Definition

Related Definitions

Market Value

What is market value?

When transacted in the marketplace, any product or service has to trade at a mutually agreeable price between the buyer and seller. This mutually agreed price is called the market value or even open market valuation (OMV). The term is frequently used in an investment context, especially for equity or business value.

Market value can be determined easily for products and commodities which are frequently traded given the multiple transactions and players in the market and the easy availability of information. As a result, the market value of instruments traded on the exchange, like stocks, bonds and derivatives, can be easily assessed. For a publicly traded company, the term is interchangeably used with market capitalisation.

Market capitalisation is calculated as the current share price multiplied by the number of outstanding shares. It is slightly difficult to assess the market value of assets traded over the counter like hedge funds. On the other end of the spectrum are highly illiquid assets like real estate and private businesses.

Summary

- The mutually agreed price at which goods and services are traded is called the market value.

- Market value may be similar to or different from the book value which is the value recorded on the balance sheet.

© Marianvejcik | Megapixl.com

Frequently Asked Questions (FAQs)

What is the calculation of market value?

Let's assume a company A currently trading at AU$25 and has a total number of outstanding shares of 100,000. As discussed above, the company's market capitalisation is the product of the number of shares and the market price, so company A's market value will be approximately AU$2500000.

How does market value differ from book value?

The value of an asset as recorded in the balance sheet is called book value. It is calculated as the difference between tangible assets and liabilities. In simple terms, the book value is the amount that the shareholders will get if a company’s assets are liquidated and debts repaid with the proceeds. Since the balance sheet value is the historical cost of the assets and liabilities, it differs from the market value, which is the current value of the net assets.

Since the book value is the liquidation value of the assets, if a stock trades well below its book value, it is considered undervalued- this is based on the assumption that the value of a running business is worth more than its liquidation value. However, the inverse of this need not be true, i.e. if a stock is trading above its book value, it does not necessarily mean that the stock is overvalued because a variety of factors impacts a stock value.

Market value and fair value

While market value depends on the supply and demand factors playing in the market, fair value is the stock's intrinsic value. In a perfect market, they both tend to align. However, inefficiencies in the market conditions often create a divergence between the two.

There are a few conditions used to assess whether a market is a perfect one. These are:

- No distress

If either of the parties, the buyer or seller, is under distress to perform the trade within a short timeframe, they will tend to close at the readily available price. However, this might not be the best available price in the market. Given the time constraint, the buyer or the seller might close the trade at a higher or lower price than its fair market value. This is not reflective of a fair market.

- Information availability

Easy and transparent availability of information is a vital requirement of a perfect market condition. It enables the parties to do sufficient research, analyse the market environment, evaluate available alternatives, and decide. The decision, so arrived, tends to be the fair value of the stock.

- Mutually agreed price

A vital feature of a perfect market condition is that the final price is arrived at through a mutual consensus between the buyer and the seller. If either of the parties is arm twisted for any reason to enter into the transaction, the final price will favour the counterparty, and hence, might not reflect the fair value.

Why is the term market value considered a dynamic one?

Market value varies widely depending on a multitude of factors, including company performance, management quality, debt capacity, the sector in which it operates, the broader economy. For instance, let us take the case of two similar companies A and B, operating in the same environment with similar growth profiles. If the market has a better perception of Company A's management, it might value it at a premium over company B. Similarly, let's assume two similar companies, X and Y, with annual revenues of AU$200m. Suppose company X operates in the technology sector and company Y operates in the oil and gas sector. In that case, the market might value company X at a premium over Company B, given the strong growth potential in the technology space. In this case, Company X might be trading at an Enterprise Value (EV) to Sales multiple of 4x, implying a valuation of AU$800m, while Company Y might be trading at an EV to sales multiple of 1x, implying a valuation of AU$200m. Market ascribes a higher multiple to the former, given the higher growth potential compared to the latter.

© Icefields | Megapixl.com

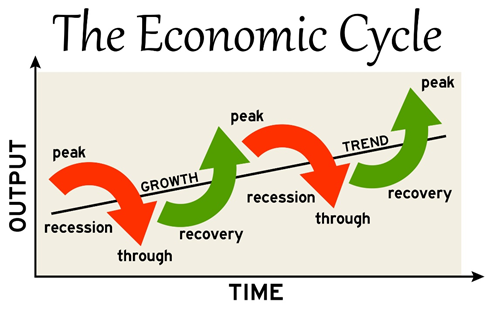

Business and economic cycles also have an impact on the market value of equities. For example, in a bear market, the market's outlook for the economy and, in turn, the company is weak. As a result, equities tend to trade at lower valuations versus regular periods. Similarly, in a bull market, investors tend to optimistic regards to the outlook for the economy resulting in higher valuations for companies. As a result, market values tend to fluctuate widely over periods of time.

What are the advantages and disadvantages of market value?

Advantages:

- Investors tend to evaluate a company's fair value based on its fundamental factors. Comparing a company's market value to its fair value allows investors to assess whether it is undervalued or overvalued. A stock that trades below its fair value is perceived as undervalued and vice versa. Investors tend to trade in such securities to exploit such situations to generate returns.

Disadvantages

- To correctly assess the market value of a company, there need to be similar peers in the market. Investors often benchmark valuation metrics with similar peers to understand whether that particular stock is undervalued or overvalued. In the absence of a comparable peer, it isn't easy to understand the value that market participants are willing to pay for the stock.