and operations of the companyâs AML/CTF framework. This professional services firm will see if any further improvements or actions can be done to improve the companyâs AML/CTF framework.

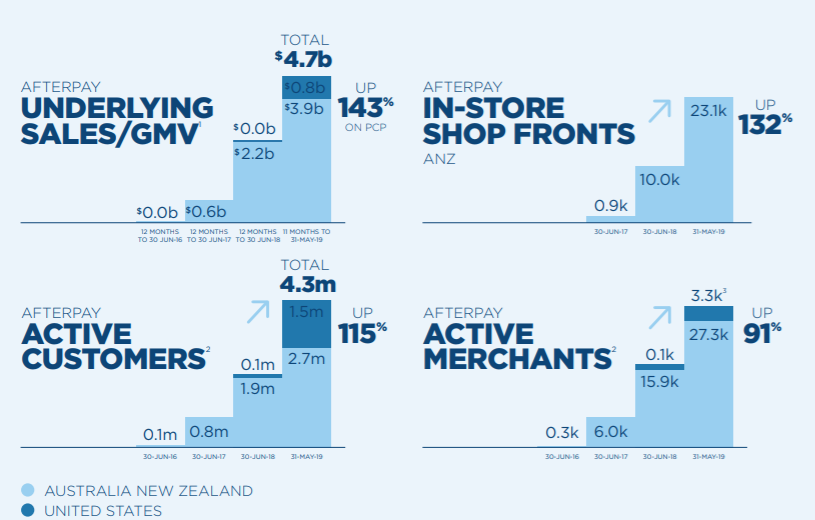

On the operational front, the company has been performing strongly with underlying sales of $4.7 billion for 11 months to 31 May 2019, 143% higher than pcp. At the end of May 2019, the company had over 4.3 million active customers, representing a growth of around 7,900 new customers per day since 31st December 2018. In the US market, for 11 months to 31st May 2019, Afterpay underlying sales were around $780 million driven by the customer and merchant demand.

(Source: Company Reports)

On the stock performance front, the companyâs stock has provided a YTD (year till date) return of 114.33% and also posted returns of 107.09%, 31.56% and 7.48% over the past six months, three and one-month period, respectively.

At market close on 26th June 2019, the companyâs stock was trading at a price of $27.140, up 5.521 percent during intraday trading session, with a market capitalisation of circa $6.5 billion. It 52-week high price stands at $28.700 and 52 weeks low price at $8.490, with an average volume of ~2,301,242.

FlexiGroup Limited (ASX:FXL)

A financial solutions provider, FlexiGroup Limited (ASX: FXL) is focused on driving its customer value propositions through improved usage of technology to deliver great user experiences, cost efficiencies and simplification. The company has a strong track record of financing Australian and New Zealand lifestyles through humm platform. The company supports its customers in financing their lifestyles as humm gives them the ability to finance in a way that helps with the affordability and management of their household budget. Various fashion retailers, home improvement retailers and health providers have joined the humm community.

During the first half of the financial year 2019, the company gained 272k new customers for its products, resulting in an active customer base of 1.24 million and along with this, the company also added 5,000 new retail partners to its network, which increased its valued partnerships with retailers across Australia and New Zealand to 62,000.

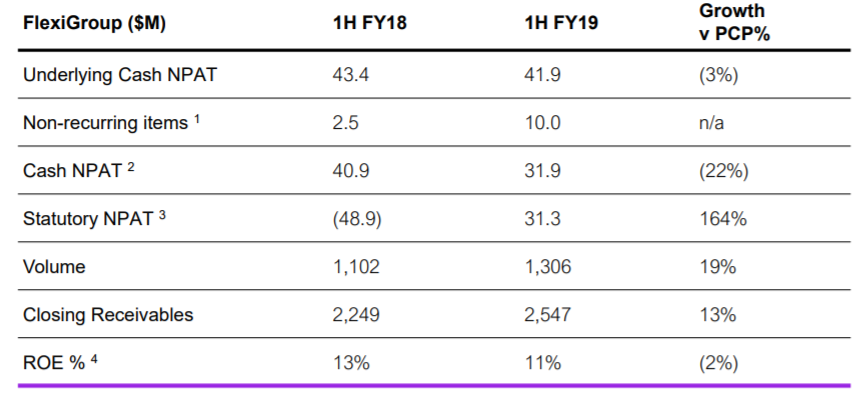

For the half year period, the company delivered a Cash Net Profit After Tax (NPAT) of $31.9 million, which was 22% lower than the previous corresponding period. In half year period, the companyâs Buy Now Pay Later volumes were up 12%, while Australian and New Zealand Credit Card volumes were up by 11% and 16%, respectively.

During the period, the company announced its first retail apparel fashion partnership with Premier Retail which is a leading global operator of the retail brands with a portfolio of more than 1,200 stores spanning Australia, New Zealand, Asia and Europe.

1H FY19 Results (Source: Company Reports)

During the half year period, the corporate debt increased by $47 million on a Y-o-Y basis and gearing increased to 70% from 44% in pcp. The company further stated that it will continue to optimise its business through simplification, consolidation of platforms, refining funding structures and the continued integration of the group functions.

At market close on 26th June 2019, FlexiGroup Limitedâs stock was trading at a price of $1.585, down by 2.16 percent during the dayâs trade, with a market capitalisation of ~$638.91 million. The stock has provided a YTD (year till date) return of 20.00% and also posted returns of 16.13%, 20.90% and 13.60% over the past 6 months, 3 month and 1 month period, respectively. Its 52-week high price stands at $2.340 and 52 weeks low price at $0.975, with an average volume of ~1,322,410. It is trading at a PE multiple of 8.660z, with an annual dividend yield of 4.75%.

Zip Co Limited (ASX:Z1P)

Zip Co Limited (ASX: Z1P) and its subsidiary, Zipmoney Payments Pty Ltd have been notified that Firstmac Limited has started proceedings in the Federal Court against Zip Co Limited alleging infringement of Firstmacâs âZIPâ trademark, which is registered in respect of financial affairs. Zip Co Limited has been using the Zip marks extensively since the business began six years ago in June 2013 and has since partnered with more than 14,000 retailers at more than 30,000 points of acceptance and has more than 1.2 million customers.

To defend the proceeding, Zip has engaged law firm, Corrs Chambers Westgarth and assured investors that it will continue to be able to use its trademarks. The company also communicated that it is concerned by the recent activity of Loans.com.au Pty Ltd related to the home loan and debit card products being promoted by reference to âZIPâ. The company is now deciding an action to be taken in relation to this conduct.

The company recently appointed highly experienced David Franks as Company Secretary, stepping into the shoes of Andrew Bursill. In his over 20 years of experience, David Franks held various senior level roles in various listed and unlisted public and private companies.

At market close on 26th June 2019, the companyâs stock was trading at a price of $3.180, up by 4.95 percent during the intraday trading session, with a market capitalisation of ~$1.07 billion. The stock has provided a YTD (year till date) return of 175.45% and also posted returns of 183.18%, 80.90% and -11.92% over the past 6 months, 3 months and one-month period, respectively. Its 52-week high price stands at $3.980 and 52-week low price at $0.835, with an average volume of ~3,628,410.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)