Highlights:

- Definition of On-Floor Order: An on-floor order refers to a security order placed by an exchange member who is physically present on the trading floor and is executing trades for their own account, contrasting with off-floor or upstairs orders placed remotely.

- Role in Traditional Trading: On-floor orders were historically significant in open-outcry trading systems, where traders would interact face-to-face to match buy and sell orders, influencing market liquidity and price discovery.

- Comparison with Off-Floor Orders: On-floor orders differ from off-floor orders in that they are executed directly by exchange members at the exchange premises, while off-floor orders are typically executed electronically or through brokerage firms outside the exchange floor.

In the world of financial markets, order execution plays a crucial role in determining market efficiency, price discovery, and liquidity. Among the various types of order placements, on-floor orders represent a traditional method where trades are executed directly on the floor of an exchange by its members. These orders are executed in person by traders handling their own accounts rather than through electronic systems or external brokers.

While electronic trading has largely taken over modern financial markets, understanding on-floor orders remains relevant in comprehending the evolution of trading practices and the unique dynamics of face-to-face order execution. This article explores what on-floor orders are, how they work, their advantages and disadvantages, and how they compare with off-floor orders.

What is an On-Floor Order?

An on-floor order refers to a trade order that is placed by a member of a stock exchange who is physically present on the exchange floor. This type of order is executed directly by the trader for their own account, rather than relying on intermediaries such as brokers or electronic trading systems.

On-floor orders were a key feature of open-outcry trading systems, where traders gathered on the exchange floor to conduct trades through verbal communication and hand signals. In this setup, traders placed orders based on real-time interactions, negotiating prices with counterparties face-to-face.

Key Characteristics of On-Floor Orders:

Executed by Exchange Members: Only registered exchange members present on the trading floor can place these orders.

Direct Market Participation: Traders have direct access to market movements and can act based on real-time observations.

Personal Account Trading: Unlike institutional orders, on-floor orders are often executed for the trader’s own account.

Manual Execution: Traditionally, these orders were handled manually rather than through electronic means.

How On-Floor Orders Work

In traditional trading environments, stock exchanges maintained designated areas known as trading pits, where exchange members gathered to place buy and sell orders. The process of placing an on-floor order typically followed these steps:

Observation of Market Conditions: Traders analyze the market trends, price movements, and order flow directly from the trading pit.

Order Execution: Once a decision is made, the trader communicates the order to a market maker or specialist to facilitate the transaction.

Confirmation and Settlement: After successful execution, trade details are confirmed, and the settlement process begins through the exchange's clearing system.

With the rise of electronic trading platforms, on-floor orders have become less common. However, they still hold significance in certain exchanges and during special trading sessions such as auctions and opening/closing bells.

On-Floor Orders vs. Off-Floor Orders

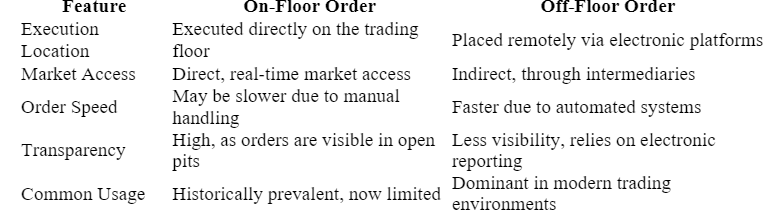

Understanding the distinction between on-floor and off-floor orders is crucial for traders and investors looking to navigate different trading environments.

Key Differences:

- On-floor orders provide a direct connection to market fluctuations but can be slower compared to electronic off-floor orders.

- Off-floor orders allow investors to trade from anywhere using brokerage platforms, offering speed and convenience.

Advantages of On-Floor Orders

Despite the decline in floor trading, on-floor orders still offer several benefits, especially in niche markets or during high-impact trading periods.

Direct Market Insights: Traders on the floor can gauge market sentiment and momentum more effectively through personal interactions and observations.

Price Negotiation Opportunities: Face-to-face interactions allow traders to negotiate better prices, potentially securing better execution than automated systems.

Increased Transparency: Physical presence provides greater visibility into order flow, reducing the chances of manipulation or front-running.

Reduced Latency Risks: In some cases, direct access to the market floor can help avoid technological disruptions associated with electronic trading.

Disadvantages of On-Floor Orders

While on-floor orders have their advantages, they also come with several drawbacks, which have led to their decline in favor of electronic trading.

Slower Execution Speed: Compared to electronic systems, manually processing trades can take more time, leading to missed opportunities in fast-moving markets.

Higher Costs: Operating on the exchange floor requires membership fees, infrastructure costs, and staffing expenses, making it less cost-effective.

Limited Accessibility: Only a select group of exchange members can place on-floor orders, restricting market participation.

Technology Lag: Modern automated systems provide real-time market data and algorithmic trading capabilities that floor traders cannot match.

The Evolution from On-Floor to Electronic Trading

The shift from on-floor trading to electronic trading has transformed financial markets, offering greater accessibility, efficiency, and speed. Exchanges such as the New York Stock Exchange (NYSE) and Chicago Mercantile Exchange (CME) have embraced electronic trading while maintaining limited floor operations for specific asset classes.

Key reasons for the transition include:

Automation and Algorithmic Trading: Modern systems enable automated order execution with high precision and speed.

Global Market Access: Traders can participate in global markets without being physically present at an exchange.

Cost Efficiency: Electronic trading significantly reduces operational costs compared to maintaining physical trading floors.

Data Analytics and AI Integration: Advanced technologies provide traders with insights based on historical data and predictive analytics.

Despite these advancements, some traders still prefer the human touch of on-floor orders, especially for complex trades and block orders requiring negotiation.

Conclusion

On-floor orders represent a traditional method of trade execution where exchange members place orders directly from the trading floor for their own accounts. While once a dominant practice, the rise of electronic trading has largely replaced this method, offering faster execution and broader market access.

However, on-floor orders continue to hold relevance in specific scenarios where face-to-face interactions and market transparency are crucial. Understanding the evolution of trading practices from on-floor to off-floor orders provides valuable insights into how financial markets have adapted to technological advancements.

Whether executed on the floor or remotely, the ultimate goal remains the same—efficient and effective trade execution in a dynamic financial landscape.