One of the Australiaâs leading Airline, Qantas Airways Limited (ASX: QAN) had acquired 19.9% interest in Alliance Aviation Services Limited (ASX: AQZ) in February 2019. Recently, Australia's competition regulator, ACCC (Australian Competition and Consumer Commission) expressed its preliminary competition concerns in relation to the acquisition as Alliance is Qantasâ only competitor on regular passenger transport routes between Brisbane and the important regional centres of Bundaberg and Gladstone.

The Qantas Group currently operates around 4,300 domestic flights per week and in the 2017/18 financial year it held around 60% of domestic airline services based on capacity, whereas Alliance operates a fleet of about 40 aircraft through which it supplies a range of services, focusing on charter air services, RPT air services and wet-leasing of aircraft.

ACCC believes that this acquisition may impact Allianceâs future growth and may also hamper the ability of Alliance to grow by raising funds from investors, or through takeovers.

As per, ACCC Chair Rod Sims, Qantas has not taken informal merger clearance from ACCC before the acquisition, which is why ACCC is now investigating whether this acquisition is likely to have the effect of substantially decreased competition in the Aviation market.

While Qantas in its release, published on 1 August 2019 has informed that it does believe that there is any evidence of a lessening of competition as a result of its minority stake and has assured that it has no plans to decrease its holding in Alliance. While ACCC is investigating whether this acquisition is likely to lessen the competition, Qantas Airways has provided an undertaking in which it has stated that it will not acquire anymore interest in Alliance until ACCC completes its investigation.

Following the investigation, if it is found that Qantasâ acquisition is substantially lessening competition, the ACCC may institute proceedings in the Federal Court which could result in making the transaction void, and it may impose a pecuniary penalty on Qantas.

The pecuniary penalty could be of up to the greater of:

- $10 million;

- three times the benefit obtained from the conduct,

- or if the benefit cannot be determined, 10 per cent of the corporationâs Australian revenue for the preceding 12 months.

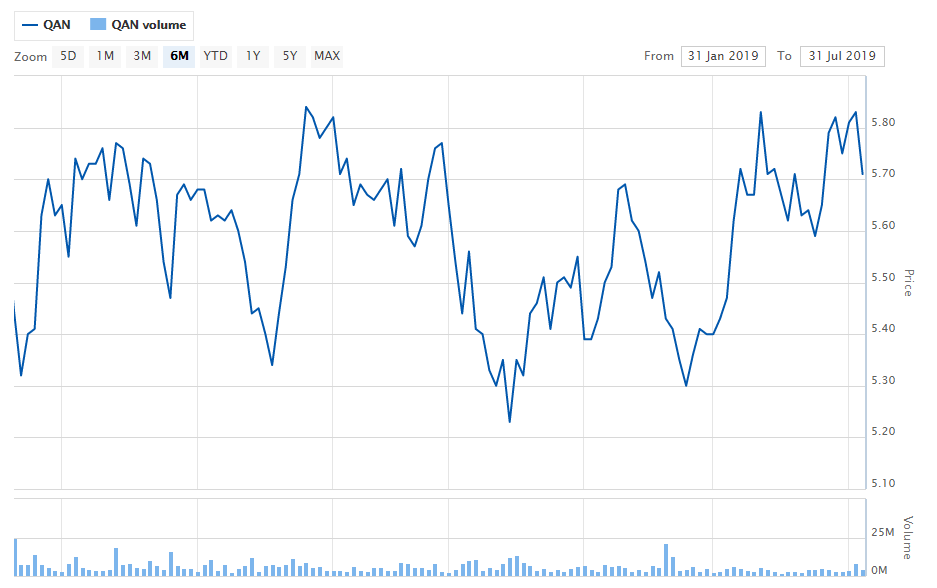

QANâs stock was trading at A$5.795, up by 0.433% (as on 2 August 2019, at AEST 12:32 PM). On the stock performance front, the share price of Qantas Airways has given a return of 8.46% in the last six months, and 1.23% in the last three months period.

QAN six-month Stock Performance (Source: ASX)

QAN six-month Stock Performance (Source: ASX)

Qantas has a market capitalisation of circa A$9.06 billion. QANâs stock was trading at a PE multiple of 11.1x and an annual dividend yield of 3.81%.

Let us now look at a few other companies which operates in aviation space.

