The Australian share market?s benchmark index, S&P/ASX 200 index closed the trading session at 6864 points, a record high level for a second consecutive day on 28th November 2019. The index even touched 6879.5 points during the day?s trade, exceeding the previous all-time high recorded in July this year. The All Ordinaries index also observed a rise of 0.2 per cent or 15 points on Thursday, closing the trading session at 6965.6 points.

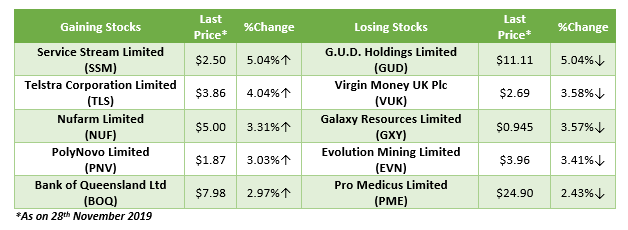

Most of the industry sectors closed the trading session in green, except S&P/ASX200 A-REIT, Financials, Financial-x-A-REIT and Consumer Staples sectors. The below table summarises a list of top five gainers and losers of the trading session:

Besides the Australian share market index, the Wall Street?s main indices also achieved fresh record high levels on Wednesday. The Dow Jones Industrial Average, S&P 500 Index and Nasdaq Composite indices closed the trading session with a rise of 0.35 per cent (at 28,164.00), 0.42 per cent (at 3,153.63) and 0.66 per cent (at 8,705.18), respectively.

The Australian share market notched fresh record high level on Thursday, driven by the following factors:

US Q3 GDP Data Revised Up

The Commerce Ministry has revised the third-quarter GDP growth rate of the US to 2.1 per cent per annum from its last month?s estimate of 1.9 per cent. Moreover, the Gross domestic income (GDI) grew at a rate of 2.4 per cent in the September quarter, following a rise of 0.9 per cent in the second quarter. Economists were anticipating the GDP growth estimate for Q3 to remain at 1.9 per cent.

In addition, the department notified that the gross domestic output rose at a pace of 2.3 per cent in the September quarter, speeding up from the growth pace of 1.4 per cent in the second quarter.

The growth in the US GDP was driven by a robust pace of inventory accumulation and a less sharp fall in business investment. As per latest reports, the US business investment fell by 2.7 per cent in Q3, rather than shrinking at a rate of 3 per cent, as earlier reported.

Better than expected US GDP data put pressure on the gold prices, that fell slightly on Wednesday as the country?s stock benchmarks strengthened.

Though the September quarter GDP growth estimates surprisingly turned out to be promising, a recent Federal Reserve survey has revealed that the Australian economy grew modestly from October to mid-November.

The survey mentioned that most districts of the US recorded stable to moderate growth in consumer spending, and several districts demonstrated a rise in auto sales and tourism. The survey also disclosed that the companies? ability to increase prices to cover elevated costs remained restricted; however, some districts observed that firms influenced by the tariffs were more inclined to forward cost increases.

Speculations over RBA rate cut

Speculations are doing rounds that the Reserve Bank of Australia (RBA) will reduce the interest rate to 0.25 per cent in June 2020. Economists are also anticipating the RBA to begin quantitative easing in the second half of 2020.

The economists? projections strengthened after the RBA?s Governor, Mr Phillip Lowe discussed the possibility that an additional cut in interest rates could have a different effect than in the past on confidence, when cash rates were at greater levels.

The speculations over the adoption of unconventional monetary policy measures rose after Mr Lowe mentioned in a recent speech that negative interest rates are highly unlikely in Australia as the country is not in the similar situation as Japan and Europe, where cash rates stayed in negative territory. He also highlighted the risks linked with negative interest rates that could make people more cautious and damage the confidence in the general economic outlook.

The Governor added that the quantitative easing would be an option to be considered at an interest rate of 0.25 per cent, nor prior to that level. He also mentioned that the threshold for commencing quantitative easing in Australia has not been reached yet, and he does not expect this to occur in the near term.

RBA?s discussion over the unconventional monetary policy measures despite recession not been in sight made economists think over the probability of QE in 2020. The speculations drove the Australian equity market high on Thursday, with rising expectations of another rate cut by the RBA, resulting in quantitative easing.

Optimism Over the US-China Trade Deal

The growing optimism over the US-China phase one deal also drove the stock markets high. Both the US and China are very close to finalising the first phase of the trade deal. The top negotiators of the two countries recently spoke regarding their desire to enter into an initial deal to put a halt on 16-month long tariff war.

The negotiators examined core matters related to the deal and attained a mutual understanding on settling relevant problems.

The ongoing trade dispute between the two countries has been adversely impacting their economies. This can be seen from the recently released data by China?s National Bureau of Statistics that indicated a fall in industrial profits by 9.9 per cent year-on-year in October to 427.56 billion yuan, marking the largest decline since January-February period and in comparison to 5.3 per cent fall in September.

The US President, Mr Donald Trump, has recently said that the trade deal is near, but he has also emphasized Washington's support for Hong Kong protesters. The Hong Kong issue could turn out to be a hurdle in US-China trade talks. China?s foreign ministry has summoned the US ambassador to scrap legislation supporting Hong Kong's protest movement, calling it as an interference in an internal Chinese matter.

The act requires the US government to impose sanctions on officials of China that are accountable for human rights violations in the territory, nullifying special status of Hong Kong. Moreover, China has vowed of negative consequences to protect its security and sovereignty, if the US? Hong Kong act becomes a law. The expected enactment of the act has raised the likelihood of China retaliating by taking a more tough stand in the trade talks. Mr Trump expects Chinese President Xi Jinping to ensure an optimistic outcome in Hong Kong.

In addition to these developments, there were many other contributory factors that propelled the Australian share market higher on Thursday. Let us stay tuned to know more updates on the Australian equity market. Further developments on the US-China trade deal would be an interesting watch!?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.