Definition

Related Definitions

Top-down Analysis

What is top-down analysis?

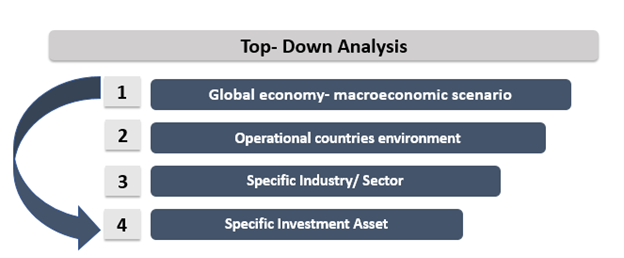

Top-down analysis is a stock analysis or business analysis approach. It begins with macroeconomic indicators, then moves to sectoral performance analysis, and finally reaches a firm's fundamentals. Thus, it moves from the set of economic indicators to the subset of firm fundamentals. It is precisely the opposite of bottom-up analysis, where the primary focus of an analyst is on the fundamentals of a business or its key performance indicators before anything else.

Highlights

- Top-down analysis targets a country’s economy, tailed by specific sectors and individual business’ assets.

- Often international investors use this approach for analysing potential risks and returns for an investment asset’s valuation.

- The top-down analysis approach tries its best to include all factors influencing business profitability and returns on investment.

Frequently Asked Questions (FAQ)

How do analysts go about with top-down analysis?

Source: Copyright © 2021 Kalkine Media

- An analyst or investor using top-down analysis will first look at the global economy. The existing macroeconomic scenario like competition, currency exchange rates, etc., are to be considered. This will help assess the indirect impacts these can have on the business.

- Next, the analyst/investor will study the operational countries political and economic environment. Investors often look at how much the local government and the economic environment favours the business or its policies. Some indicators helpful at this stage are the gross domestic product (GDP), unemployment rates, inflation, interest rates, the local government’s policies and existing laws & regulations.

- Next, analysts cut down their analysis to the specific industry in which the investment is headed. Some industries perform better than others and align or deviate from macro-economic environments. The analyst needs to choose the right sector and study the potential growth, existing volatility, and life cycle.

- Next, the analyst/ investor studies the specific company/investment asset in which they are interested. A deep dive into its fundamentals, financials and market valuations are done. An investor may also study technical charts of stock before investing in real-time.

Example

Source: © Andreypopov | Megapixl.com

A high net-worth investor, Joy Kong from China, wants to invest AU$10 million in XYZ Automobile Ltd in Australia. However, before investing, he undertakes a top-down analysis.

So, he first studies the global scenario and the world economy, whether in a recessionary/inflationary phase. Then he explores the investment environment in Australia. How easy is it for foreign investors to invest there? Next, he shifts his focus to the automobile industry in Australia. How supportive are the conditions for the growth of this sector? After studying all this, he next takes up a thorough analysis of XYZ Automobile Ltd. How well is it placed in the industry? What was its profitability in the recent past? What is its future?

By going from the larger to the smaller segment, he will thus be able to determine how much XYZ Automobile Ltd is affected by macro and micro factors? It will give Joy Kong a comprehensive idea, whether he should invest so much in XYZ Automobile Ltd. How well is it placed in the industry? What was its profitability in the recent past? What is its future?

By going from the larger to the smaller segment, he will thus be able to determine how much XYZ Automobile Ltd is affected by macro and micro factors? It will give Joy Kong a comprehensive idea, whether he should invest so much in XYZ Automobile Ltd.

Most domestic and foreign Institutional investors undertake a similar approach. Individual assets are examined for both the fundamental and technical aspects.

When should an investor/analyst use top-down analysis?

- When one wants to compare different economies and different sectors for investment.

- If an investor wants to reduce the chances of investing in a downward trend and seeks to minimise risks.

- The top-down analysis allows diversification of investments across different sectors.

- It helps investors in international markets.

- Investors interested in benefitting from global trends choose this approach.

- It is helpful to develop a vast understanding of hedging purposes by investment houses.

- Investors interested in getting a comprehensive picture go for it.

- It helps shift invested capital before global trends set in locally.

- Portfolio investors and fund houses widely use it to expand portfolios globally.

How does the top-down analysis work in technical charts?

Source: © Sgarziera | Megapixl.com

Top-down analysis is also possible in technical analysis. When using the approach to study technical charts, the analyst or investor explores the prices of securities for a more extensive time to shorter ones. The focus on analysing charts moves from yearly to weekly and next to daily movements. It helps in identifying long-term trends and understanding stocks support and resistance levels. Investors are better placed with this approach as they can easily decide on the term of their investment.

What are the pros of top-down analysis?

- Top-down investing is a more efficient approach.

- It is all-inclusive and does not leave out even a single critical factor influencing the investment.

- It captures the investor’s time and attention towards relevant data.

- It studies large-scale economic combinations and public data.

- It provides a diverse range of information for optimal investment.

- It helps investors explore potentially profitable opportunities.

- Investors can quickly identify stocks that outperform the general market.

- Investors gain knowledge on macro and micro trends and settings.

- It helps in tactically managing investments across borders.

- Investors can easily benefit from cross-currency and economic trends.

- Investors/ fund managers can develop a low-risk well-hedged investment portfolio.

Is top-down analysis better than bottom-up analysis?

Both strategies are exact opposites. While the bottom-up approach focuses first on microeconomic factors affecting an investment asset, top-down focuses on macro factors first. Thus, the top-down approach is said to be for a more long-term portfolio, while a bottom-up approach is for more tactical, actively managed funds. None of them can be termed as the best fit for all. It is the investor and his expectations that will decide which approach he should go for.