Definition

Related Definitions

PEG Ratio

What is PEG Ratio?

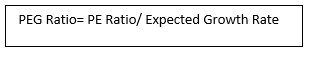

PEG ratio is defined as the price earnings ratio divided by the expected growth rate in earnings per share.

Copyright © 2021 Kalkine Media

The price-earnings (PE) ratio is the ratio of market price per share to earnings per share. For portfolio analysis, PE ratios may be compared to the expected growth rate to assess if stocks are overvalued or undervalued. The relative value is estimated, If the PE ratio is less than the anticipated growth rate, the firm is undervalued. A higher number would imply that the market has overvalued the stock.

Summary

- PEG ratio is the price-earnings ratio divided by the expected growth rate in earnings per share.

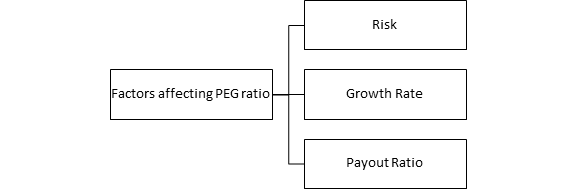

- PEG Ratio is a function of the risk, growth potential and payout ratio of the firm.

- PEG ratio is not effective in correctly assessing companies that are either mature or those with high growth potential.

Frequently Asked Questions

What are the determinants of the PEG Ratio?

Copyright © 2021 Kalkine Media

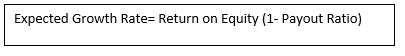

PEG Ratio is a function of the risk, growth potential and payout ratio of the firm. The riskiness is assessed based on beta value. As risk increases, the PEG ratio of a firm will decline. This means that when different firms are compared, riskier firms will have lower PEG than the firms with safer performance. In the PEG, as the growth rate increases, the PEG ratio initially declines and then gradually begins to rise again. This indicates a U shape relationship between PEG ratios and growth. Thus, it can be a very complex task to compare firms with widely varying growth rates. Also, with the increase in payout ratio, the PEG ratio too should increase. A firm’s return on equity links its growth rate and payout ratio. So the expected growth rate of the firm can be estimated as

Copyright © 2021 Kalkine Media

This implies that at a given rate of growth, firms with higher returns on equity must have a higher PEG ratio.

How is PEG ratio used for comparing firm valuations?

Fundamental analysis is a method of determining a stock's exact worth based on internal and external factors. The three accounting sheets, namely the balance sheet, income statement, and statement of cash flows, provide many of the ratios and resources needed for fundamental analysis. PEG ratio is one such instrument.

PEG ratio is used to compare the valuations of firms from the same industry. Firms from the same sector with lower PEG ratios are deemed undervalued. This direct comparison of PEG ratios of firms is logical if the PEG determinants- risk, payout ratio and potential growth are similar across the firms being compared.

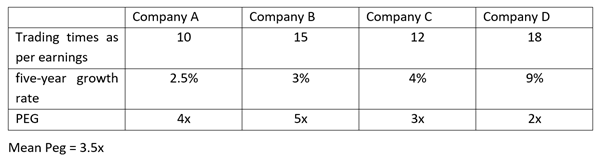

Suppose we need to evaluate four players A, B, C and D, from the same industry.

Company A trades at ten times its earnings, Company B trades at 15 times its earnings, C at 12 times, and D trades at 18 times its earnings.

Based on an isolated look at the details, company A looks attractive. Suppose we are given additional information that the five-year growth rate of company A stands at 2.5%, 3 % for Company B, 4% for company C and 9% for company D.

With this additional piece of information, we can evaluate the PEG ratio of each of the companies using the above formula of PEG ratio= PE ratio/ expected growth rate.

Copyright © 2021 Kalkine Media

The values of PEG ratio will be 4.0, 5.0, 3.0 and 2.0 for company A, B, C and D respectively.

Here we see an average PEG of 3.5 for the industry. So Company A and C are the closest, Company B looks over valued while D looks undervalued given the growth prospects on a relative basis.

When firms with different features are compared, it is found that there is a lot of volatility in the relationship between growth and PEG ratios.

Firms with extremely low or extremely high growth rates will have higher PEG ratios than firms whose growth rates dip in between, leading to mild dips in PEG ratios too.

Firms with lower PEG ratios and higher risks would seem more undervalued when compared to firms with lower risks because the movement of PEG ratios and firms risk move in opposite directions.

Similarly, firms with lower returns on equity indicated by lower payout ratios will have lower PEG ratios and seem more undervalued than those firms which have more returns and higher payout ratios. Thus we can see that based on direct PEG ratio comparisons, undervalued firms may actually be firms with higher risk or lower returns on equity that are correctly valued. As a result, it is essential to control for the inter-firm differentials in risk, growth and payout ratios while drawing comparisons.

What are the drawbacks of the PEG ratio?

When it comes to calculating low-growth businesses, the PEG ratio has certain drawbacks. A mature business, for example, may have strong earnings and a reliable dividend, but its growth rate is slow.

For fast-growing businesses, the PEG ratio is often prone to significant errors. A business that grows at a rate of more than 25% per year, for example, would be unable to maintain such a rate. As a result, you must make speculative assumptions about growth rates. The PEG ratio is just as strong as its inputs, once again.

When it comes to low-growth businesses, the PEG is less successful. Large, well-established businesses may have limited room for expansion.

Similarly, PEG may be less suitable for use with small, high-risk risky companies that may have a low PE due to extremely low price, followed by high EPS growth triggered by doubling or higher growth of the share price from a very low level.

The EPS growth of an organisation is an estimation that is subject to the limitations of forecasting future events and can fluctuate due to a variety of factors.

Furthermore, when considering PEG, the business’ EPS growth does not account for the economy's overall growth and does not account for inflation. A business that grows at the same rate as inflation, for example, is not rising in real terms.