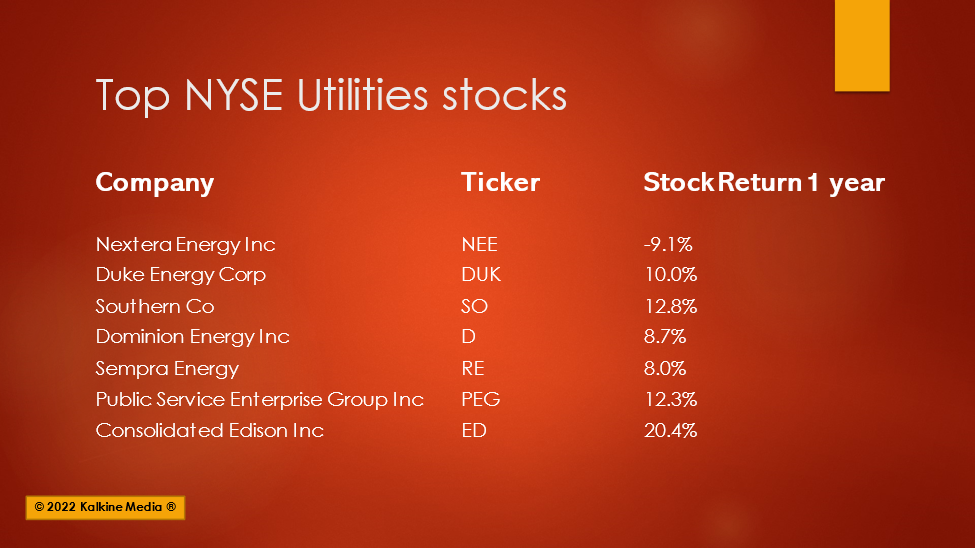

Highlights

- NextEra Energy, Inc. (NEE) has raised its outlook for adjusted earnings per share to between US$2.75 and US$2.85 in 2022.

- Duke Energy Corporation (DUK) will declare its fourth and full-year results on February 10. Its dividend yield is 3.75%, and the annualized dividend is US$3.94.

- Consolidated Edison, Inc. (ED) has a P/E ratio of 25.7 and a dividend yield of 3.56%.

Utility companies provide electricity, water, natural gas, sewage, and other services that are always in demand. Most utility companies are large and heavily regulated. Most of them also pay regular dividends. We discuss the top seven utility stocks on the New York Stock Exchange based on their market capitalization.

Also Read: Top five cloud computing stocks to explore in 2022

NextEra Energy, Inc. (NEE)

Market Cap: US$148.65 billion

Closing price on February 7, 2022: US$76.01

Juno Beach, Florida-based NextEra Energy’s subsidiary Florida Power & Light (FP&L), distributes power in Florida. It serves around five million customers.

Its renewable segment sells power in the US and Canada.

In the fiscal year ended December 31, 2021, its revenue was US$17.07 billion. Its GAAP net income attributable to NextEra Energy was US$3.573 billion, or US$1.81 per share, compared to US$2.919 billion, or US$1.48 per share, in 2020.

The company expects adjusted earnings per share to be between US$2.75 and US$2.85 in 2022, up from the previous range of US$2.55 to US$2.75.

Its P/E ratio is 41.86, the forward P/E for one year is 26.96, the dividend yield is 1.98%, and the annualized dividend is US$1.54.

Also Read: Top ETF trends to watch in 2022

Also Read: Amazon (AMZN), Meta (FB) epic gain, loss – case of want and necessity?

Duke Energy Corporation (DUK)

Market Cap: US$80 billion

Closing price on February 7, 2022: US$104.25

Duke Energy provides regulated utilities in the US. It is one of the largest utility companies. Its three primary segments are electric utilities & infrastructure, gas utilities & infrastructure, and commercial renewables.

The Charlotte, North Carolina-based Duke Energy will declare its fourth and full-year results on February 10.

