The below-mention stocks belong to the Industrials sector, a crucial sector for the Australian economy. These stocks have made strong operational progress in the past, which is why we are taking closer look at these stocks.

CIMIC Group Limited (ASX:CIM)

The shares of CIMIC Group Limited (ASX: CIM), an engineering-led construction, mining and services group, were trading at a price of $33.160 at market close on 9 August 2019,near to its 52 weeks low of 33.820.

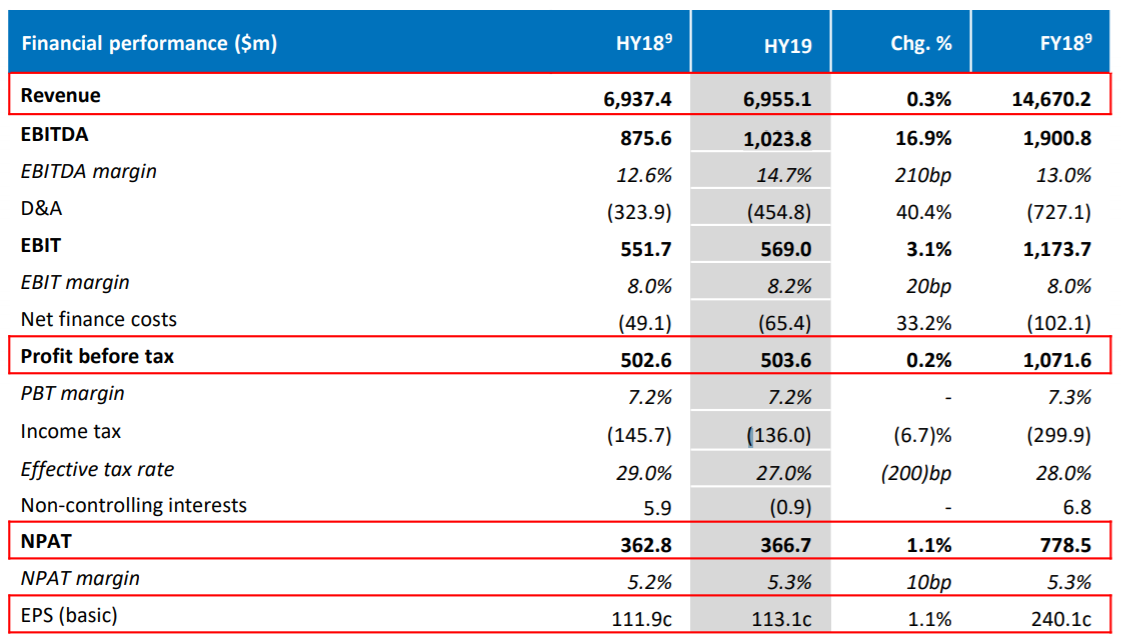

Despite reporting, solid operating performance in the first half of FY19, the companyâs stock has witnessed a decline of 30.46% in the past six months, as on 7th August 2019. In H1 FY19, the company earned EBITDA of $1,023.8 million, which was 16.9% higher than pcp.

H1 FY19 Results Snapshot (Source: Company Reports)

H1 FY19 Results Snapshot (Source: Company Reports)

On 9th August 2019, the company announced that its services company, UGL Pty Limited (UGL) has reached an in-principle settlement agreement in relation to a class action which was file by various shareholders who acquired an interest in UGL between 16th April 2014 and 5th November 2014. The company in its announcement has assured that this settlement will have no material impact on earnings or profit forecasts of the company.

UGL was recently awarded new rail and mining services contracts across Australia, maintaining CIMIC Groupâs position as Australiaâs premier rail and mining services provider. It is expected that this contract will result in generating combined revenues of around $260 million. Earlier in July 2019, UGL successfully secured a five-year extension to its contract with Sydney Trains, in anticipation of generating revenue of approximately $630 million.

Aurizon Holdings Limited (ASX:AZJ)

Operator of Australiaâs largest integrated freight rail network Aurizon Holdings Limited (ASX: AZJ) is going to release its full year FY19 results on 12 August 2019.

Recently, the company informed that few customers have lodged on 25 July 2019, challenging the decision of the Supreme Court of Queensland on 27 June 2019 which confirmed Aurizon Networkâs ability to charge fees agreed by customers under the Wiggins Island Rail Project Deeds.

