Melbourne â based West African gold developer, Bassari Resources Limited (ASX: BSR) is rapidly progressing to bring its Makabingui Gold Project into production in 2019. Located in Senegal, Western Africa, the Makabingui Gold Project has various plus points which are as follows:

Merits of Makabingui Gold Project

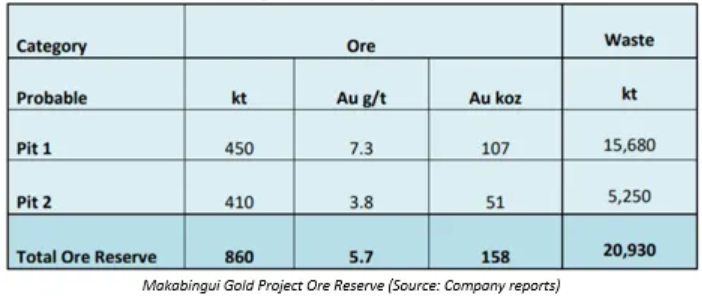

- The project hosts a Mineral Resource, which comprises 11.9 million tonnes averaging 2.6 g/t Au for a contained 1 million ounces of gold classified into the Indicated and Inferred Resource categories, with 158,000 ounces classified as reserves;

- Well located tenements in a +60-million-ounce gold province hosting world-class deposits;

- Multiple prospects identified along 60km of partially drilled mineralised strike;

- Open Pit Feasibility Study for the initial open-pit mining phase delivered outstanding results:

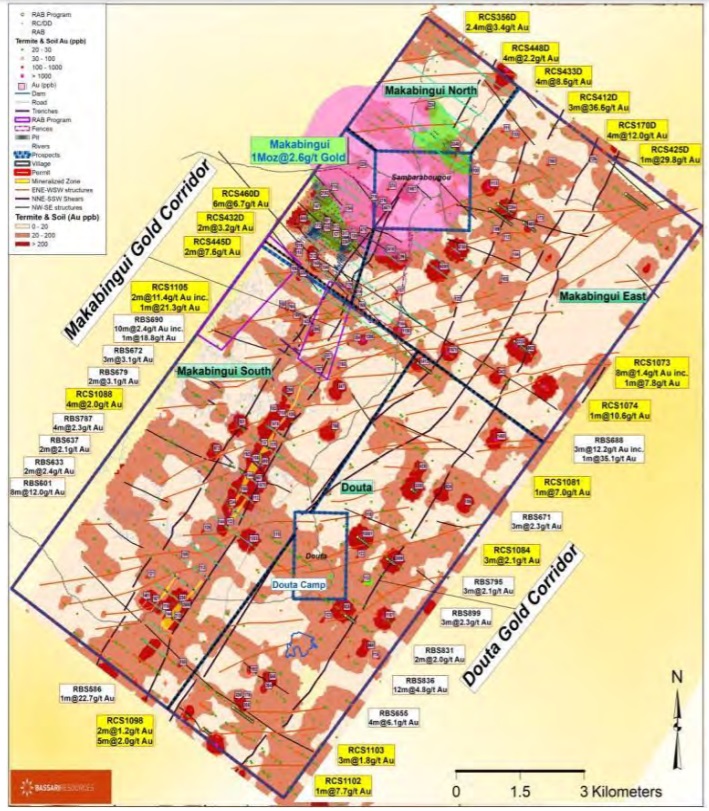

The companyâs exploration team has completed a detailed review of the numerous anomalous gold extensions to the Makabingui one-million-ounce gold resource grading 2.6 g/t contained within the 122 sq km exploitation permit. With more results coming from the exploration work, Bassariâs confidence in the Makabingui area is increasing with Directors now believing that this area will emerge as a multi-million ounces major gold zone

The company today has provided an update, wherein, it reported on the gold extensions discovered at the Project. BSRâs stock zoomed up by over 7% during the dayâs trade.

Exploration Update

Makabingul Project

The recent exploration work at the project has identified several inferred resources in and outside the current pit shell of Pits 1, 2, 3 and 4.

- Pit 1 - this deposit of 110,000 of proven oz at 7.6 g/t is still open to the north and at depth. In addition, drilling has exposed underground potential;

- Pit 2 - this deposit of 51,000 oz at 3.8 g/t is still open to the south and at depth;

- Pit 3 - this deposit of 5,000 oz at 3.1 g/t is open on strike and at depth;

- Pit 4 - this deposit of 13,000 oz at 5.9 g/t is open on strike and at depth

The company is planning to convert these inferred resources into indicated resources and increase reserves.

Makabingui East Prospect

Makabingui East Prospect covers an area of 32 sq km and contains high termite geochemical gold values including 4380 ppb and 5760 ppb. At this prospect, the company has identified Mineralised zones with encouraging rock chip assay results including 3.5 g/t Au, 4.2 g/t Au, 6.7 g/t Au and 7.4 g/t Au.

For Follow-up, the company has proposed Reverse Circulation (RC) drilling program which will be focussed on delineating additional inferred resources for the Makabingui gold project. Further, the company has proposed a 5,000 metres of Rotary Air Blast (RAB) drilling program to follow up the high and structured geochemical values coinciding with geophysical structures.

Makabingui South Prospect

As per the geological review, the intersections between the main Makabingui/Lafia shear and the secondary ENE structures are considered to be strong targets to advance the prospect. The company has proposed a Follow-up RC drilling which will be focussed on delineating inferred resources. Besides this, a 5,000 metre program of RAB is also proposed to follow up the extension south of the pit 1 and pit 2 mineralised lodes.

Douta prospect

At the Douta prospect, a 5,000 metre program of RAB is proposed to follow up the high and structured geochemical values coinciding with geophysical structures and generate RC drill targets. Considering the fact that a 12 km of strike already identified at Makabingui South, the companyâs Directors are confident that the Makabingui area will emerge as a multi-million ounces major gold zone.

Anomalous gold zones (in red) throughout the entire permit (Source: Company Reports)

In the past few months, the company has made significant development at the projects with various key tasks now being completed. In todayâs ASX release, the company has provided an update on Camp Construction and Rehabilitation works.

Camp Construction and Rehabilitation

The company has cleared 13 kms of haul road construction from the plant to the mining area. Further, the company has completed the Douta Clinic and its medical equipment and extended the housing capacity at the camp to 200 from the present 114.

The company has also completed the mess extension and have procured five Toyota pickups and a bus.

The company has completed the upgrade of the workshop and the workshop is now operational. Bassari has placed orders for major components of the processing plant including ball mills, screens, cyclones and agitators. The payment for these components has already been made.

What now?

The company is now waiting for the delivery of a number of containers to the Port of Dakar. The pre-mining grade control drilling contract has been awarded to AMS Drilling with drilling of Pits one and two to commence in October 2019.

At market close on 1 October 2019, BSRâs stock was trading at a price of $0.015, up by 7.143% during the intraday trade.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.