Absolute return is a measuring metric that tabulates an asset?s return over a certain duration. The absolute return as opposed to a relative return, does not compare the returns to any other benchmark.

What is an Absolute Return Index?

The Absolute Return Index is an index designed for evaluation of absolute returns on investment and used by investors to measure the performance of a single hedge fund with another or against the entire hedge fund market.

Different hedge funds use different strategies to earn a profit. As a result, success can look different for every fund. A fund may have a higher return on investment but with an equivalently higher degree of risk. Although, this added risk can be worth it if the investment pays off and profits are earned. Otherwise, investors may have to bear large losses. The Absolute return index would come handy to make comparisons.

An investor may analyse the risk profile to compare one fund against another, but it is difficult as every fund has varying risks associated with its business, which may not be comparable. The Absolute Return Index makes it easier for investors to examine the potential success or failure of their investments against the market and without tediously going through every transaction.

S&P/ASX 200 Net Total Return is an Absolute Return Index trading on the ASX, with ASX code XNT. Currently it is trading at 65,893.8 (AEST: 1:49PM, 13 June 2019).

The working of Absolute Return Funds

Absolute return funds seek to deliver returns by deploying different non-conventional investment strategies and target positive returns over a full market cycle (rise and fall of markets). Therefore, the performance of absolute return funds has minimum correlation to the traditional asset classes such as shares, property or fixed interest.

Also, the absolute return funds typically use more complex investment strategies based on deep dived research than traditional fund managers in listed investment companies or investment trusts. But with complexity, comes a greater risk and difficulty in conducting due-diligence by advisors.

The underlying investments in absolute return funds may comprise real estate securities, bonds, currencies, derivatives, options, swaps, money markets, futures, metals, mortgages, stocks or other specialised financial instruments.

The strategies adopted may include leverage, derivatives, alternative assets and others. Absolute return fund managers may also take short selling positions or invest in exotic securities. Sometimes, the managers may adopt a ?fund of funds? approach, whereby they invest in a number of other funds.

Absolute Return Funds in Australia

Some of the absolute return funds operating in Australia include Firetrail Absolute Return Fund, Blackrock Australian Equity Market Neutral Fund, Schroder Absolute Return Income Fund, Munro Global Growth Fund, Atlantic Absolute Return Fund and others. Three of these are discussed in detail below:

Firetrail Absolute Return Fund

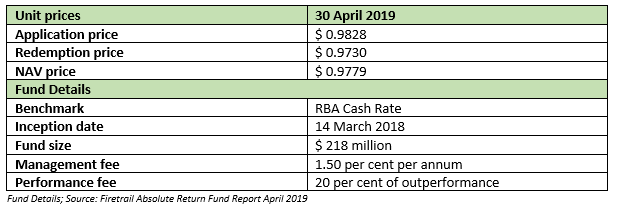

A Sydney-based investment management boutique owned by the Firetrail investment team with an aim to beat the RBA cash rate over the medium to long term. The fund details are tabulated as follow:

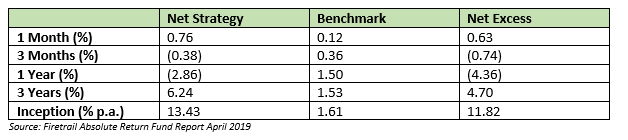

The fund?s strategy performance to 30 April 2019 is tabulated as follows:

According to Firetrail Absolute Return Fund?s portfolio positioning as of 30 April 2019, the top three overweight holdings include Amcor Limited (ASX:AMC), Woolworths Group Ltd (ASX:WOW) and WorleyParsons Limited (ASX:WOR). Also, the fund exposure as at 30 April 2019 comprised of Long Equity at 152%, Short Equity at 152% and Net Equity Exposure at 0%.

The Fund returned 0.76% during April 2019, outperforming the RBA Cash Rate by 0.63%. While small, mid and large cap positions were positive contributors during the month, fundamental shorts detracted from performance.

The top contributors for the month of April included a midcap long position in buy now, pay later provider Afterpay Touch Group Limited (ASX:APT) ?(+22%) as the company continued to add retailers and customers to its product offering in the United States after demonstrating its success in the Australian market over the past 3.5 years. The company is also expected to enter the UK market (under the name Clearpay) in the next few months.

In addition, Firetrail Absolute Return Fund?s long position in A2 Milk Company Limited (ASX:A2M) (+17%) also turned out fruitful as A2 Milk continues to penetrate into two large markets being - infant formula sales into China, as well as fresh A2 product into the US market. As a lead indicator, the port shipment from Lyttleton in New Zealand of Stage 1-3 infant formula were up 84% year on-year for the first three months of CY2019. Subsequent to the month end, A2 reiterated its guidance for revenue growth in the second half to be broadly in line with the first half (around 41%).

A short position in paint producer DuluxGroup Limited (ASX:DLX) (+32%) was the largest detractor for the month while Rio Tinto (ASX:RIO) (-2.6%) also detracted from performance after a strong rally in recent months.

