Highlights:

- AAPL stock showed gains of about 13 per cent YoY.

- Microsoft Corporation's (NASDAQ:MSFT) revenue rose 18 per cent YoY in fiscal 2022.

- Adobe Inc. (NASDAQ:ADBE) marked a record revenue in the second quarter of fiscal 2022.

The technology sector is one of the major and biggest industries in the market, and it consists of some of the biggest companies with solid market capitalization. Apple Inc. (NASDAQ: AAPL), Microsoft Corporation (NASDAQ: MSFT), Adobe Inc. (NASDAQ: ADBE), Salesforce, Inc. (NYSE: CRM), and ON Semiconductor Corporation (NASDAQ:ON) are among the popular players in the technology sector.

The sector offers various services, including consumer electronics, software, semiconductors, artificial intelligence (AI), computers, and related products. The global push toward digitalization has also helped significant gains in the sector.

Meanwhile, one of the most favourite investments in recent years was the technology growth stocks. COVID-19 had accelerated the trend, as demands for technology services had surged in that period. However, this year the markets have witnessed ups and downs, and the volatility affected even the technology stocks.

That said, some investors could explore technology growth stocks. Now, some might be thinking that what are growth technology stocks? As the name suggests, these technology stocks have notable growth potential and have witnessed rapid growth in recent years.

Although the growth stocks tend to be more expensive than other stocks from the same sector, there is no hard and fast rule. Meanwhile, the growing technology companies could see a surge in their revenues if they continue to grow.

Let's explore the stock performance and recent financials of some growth technology stocks with Kalkine Media®, which may continue to maintain a steady momentum in the coming months.

Apple Inc. (NASDAQ:AAPL)

The leading technology firm, Apple Inc, is one of the biggest firms by market cap. Its current market cap stands at US$ 2.92 trillion.

The AAPL stock gained over 13 per cent in the last 12 months while adding about 23 per cent in the ongoing quarter. However, on a year-to-date (YTD) basis, it lost about five per cent.

The iPhone maker posted a revenue of US$ 83 billion in the third quarter of fiscal 2022, representing a growth of two per cent from the same quarter of the previous year. Its net income was US$ 19.44 billion, or US$ 1.2 per diluted share in Q3 FY22, comparatively less than US$ 21.74 billion, or US$ 1.3 per diluted share in Q3 FY21.

Microsoft Corporation (NASDAQ:MSFT)

Microsoft is another leading technology firm specialising in software, consumer electronics, and other products. The firm holds a market cap of US$ 2.08 trillion, and its current yield is 0.87 per cent. The annualized dividend of Microsoft is US$ 2.48.

The firm's stock hadn't enjoyed a steady journey this year, as seen by the stock price slumping. The MSFT stock fell about 17 per cent this year while falling around eight per cent year-over-year (YoY). However, in the current quarter, it showed over eight per cent gains.

Microsoft had an RSI of about 49, according to Refinitiv data. Some analysts believe that the RSI or Relative Strength Index between 30 and 50 indicates that the stock could be volatile, trading in an explosive condition at the period.

