Definition

Related Definitions

Share Capital

Share Capital is the amount raised by a company through the issue of common/preferred shares. It remains with the company till it is liquidated.

The company’s shareholders own the share capital. Since shareholders are also the company's owners, share capital is the company's owned capital.

Source: © Djbobus | Megapixl.com

Why do companies issue shares?

Primarily, a company issues shares to raise capital. Typically, a large privately held firm would issue stock on a stock exchange for public trading.

A business would allow the general public to purchase its shares to gain fractional ownership. Shareholders are also eligible to collect dividends based on their holdings.

What are the features of Share Capital?

Availability: A Company can easily raise share capital to fund its expansion plans or other business development activities.

Owned Capital: Share Capital is the company's own money, unlike debt. As highlighted above, it is owned by a company’s owners and is thus the company’s owned capital.

Permanent Capital: Raising money via share issue brings the company its permanent capital. It can use the funds during the business’s lifetime without worrying about repayment of the owner’s funds. Also, there is no agreement as such to refund the money of shareholders.

Shareholders will receive their capital after the company is liquidated and all obligations are met.

If a shareholder wishes to recoup his investment, he can sell his stock to others, provided he is allowed to do so under the Companies Act. It would be a permanent investment for the investors who wish to stay invested throughout the company’s lifetime.

No Compulsory Dividend: Another benefit of redeeming stocks is that there is no fixed fee, and the corporation is not obligated to pay dividends. Shareholders have no right to intervene if the management uses its profits for reinvestment.

No Security: The issuing company does not have to mortgage any of its properties to obtain share capital.

Participation: Share capital gives the shareholders the right to be a part of the company’s management through their normal rights as shareholders.

Residual Claims to Income and Property: Once a debtor’s claims are addressed, the shareholders’ claim to income are met. Similarly, creditors have the first claim to the company's assets if it is liquidated. The shareholders would get the remaining amount.

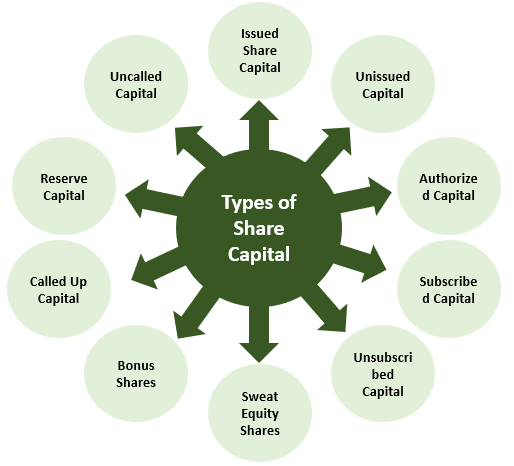

What are the types of Share Capital?

To generate share capital, a Company has various types of equity shares to consider. The different types of share capital are highlighted below:

- Issued Share Capital: Issued share capital refers to the shares that a company sells to its investors. For instance, if a company issues 800 shares at $100 each, the issued capital will be $80,000.

- Unissued capital: It refers to the portion of the approved capital that is not distributed to the general public.

- Authorized capital: It refers to the biggest amount a company can raise by issuing shares to the general public. The approved capital of a corporation is the amount of money with which it is registered.

- Subscribed Capital: It's the portion of the issued capital that the general public buys. For example, if a company issues 800 shares at $100 each and the general public buys 700 shares out of the total, the subscribed capital would be $70,000.

Copyright © 2021 Kalkine Media Pty Ltd.

- Unsubscribed capital: It's the portion of the issued capital that the general public does not subscribe. Thus, if a company issues 800 shares at $100 each and 600 shares are bought by the general public, the remaining 200 shares form a part of the unsubscribed capital, worth $20,000.

- Called up capital: It is the portion of the subscribed money that a company uses. For instance, if a company's shareholders pay $50 per share for 100 shares, they have to pay a total of $5,000.

- Uncalled Capital: This is the portion of a firm’s subscribed capital that has not been called up yet. It could be called upon if the organization needs funds.

- Reserve Capital: Reserve capital is the component of the uncalled capital set aside to be called up only if a company's winding up or liquidating. It is not possible to name it during the life of the company. It can only be used under exceptional circumstances, such as the company's liquidation. Reserve capital intends to protect the interests of creditors when the company is wound up.

- Sweat equity shares: Companies give shares to their staff or directors as a token of gratitude for a job well done. Sweat equity shares are the term for these types of shares.

- Bonus Shares: Investors earn these securities in the form of a dividend.

What are the associated risks?

Equity shares have their fair share of drawbacks, which tend to amplify associated risks with equity share capital. Here are the key risks linked with share capital:

No Buyers

A business can sell its equity shares to the general public for purchase. These days, investors have a greater understanding of how the investment market works and which practices will benefit them. They gather detailed data and evaluate an investment opportunity to determine its prospects before deciding to invest.

Investors would not be able to invest in a company's shares if they do not meet their criteria or standards. The firm would not be able to raise equity share capital if there are no investors in the stock market.

Insufficient Capital Raise

As there are many options for investors to pick from in the stock exchange, there are chances of raising capital, which is insufficient for the intended purpose.

Liabilities

Companies that sell several shares at a low-face value risk attracting a higher number of investors than expected.

Getting a broad shareholder base is only helpful if the number of shareholders is held within a manageable range. When the amount becomes unmanageable, it increases the company's liability burden by requiring them to pay a larger portion of their profits as a dividend than they had expected.