Blackrock Australian Equity Market Neutral Fund

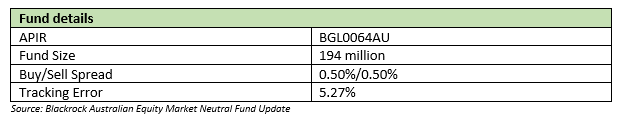

The Fund has a market neutral strategy whereby it gains exposure to long and short positions in Australian equities. It is a highly risk-controlled strategy that employs a scientific process to identify mis-priced stocks using a range of fundamental investment insights, derived from the ongoing research by BlackRock?s global team of investment professionals.

These insights may be categorised as Earnings Direction, Relative Valuation, Earnings Quality, Market and timing. The fund details are as follows:

According to Blackrock?s Fund vs Market performance summary, the S&P/ASX200 Accumulation Index continued to trend higher and finished the month gaining +2.5% supported by positive sentiments building around the possibility of an interest rate cut by the RBA. Likewise, the global equity markets benefited from growing expectations for fiscal and monetary stimulus. Overseas in the US, the encouraging results of the reporting season as well as the latest economic data lifted investor sentiment.

Meanwhile, the economic data out of Australia was mixed with employment increasing by 25,700 with 48,300 new full-time jobs, the unemployment rate was steady at 5.0% for five months. Moreover, the latest inflation figure (+1.3%) was the weakest quarterly result in around three years. Australia?s soft inflation combined with a weakening Australian dollar and domestic housing market amidst sluggish global growth has intensified expectations for an interest rate cut.

Nevertheless, April 2019 was a strong month for the Fund with most sectors recording positive performance. Information Technology (+7.3%) was the best performing sector, followed by Consumer Staples (+7.3%), Consumer Discretionary (+4.9%) as well as Financials sector (+4.4).

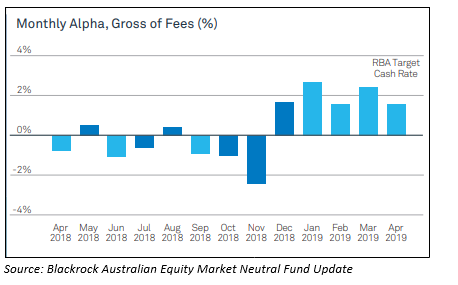

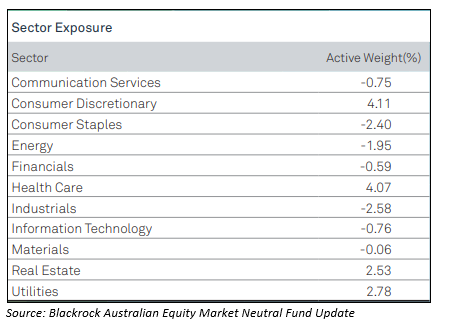

The fund has an extensive exposure to multiple sectors as illustrated below:

The Fund?s strategy witnessed another month of positive performance as it outperformed its benchmark. Materials was the best performing sector driven primarily by their shorts positions in metal companies and miners as commodities prices trended lower. Financials (including long capital markets and short insurance) was another area of strength while short positions in the oil and gas companies also paid off.

On the contrary, the Real Estate sector detracted including the fund?s longs in REITs and shorts in real estate development companies. Amongst signal insights, Earnings Quality and Timing were the top contributors while Market insights slightly detracted.

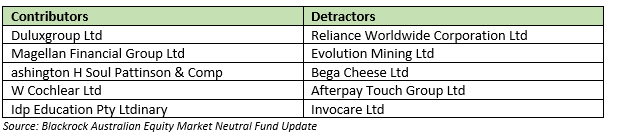

The list of contributors and detractors for the month is as follows:

On a market adjusted basis, amongst the top contributors for the April 2019 was a long position in DuluxGroup Limited (ASX:DLX) ?and a long position in Magellan Financial Group (ASX:MFG). Amongst the largest detractors was a long position in Evolution Mining (ASX:EVN) and a long position in Charter Hall Group (ASX:CHC).

Atlantic Absolute Return Fund

Sydney-based Regal Funds Management owns the Atlantic Absolute Return Fund, which aims to deliver high absolute returns through its adoption of an aggressive investment approach, that may have an elevated degree of associated risk. The fund employs a long/short strategy for diversification of its portfolio and gaining maximum exposure to markets and sectors over time. It is operated on the basis of Regal?s fundamental investment process and the majority of companies are listed in Australia and various Asian markets. The fund may also have exposure to emerging markets and suitable for investors with a long-term investment horizon, around 3-5 years.

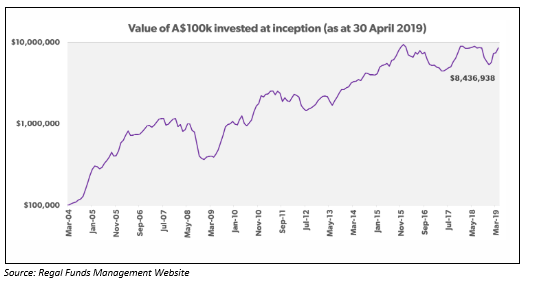

The Fund?s performance highlights as at 30 April 2019 includes Unite Price (Mid Price) of $ 8.92 with a last three months return at 50.26 % and the Annualised Return since inception at 33.97%. The following chart depicts the performance of the Atlantic Absolute Return Fund (net of fees) and highlights the current value of AU$ 100k invested at the time of inception in March 2004.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.