Definition

Related Definitions

401k Plan

What is 401k retirement plan?

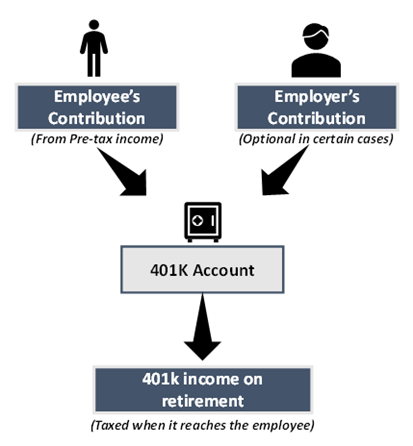

The 401k retirement plan is an employer sponsored account that allows employees to cumulate a percentage of their pre-tax salary into a retirement account. These contributions to the retirement account have certain annual limitations attached to them. The employer may also opt to match up a portion of the contributions made by the employee into the account.

The funds put into the retirement account could be used to invest in mutual funds offered within the plan. The 401k account is a defined contribution account, so the contribution to be made to the account is decided beforehand.

Summary

- The 401k is a company sponsored retirement plan which allows employees to cumulate a percentage of their pre-tax salary into a retirement account.

- Employers’ contributions to the 401k plan are optional and are usually lesser than those of the employees.

- Only an employer can sponsor the 401k account.

- Money deposited in 401k account cannot be withdrawn during emergency.

Frequently Asked Questions (FAQs):

How does 401k plan work?

Under a section of the Internal Revenue Code, the 401k plan is listed as a defined contribution plan. The employers’ contributions to the 401k plan are optional and are usually lesser than those of the employees.

Image Source: Copyright © 2021 Kalkine Media

The employers must ensure that the plan is run in accordance with the law and the appropriate rules and regulations. Thus, the employer must decide who is eligible to have a 401k plan, the available investment options, how often the employees can reallocate their investment assets, and the features that the plan would have.

The employers can decide what percentage of employees' pre-tax salary could be contributed to their 401k account. Therefore, a 401k account effectively reduces the amount of tax that is to be paid by employees. However, the distributions made at the time of retirement are taxed.

The money placed in a 401k plan cannot be removed prior to its maturity. However, some plans do allow early withdrawals in case of an emergency. Thus, the 401k account is considered a retirement account and not a savings account.

The plan sponsor must provide the employee with a Summary Plan Description. The description contains thorough information about the features, what options are available, the associated trustees and other relevant information.

What are the different types of 401k accounts?

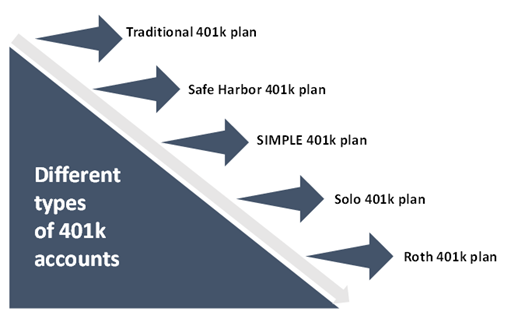

Employees can choose from the following set of plans:

- Traditional 401k plan: Under a traditional 401k plan, employees contribute a percentage of their pre-tax income. In a traditional account, an employer may also choose to contribute as they are not taxed either. A traditional 401k plan must come with an annual nondiscrimination test that ensures that contributions are not only benefitting the highly compensated employees.

- Safe Harbor 401k plan: This is a special retirement plan which automatically passes the nondiscrimination test. These plans are usually opted by small businesses as they save the time and money required to conduct the nondiscrimination test. However, in a safe harbor plan, the employer must contribute regardless of the employee’s title, compensation, or length of service. Thus, employers do not have the option to opt out of the 401k contribution.

The contributions made by the employer can be eligible matching or nonelective contribution. A basic match is a 100% match on the first 3% of deferred compensation and an additional 50% for contribution from 3-5%. While an enhanced includes a 100% match on the first 4% of deferred compensation. On the other hand, a nonelective contribution is 3% of the compensation irrespective of what the employee contributes.

- SIMPLE 401k plan: This type of plan suits a small business or self-employed professionals with 100 or fewer employees. It can be understood as a simplification of the traditional 401k plan. The contributions made under the SIMPLE 401k plan are nonforfeitable as soon as they are made. The feature that makes SIMPLE 401k plans stand out is that the employees cannot receive contributions and accruals with any other employer-sponsored retirement plan.

Businesses above the 100-employee limit must change their 401k plan within a grace period of 2 years. The contribution made by the employer must either be up to 3% of the employee’s pay or a nonelective contribution of 2% of the employee’s pay.

- Solo 401k plan: A solo 401k plan has one participant and can be understood as a traditional 401k plan specially designed for a business owner or self-employed individuals with only spouses and business partners included in their operations.

Under the Solo 401k plans, there is no compulsion for the employer to contribute to the plan and there is no employer in the organization i.e. you can contribute as both an employer and an employee. An employee can pay 100% of the compensation up to USD 19,500, whichever is less, for 2021 and make additional contributions of up to 25% of the compensation. However, the total contribution made under the account cannot exceed USD 58,000 in 2021. The only requirement for opening a Solo 401k is to have an Employer Identification Number (EIN) if the eligibility criteria is met.

- Roth 401k plan: A Roth 401k is much like a traditional 401k and a Roth IRA. However, the difference in Roth 401k is that it includes contributions from the post-tax salary instead of pre-tax salary. However, the withdrawals from a Roth 401k are tax-free.

Just like traditional 401k, Roth 401k also needs to go through a nondiscrimination test. Additionally, a Roth 401k account must be different from the other 401k accounts maintained by an employer.

Businesses of any size can have a Roth 401k account. Employers are not mandated to contribute to the Roth 401k account. A traditional 401k plan must be offered with a Roth 401k plan.

Image Source: Copyright © 2021 Kalkine Media

Why are 401k contributions important?

The 401k contributions come with a great level of flexibility. Under this plan, employees may contribute more than other IRA plans available. Additionally, it gives an option to the employer to contribute. The investment choices available for the fund range from 8 to 25 options. The plan may allow loans and hardship withdrawals at times. The tax deferrals make 401k accounts popular among many employees.

How can one start a 401k account?

Some plans may come with model portfolios that can allow employees to choose from a selection of investment options. Those employees who are new to a 401k account can opt for a target-date fund or model portfolio option. The plan can be availed from the employer. Otherwise, the same tax benefit can be availed from an IRA account.

What are investment options available under 401k plans?

Most 401k plans offer at least 3 investment options. These options come with different risk levels and can be chosen by the employee depending on his risk appetite. Government restrictions in place limit the amount of employer stock or other options. Some plans come with a default investment option.