Health care sector

During the past several years, the Australian Health Care Sector had seen rapid development, and as a result it stands out as one of the best health care systems in the world, delivering safe, effective and affordable health solutions to people, regardless of a few uncertainties in the stock market. This sector is mutually operated by federal, state and local government bodies. Australian Department of Health had been providing generous funding to health care sector considering an increase in ageing population and upsurge in chronic diseases.

Health care players often collaborate with stakeholders or financiers within the health care space, to raise funds through capital raising or capital funding programs for their operational activities as well as to shape the future with financial sustainability. Simply put, capital raising refers to fundraise through capital funding programs. Capital funding is the money that is offered to a company for their daily needs as well as long-term requirement. In return, the financiers expect profits in terms of interests, dividends and appreciation of stocks. Two primary ways by which a company can raise funds include stock issuance and capital raise via debt.

In this article we would be discussing a health care company, Genetic Signatures Limited (ASX: GSS) that recently delivered a capital presentation and provided insights on capital raising, a report for the quarter ended 30 September 2019, corporate update and commercialisation strategy.

Genetic Signatures Limited (ASX: GSS)

A specialist molecular diagnostics (MDx) company, Genetic Signatures Limited (ASX: GSS) has a prime focus on development and commercialisation of its well-established patented platform technology, 3base⢠that provides molecular tools to hospitals and pathology laboratories. Under the EasyScreen⢠brand, the company designs and manufactures a suite of real-time Polymerase Chain Reaction (PCR) based products used for the routine detection of infectious diseases. The company has an extensive patent coverage with 9 patent families in 20 countries including all large key markets such as US, China, UK, Australia etc. Genetic Signatures had spent more than $24 million and 9 development years on research and development and Intellectual Property expenses.

Genetic Signatures Limited raised $35.0 million Capital

- Dated 28 October 2019, it was notified to the market that Genetic Signatures had successfully undertaken a two-tranche placement that would raise $35 million on settlement via issuing 35.7 million new ordinary shares.

- First tranche- The issue comprised of 6 million new shares and would raise ~$15.3 million, expected to take place on 4 November 2019.

- Second tranche -The issue comprised of 20.1 million new shares to raise $19.7 million, provided GSS obtains approval from the shareholder. Genetic Signatures will be organising a meeting of shareholders in early December 2019 to seek this approval.

- The placement was completed at $0.98 per share that represents a discount of 9.3% to the last closing price on Wednesday, 23 October 2019. This placement was underpinned by new and existing institutional investors.

The earnings from this placement would be utilised for-

- expanding business commercially in the European Union and USA,

- obtaining further regulatory approvals to Genetic Signaturesâ products,

- additional product development including for new instrumentation, and

- for working capital purposes.

The company also received a significant keystone investment from a large global fund manager and Australian institutional investors Perennial Value Management and Regal Funds Management.

Furthermore, it was reported that Capital Raising would fast-track the global rollout as well as drive the revenue growth rapidly. It is also expected that this funding would place Genetic Signatures Limited as cash flow positive and would also result in profitability.

Share Purchase Plan

In amalgamation with the Placement, a share purchase plan would be provided to the eligible shareholders (SPP) offering the shareholder an opportunity to subscribe for $30,000 of new shares under this plan, which would be at the same price as the Placement. SPP would be capped by $2 million.

Genetic Signatures would utilise the fund raised from the Placement and Share Purchase Plan will be deployed to fund global marketing as well as the expansion of sales. This amount should also fund the company through to profitability and breakeven.

For the capital raising, Bell Potter Securities Limited served as Lead Manager to the Capital Raising.

Highlights from Genetic Signaturesâ September 2019 Quarterly Activities Report

Released on 28 October 2019, the quarterly report provided an update on the companyâs activities and a summary of unaudited revenue for the quarter ended 30 September 2019 or 1Q FY20. Key highlights are as follows-

Corporate Update

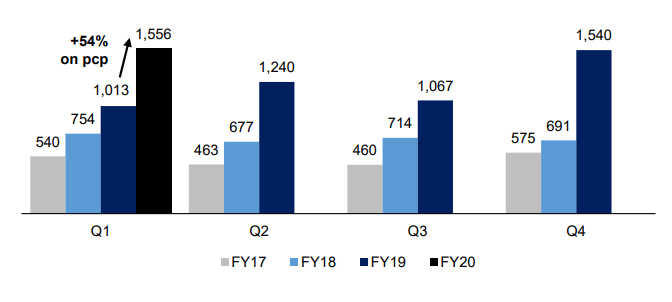

- A quarterly revenue of $1.6 million was recorded, although it was marginally higher than the record set in the fourth quarter of FY19. The revenue in the first quarter reflected an increase of 54% over the previous corresponding period. A relatively long flu season that sustained up to early 1QFY20, as well as rising customers demand had been the main driving force for the growth in revenue.

- It was further reported that the sales pipeline in Europe is growing and several customer trials/tenders approaching completion. First material sales in Europe as well as in the United States is expected in the second half of FY20.

- It is expected that the FY20 revenue growth would surpass historical CAGR of 47%.

- The company held $4.9 million cash and cash equivalents in hand as at 30 September 2019, a decline from $6.3 million at 30 June 2019.

- Net operating cash outflows in the first quarter of FY20 were $1.3 million, which included receipts from customers amounting to $1.5 million.

Genetic Signatures Commercialisation Strategy

- With a focus on the implementation of its global commercialisation strategy and to broaden the product portfolio, Global Signatures continued to work towards fast-tracking the sale of international product.

- For the EasyScreenTM STI / Genital Pathogen and Flavivirus / Alphavirus Detection Kits, CE-IVD and TGA regulatory applications in Europe and Australia, respectively are likely to be submitted with product launch following in early 2020.

- Genetic Signatures is also progressing towards expanding its product range through local and international regulatory approvals along with the development of additional EasyScreenTM Detection Kits.

- It is expected that the FDA submission for the EasyScreenTM Enteric Protozoan Detection Kits would be lodged in mid-2020 while the registration is anticipated approximately 90 days post submission.

- The company also continued to focus on actively endorsing its 3baseTM technology and the EasyScreenTM brand at important industry events.

- The company also would remain focused on developing new Kits to expand its product portfolio further.

- A material contract to be signed in each significant EMEA and North American market to support FY20 revenue growth.

Received $2.1 million R&D rebate

The company announced, on 28 October 2019, the receipt of Research and Development (âR&Dâ) tax incentive of $2,146,943 from Australian Tax Office under the Australian Government R&D tax incentive program.

Retirement of Non-Executive Director

Recently, it was also informed that Mr. Phillip Isaacs, the Non-Executive Director, who was appointed to Genetic Signaturesâ board in 2003, would be taking retirement from his services at the conclusion of the 2019 Annual General Meeting scheduled on 22 November 2019 in Sydney, as announced on 28 October 2019.

Stock Information

GSS shares last traded at $0.98 on 31 October 2019. The company has market capitalisation of 101.98 million and ~104.06 million outstanding shares. The 52 weeks high of the stock was noted at $1.4 and average volume (year) is 30,819. GGS generated a return of 22.5 % on year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.