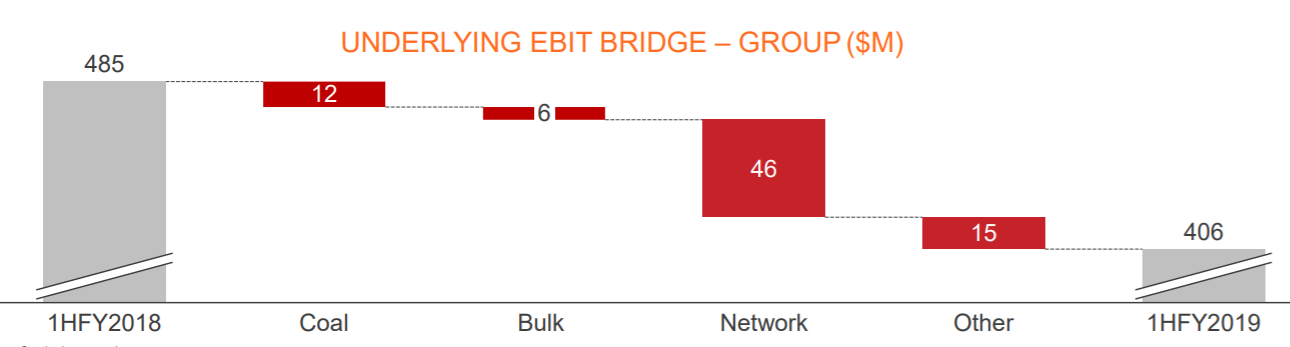

In the first half of FY19 , the company reported an Underlying EBIT of $406 million, down by 16% on pcp. The total Above Rail volumes were down by 5% in the first half.

Underlying EBIT Bridge (Source: Company Reports)

Underlying EBIT Bridge (Source: Company Reports)

The company believes that the maintenance investment it has made in FY2019, along with fleet reliability program, is positioning the company for future volume growth. The company is on track to achieve a cost reduction of $21 million by FY2021.

In the past six months, the companyâs stock has provided a return of 29.50% as on 9 August 2019. At market close on 9 August 2019, AZJâs stock was trading at a price of $5.750, down by 0.862% intraday, with a market capitalisation of circa $11.54 billion.

Auckland International Airport Limited (ASX:AIA)

Auckland International Airport Limited (ASX: AIA) is soon going to release it FY19 Results on 22 August 2019.

In the month of May 2019, Auckland Airport experienced total passenger growth of 1.7% (YOY) which includes International passengers of 0.9% (YOY) and domestic passengers growth of 3.3% (YOY).

In the first half of FY19, Auckland International Airport reported a revenue of $370.6 million which was 11.5% higher than pcp. However, there was a negative growth of 11.3 in the half yearâs reported profit after tax which was around $147.2 million.

In H1 FY19, the Airport worked closely with its airline partners to understand their requirements for the new domestic jet facility and the new international arrivals projects. It is believed that these deeper design insights will help the Airport to deliver improved project outcomes in the future including planning certainty, improved cost control and a realistic and achievable build programme.

In the past six months, AIAâs stock has provided a return of 30.58% as on 9 August 2019. At market close on 9 August 2019, AIAâs stock was trading at a price of $9.310, down by 0.214% intraday, with a market capitalisation of circa $11.3 billion.

Six months Price Chart of AIA (Source: AIA)

Six months Price Chart of AIA (Source: AIA)

Qantas Airways Limited (ASX:QAN)

Australiaâs competition watchdog, ACCC (Australian Competition and Consumer Commission) recent raised some concerns over Qantas Airways Limitedâs (ASX: QAN) 19.9% in Alliance Aviation Services Limited, acquired in February 2019. Qantas Airways awaits ACCC final decision in this matter, while it is of the view this transaction has not and will nor lessen any competition in the market.

In the third quarter of FY19, Qantas Airways had reported a revenue growth of 2.3% as compared to pcp while it overall market share of corporate travel revenue increased by 2.5 percentage points in the quarter.

While revealing the third quarter results, the companyâs CEO highlighted the fundamentally strong position of the company as well as noted increased softness in parts of the domestic corporate market for May and June. The CEO further informed that the company expects to achieve a record level of revenue in the full year (FY19) and strong cash flow.

In the past six months, QANâs stock has provided a return of 1.59% as on 9 August 2019. At market close on 11 August 2019, QANâs stock was trading at a price of $5.740, up by 0.702% intraday, with a market capitalisation of circa $8.95 billion.

SEEK Limited (ASX:SEK)

Diverse group of companies SEEK Limited (ASX: SEK) encompasses a strong portfolio of employment, education and volunteer businesses with operations spanning around 18 countries.

In the month of April 2019, the company has made an announcement regarding making investments in two high growth global online education businesses: Future Learn and Coursera, in line with the companyâs strategy to deploy capital into market leading high growth assets across the large human capital market.

The company had acquired a 50% of FutureLearn (a world leading online education platform) and a minority interest in Coursera (worldâs leading online learning platform for higher education).

In the past six months, SEKâs stock has provided a return of 11.54% as on 9 August 2019. At market close on 11 August 2019, SEKâs stock was trading at a price of $19.230, down by 0.052% intraday, with a market capitalisation of circa $6.77 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.