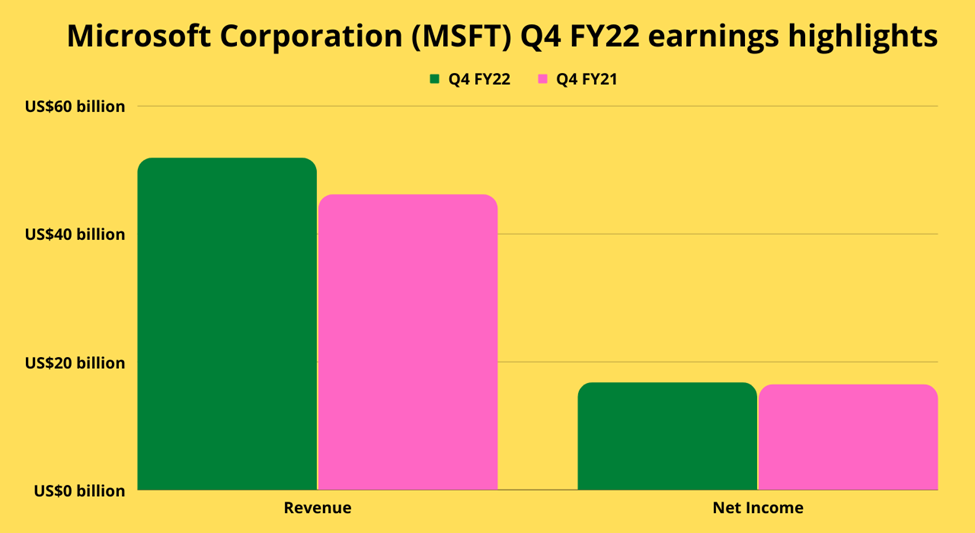

The Redmond, Washington-based company reported a revenue of US$ 51.9 billion in Q4 FY22, marking a 12 per cent YoY and 16 per cent YoY increase in constant currency. Microsoft's net income soared two per cent YoY to US$ 16.7 billion in Q4 FY22, while its diluted earnings per share grew at a three per cent rate YoY to US$ 2.23 apiece.

For fiscal 2022, the technology giant noted a jump of 18 per cent YoY in its revenue of US$ 198.3 billion. Its net annual income was US$ 72.7 billion, up 19 per cent from the prior year.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Adobe Inc. (NASDAQ:ADBE)

The stock of the computer software firm also witnessed a rocky journey this year while showing some gains in the current quarter. On a YoY basis, ADBE stock lost about 36 per cent, while in the ongoing year, it fell about 27 per cent. However, on a quarter-to-date (QTD) basis, it gained over 12 per cent.

At the time of the drafting, the US$ 192.64 billion market cap firm had an RSI of about 45, according to Refinitiv data. Given its current trading price, it traded about 21 per cent above its 52-week low of US$ 338, noted on June 17, 2022.

Adobe marked a record revenue of US$ 4.39 billion in Q2 FY22, a 14 per cent YoY jump. The net income of the San Jose, California-based firm also improved to US$ 1.17 billion, or US$ 2.49 per diluted share in Q2 FY22, from an income of US$ 1.11 billion, or US$ 2.32 per diluted share in Q2 FY21.

Salesforce, Inc. (NYSE:CRM)

The CRM stock grew nearly seven per cent in the ongoing quarter. However, on an annual basis, it lost about 31 per cent while slipping around 30 per cent in the ongoing year. It had an RSI of about 42, as per Refinitiv data.

The US$ 175.93 billion market cap firm noted the highest price of US$ 311.75 (November 9, 2021) and the lowest price of US$ 154.55 (May 24, 2022) in the last 52 weeks.

The cloud-based software firm will report its fiscal 2023 second quarter financial results on August 24, after the market close.

ON Semiconductor Corporation (NASDAQ:ON)

The semiconductor manufacturing firm holds a market cap of US$ 30.17 billion. Meanwhile, the firm's stock has witnessed notable growth in recent months.

On a YoY basis, ON stock gained about 66 per cent while growing about 1.5 per cent YTD. In the ongoing quarter, it returned gains of nearly 37 per cent. At its current trading price, it traded lower by about eight per cent from its 52-week high of US$ 75.26, noted on August 18, 2022. It touched its 52-week low of US$ 41.76 on August 23, 2021.

The Phoenix, Arizona-based firm noted a quarter per cent growth YoY in its second quarter fiscal 2022 revenue of US$ 2.08 billion. On Semiconductor's attributable net income was US$ 455.8 million, or US$ 1.02 per diluted share, marking a significant increase from US$ 184.1 million, or US$ 0.42 per diluted share in Q2 FY21.

Bottom line:

The first two quarters haven't been a great time for the broader market, while the mega-cap growth stocks suffered the most. However, the starting month of the third quarter proved to be the best-performing month for the overall market in about a year and a half.

The positive earnings season had especially helped gains in the market while fuelling the investors' confidence. However, the investors have been trading cautiously again in recent days, given the uncertainties over Fed's next move to bring down inflation to their two per cent target.

Meanwhile, the S&P 500 information technology sector fell about four per cent YoY while losing about 15.25 per cent in the ongoing year.