Webjet Limited (ASX:WEB)

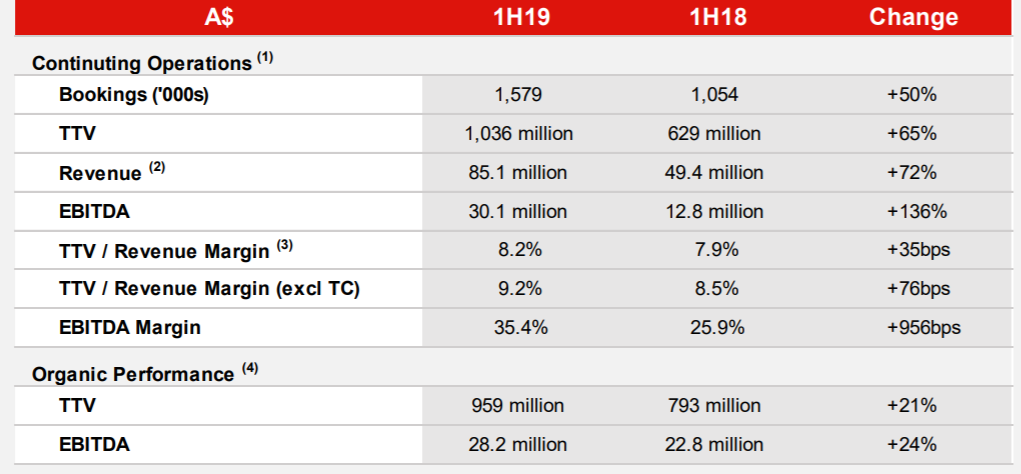

Digital travel business, Webjet Limited (ASX: WEB) has been experiencing tremendous success with its accommodation providing business WebBeds which is currently the worldâs 2nd largest and fastest-growing accommodation supplier to the travel industry. In the first half of FY19, the WebBeds business reported a revenue of $85.1 million, TTV (Total Transaction value) of $1,036 million, EBITDA of 30.1 million with EBITDA Margin 35.4%. In the Middle East and Africa, the WebBeds business is the regional market leader with operations in around 25 markets. In the first half, the business reported TTV growth of 16% in the Middle East & Africa region.

In the European region, despite 2018âs European summer and uncertainty surrounding Brexit, WebBeds reported strong organic growth with Organic TTV growth of 22% as well as solid growth in direct contracts.

First half of FY19 results (Source: Companyâs Report)

First half of FY19 results (Source: Companyâs Report)

In Asia Pacific, the companyâs WebBeds business reported TTV growth of 67% and Organic TTV growth of 35%.

On 19 June 2019, WEB notified that Challenger Limited (ASX: CGF) became a substantial holder by holding 6,831,968 ordinary shares with 5.04% voting power.

On the stock performance front, the share price of Webjet Limited has generated a return of 14.82% in the last six months duration. On 2 August 2019, WEBâs shares were trading at a price of A$13.35 with a market capitalization of circa A$1.82 billion (at AEST 1:01 PM). QANâs stock is currently trading at a PE multiple of 33.28x and an annual dividend yield of 1.53%.

Flight Centre Travel Group Limited (ASX:FLT)

One of the Worldâs largest travel agency groups, Flight Centre Travel Group Limited (ASX: FLT) has been strengthening its global corporate travel network by making investments in its European footprint (as announced on 1 July 2019). This includes taking 100% ownership of the 3Mundi corporate travel business in France and Switzerland to have a stronger corporate network and more powerful proposition for Swiss and French customers.

In April 2019, the company revised its FY19 guidance with PBT now expected to come in between $335million and $360million. The midpoint of this PBT guidance i.e., $347.5million is representing a 10% decline as compared to the $384.7 million underlying PBT earned in FY18.

As per FLTâs managing director Graham Turner, the companyâs overall results for FY19 are likely to be disappointing; however, the company is well placed to deliver further growth in the future. It is believed that the FY19 Short-term results will be lower than the initial expectations however there are some promising signs for the future growth.

On the stock performance front, the share price of Flight Centre Travel Group Limited has provided a return of 13.48% in the last six months. On 2 August 2019, FLTâs shares were trading at a price of $45.43 (at AEST 1:10 PM) with a market capitalisation of circa $4.66 billion. FLTâs stock is currently trading at a PE multiple of 18.940x and an annual dividend yield of 3.62%.

Corporate Travel Management Limited (ASX:CTD)

A global provider of innovative and cost-effective travel solutions Corporate Travel Management Limited (ASX: CTD) recently appointed Neale OâConnell as its new Global CFO. Mr OâConnell has a strong track record in listed company financial management and corporate transactions and has worked with global companies like Tatts Group Smorgon Steel Tattersalls and Delta Group.

On the stock performance front, the share price of Corporate Travel Management Limited has given a negative return of 4.17% in the last six months. On 2 August 2019, CTDâs shares were trading at a price of $22.27 (at AEST 1:14 PM) with a market capitalisation of circa A$2.47 billion. CTDâs stock is currently trading at a PE multiple of 28.620x and an annual dividend yield of 1.71%.

Virgin Australia Holdings Limited (ASX:VAH)

Virgin Australia Holdings Limited (ASX: VAH) recently on 11 July 2019, provided an update on Velocity Frequent Flyer in which it advised that Connectivity Pte Limited (Affinity) is exploring an exit from its approximately 35% minority investment in Velocity Frequent Flyer Holdco Pty Limited.

On the stock performance front, the share price of Virgin Australia Holdings Limited has provided a negative return of 13.51% in the last six months period. On 2 August 2019, VAHâs shares were trading at a price of A$0.165 with a market capitalization of circa A$1.35 billion.

To know about Virgin Australiaâs half-year results released in February this year, click here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.