Summary

- Aguia Resources has been actively engaged in obtaining Installation Licence for its Tres Estradas Phosphate Project.

- AGR announced a Renounceable Rights Issue in addition to the private placement financing, which took place in April 2020 for gross proceeds of approximately $730,250.08. Funding raised in each case shall be used for the advancement of the phosphate project.

- Funds shall also be used towards maintenance of copper assets and meeting working capital requirements.

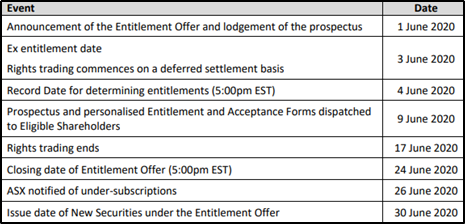

- The tentative date for closure of the entitlement offer as announced by AGR is 24 June 2020.

Fertiliser focused company with mineral resource projects, Aguia Resources Limited (ASX:AGR) owns significant land holdings comprising of phosphate and copper projects in Southern Brazil. The Company is in the pre-production stage of a low-cost natural phosphate fertiliser project and has identified multiple copper targets at its copper assets located in Brazil.

On 1 June 2020, AGR has shared its intention to undertake a Renounceable Rights Issue to raise up to $2.5 million, assuming full subscription under the Rights Issue. Aguia Resources looks forward to offering its shareholders 2 New Shares for every 9 Existing Shares held on 4 June 2020 (record date) at an attractive price of $0.05, with one attaching Option for each New Share subscribed for and exercisable at $0.10 and expiring on 30 June 2023.

AGR offers its shareholders with the opportunity to participate in its significant milestones by way of the Rights Issue, the price of which represents a discount of:

- 26% to the Company’s last close of $0.068

- 33% to the Company’s 30-day VWAP of $0.075

- 44% to the Company’s 90-day VWAP of $0.089

Shareholders who have a registered address within Australia or New Zealand, and who hold shares on the Record Date are eligible to access the Rights Issue for which the closing date is 24 June 2020. Moreover, AGR also declared that eligible shareholders can apply for the shortfall in excess of their entitlement and shareholders can trade their rights from 3 June 2020.

The Lead Manager to the Rights Issue is Mahe Capital, and a prospectus has been lodged with ASIC on 1 June 2020 in relation to the Rights Issue. The tentative dates shared by AGR regarding the Progress of Rights Issue are given below:

Source: Company's Report

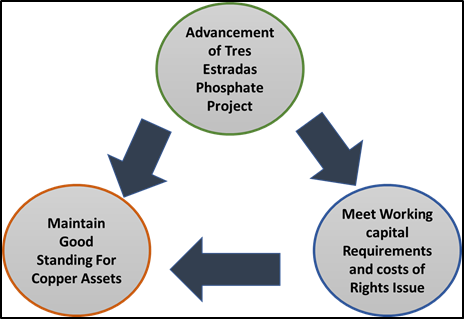

Employment of Funds Raised

The funds raised through the rights issue shall be utilized towards the completion of the Installation Licence (LI) stage and advancement at the Company’s Tres Estradas Phosphate Project, ensuring fair positioning of AGR’s copper assets and meeting working capital requirements as well as costs of the Rights Issue.

AGR’s progress during the period of last one year can be accessed at: A Year in Review for Aguia Resources, Major Developments at Phosphate and Copper Assets

Recent Engagement of AGR

Currently, AGR’s main focus is on exploration and development of its phosphate as well as copper projects in Brazil. Moreover, the Company has identified multiple copper targets with the deployment of its very experienced in-country exploration team.

Details at: Tracing the Progress at Copper Exploration Activities for Aguia Resources Limited

Also, AGR’s low-cost natural phosphate fertilizer project is moving into a very exciting phase of its development and is anticipated to be operational in early 2022. The Company has made significant progress towards the development and advancement of its Três Estradas Phosphate Project.

March Quarter Update: Aguia Resources Provides March Quarter Update, Progressing Well with Agronomic Trials and Installation License

Recent Capital Raising

Previously, in the month of April 2020, AGR had concluded a private placement financing for gross proceeds of approximately $730,250.08 through the issue of around 9,128,126 fully paid Ordinary Shares to sophisticated and institutional investors at a price of $0.08 per share through a non-brokered private placement.

Similar to the current rights issue, AGR had announced the issue of one Option (Unlisted) for no additional financial consideration with an exercise price of $0.16 and an expiry date of 20 April 2022. Moreover, the Company intended to utilise the proceeds from the placement towards the following:

- Advance the Três Estradas Phosphate Project towards construction and accelerate the investigation of direct application natural fertilizer (DANF) opportunities, including three other projects being worked on regarding Trial Mining

- Maintain the fair position of all tenements and meet general working capital requirements of the business

Detailed Discussion at: Aguia Resources Eyeing Advancement at Três Estradas Phosphate Project; Raises Funds Through Placement

AGR looks forward to sending the Prospectus as well as a personalised entitlement acceptance form to eligible shareholders soon after the Record Date of 4 June 2020. Moreover, the Company advises the shareholders to consider the Prospectus in deciding whether to acquire securities under the Rights Issue as they shall be required to abide by the instructions on the entitlement and acceptance form that shall go along with the Prospectus.

The AGR stock was closed at $0.06 on 1 June 2020, with a market capitalisation of $15.04 million.