In the September quarter of 2021, it earned a net income attributable to the company of US$1.4 billion or US$1.79 per share diluted on revenue of US$6.95 billion.

Its P/E ratio is 26.88, the forward P/E for one year is 20.16, the dividend yield is 3.75%, and the annualized dividend is US$3.94.

Also Read: Banks expect Fed to raise benchmark rate by 50 bps in March

Southern Company (SO)

Market Cap: US$71.82 billion

Closing price on February 7, 2022: US$68.69

Atlanta, Georgia-based Southern Co. distributes electricity and natural gas in nine states, covering roughly nine million customers.

The company will release its fourth-quarter earnings on February 17, 2022.

For the three months ended September 30, 2021, the net income came in at US$1.11 billion or US$1.03 per share diluted on revenue of US$6.28 billion.

Its P/E ratio is 23.95, the forward P/E for one year is 20.43, the dividend yield is 3.84%, and the annualized dividend is US$2.64.

Also Read: Two food stocks to explore in February

Dominion Energy, Inc. (D)

Market Cap: US$64.8 billion

Closing price on February 7, 2022: US$80.18

Dominion Energy is an integrated energy company with over 90,000 miles of electric transmission and distribution lines and around 30 GW of electric generation capacity. The company is headquartered in Richmond, Virginia.

The company will declare its fourth results on February 11, 2022.

For the quarter ended September 30, 2021, the net income attributable to the company was US$654 million or US$0.79 per share diluted on revenue of US$3.18 billion.

Its P/E ratio is 25.24, the forward P/E for one year is 20.99, the dividend yield is 3.1%, and the annualized dividend is US$2.67.

Also Read: Top penny stocks to explore in February

DBA Sempra (SRE)

Market Cap: US$43.6 billion

Closing price on February 7, 2022: US$136.27

Sempra Energy distributes natural gas and electricity in the US. It is based in San Diego, California. DBA Sempra will announce its full-year earnings on February 25, 2022.

The company incurred a net loss of US$648 million or US$2.03 per share diluted on revenue of US$3.01 billion for the quarter ended September 30, 2021.

Its P/E ratio is 37.52, the forward P/E for one year is 16.53, the dividend yield is 3.18%, and the annualized dividend is US$4.40.

Also Read: Top 10 Nasdaq semiconductor stocks to explore

Public Service Enterprise Group Incorporated (PEG)

Market Cap: US$33.6 billion

Closing price on February 4, 2022: US$66.64

Newark, New Jersey-based Public Service Enterprise Group is a holding company. Its regulated PSE&G provides gas and electricity to around four million customers in New Jersey.

For the three months ended September 30, 2021, it posted operating revenue of US$1.9 billion and a net loss of US$1.56 billion or US$3.10 per share diluted.

Its forward P/E for one year is 18.38, the dividend yield is 3.03%, and the annualized dividend is US$2.04.

Also Read: Top 7 healthcare stocks on NASDAQ to consider

Source - pixabay

Also Read: What is NFT? How to create and sell?

Consolidated Edison, Inc. (ED)

Market Cap: US$30.45 billion

Closing price on February 4, 2022: US$86.09

Consolidated Edison is the holding company of Consolidated Edison of New York and Orange & Rockland. They provide electricity and natural gas in the US.

The power generation company will report its 2021 earnings on February 17, 2022.

For the September quarter, 2021, it posted revenue of US$3.61 billion and a net income of US$469 million or US$1.52 per share diluted.

Its P/E ratio is 25.7, the forward P/E for one year is 20.52, the dividend yield is 3.56%, and the annualized dividend is US$3.16.

Also Read: Top 7 financial stocks on NYSE to explore

Bottomline

The Dow Jones US Utilities Index returned 7.99% gains in one year. The utility stocks relatively stay stable in a volatile market condition. However, investors should apply due diligence before investing in the stock market.