Highlights:

- The net income of Coterra Energy (CTRA) totaled US$ 1.19 billion in Q3 FY22.

- VICI Properties's (VICI) revenue rose 100 per cent YoY in Q3 FY22.

- VICI Properties has raised its quarterly cash dividend by over eight per cent YoY.

The historical performance shows that the market generally goes in a positive direction after the midterm election. Even though the historical performance doesn't indicate the market's future performance, the investors are hoping for a positive performance due to a split government.

Meanwhile, investors are still focusing on the inflation and Federal Reserve, which is likely to remain the market’s main concern for some time. In addition, the recent hawkish comments from the policymakers have added to concerns.

The Republicans had a narrow win in the House on November 16, while the Democrats retained the control of the Senate. Now, the US would witness a divided government for two years, as President Joe Biden would remain in power for that period.

The investors seemed to struggle for direction lately amid higher inflationary pressures and other uncertainties in the market. Now, with the midterm election on focus, the market participants might be looking for shelter from the higher inflation, which could also provide a passive income.

Coterra Energy Inc. (NYSE:CTRA)

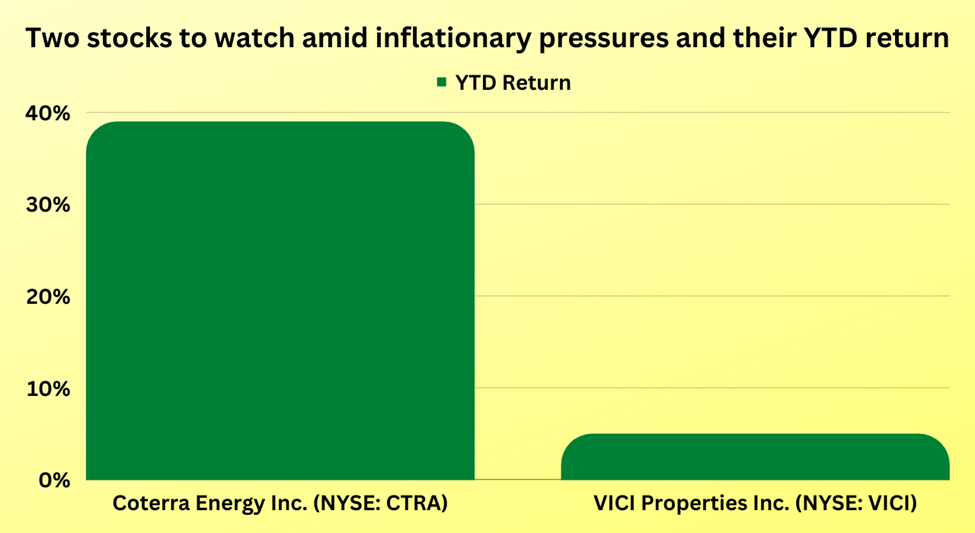

The diversified energy company engaging in hydrocarbon exploration operations, Coterra Energy's dividend yield was 2.16 per cent. The US$ 20.69 billion market cap company's stock surged about 39 per cent YTD and around 26 per cent YoY.

Coterra Energy's net income totaled US$ 1.19 billion in Q3 FY22, a notable increase from US$ 64 million in the year-ago quarter. Its adjusted EPS totaled US$ 1.42 apiece in the quarter versus US$ 0.52 apiece in the year-ago period.

Its net income totaled US$ 3.03 billion for the nine months, against US$ 220 million in the preceding year's same period. The company said it paid US$ 519 million in dividends in Q3 FY22 against US$ 44 million in Q3 FY21.

Coterra Energy's board announced a quarterly dividend of US$ 0.68 per share (US$ 0.15 base and US$ 0.53 variable). The dividends would be paid to the investors on November 30, 2022.

VICI Properties Inc. (NYSE:VICI)

The gaming and entertainment properties-focused REIT firm, VICI Properties' dividend yield was 4.9 per cent. The REIT firm owns experiential real estate properties across gaming, hospitality, and other related sectors.

VICI Properties Inc's revenue soared 100 per cent YoY to US$ 751.5 million in the latest quarter, and its net income totaled US$ 336.87 million, against US$ 164.18 million in Q3 FY21. The REIT firm has raised its quarterly cash dividend by 8.3 per cent YoY to US$ 0.39 per share.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Bottom line:

According to government data that came in recently, the investors seemed to have cooled in October. The US CPI increased 7.7 per cent at an annual basis in the prior month, its lowest pace in 2022, while the PPI rose eight per cent in the month, following a surge of 8.4 per cent in September.

However, the central bank has also raised the interest rates at the highest pace in years to curb the soaring prices, which have weighed on the investors' and consumers' sentiments.

Now, the officials have indicated that even though the central bank might ease its approach with monetary policy, there might not be a pause in the coming days.