Highlights

- Alcoa Corporation (NYSE:AA) has been included in the S&P Global’s Sustainability Yearbook 2022 to recognize its contribution to sustainable projects.

- Teck Resources Ltd (NYSE:TECK) aims to achieve net-zero Scope 3 (value chain) emissions by 2050.

- Chevron Corporation (NYSE:CVX) has a P/E ratio of 20.33, a dividend yield of 3.46%, and an annualized dividend of US$5.68.

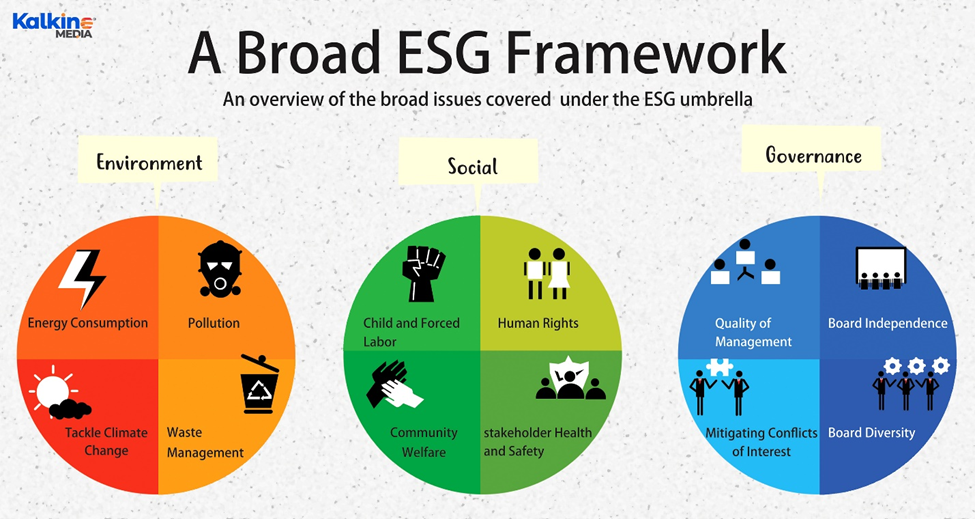

Environmental, Social and Governance or ESG scores are a unique way of looking at a company’s performance. Unlike the financials, these measures open a new window to analyze the sustainability of the corporate entities. There are several ESG rating providers, including MSCI, Sustainalytics, FTSE Russell, S&P Global, Refinitiv, etc.

These organizations analyze the companies’ ESG policies to determine their sustainability. ESG firms provide a rating after screening the companies based on their environmental, social, and governance (ESG) parameters.

The rating criteria may include gender, pay gap, working conditions, climate policies, etc. Thus, the ESG-conforming companies are lauded for their responsible actions.

Here we discuss five stocks with an ‘A’ rating by Refinitiv (TR), a financial market data provider. It measures the companies’ performance across ten main themes, including emissions, environmental product innovation, human rights, shareholders, etc.

The following are five large-cap stocks that gave two digits returns in one year and YTD.

Also Read: UNP to MANH: Top supply chain stocks to watch amid global concerns

Alcoa Corporation (NYSE:AA)

Closing Price on March 30, 2022: US$92.19

ESG score: A

Pittsburgh, Pennsylvania-based Alcoa is a vertically integrated aluminum company. It is engaged in bauxite mining, alumina refining, and manufacturing primary aluminum. It is one of the largest bauxite miners and alumina refiners globally by production volume. This year, the company has been included in S&P Global’s “The Sustainability Yearbook 2022”.

Alcoa will declare Q1 results on April 20, 2022.

Also Read: Top lithium stocks to explore in April: ALB, LTHM, LAC, SQM & PLL

For the fiscal year ended December 31, 2021, its sales were US$12.15 billion compared to US$9.28 billion in FY 2020. The net income attributable to the company came in at US$429 million or US$2.26 per share diluted, compared to a net loss of US$170 million or US$0.91 per share diluted in FY 2020.

Its market capitalization is US$17 billion, and its P/E ratio is 41.71. The dividend yield is 0.44%, and the annualized dividend is US$0.40.

The stock traded in the price range of US$98.09 to US$30.02 in the last 52 weeks.

Also Read: Top fertilizer stocks: CF, MOS, CTVA and 2 more to explore in March

© 2022 Kalkine Media ®

© 2022 Kalkine Media ®

Also Read: NEE to GE: Top 5 green stocks to explore amid Russia-Ukraine turmoil

Teck Resources Ltd (NYSE:TECK)

Closing Price on March 30, 2022: US$40.88

ESG score: A

Teck is a diversified miner with coal, copper, zinc, and oil sands operations. The company is based in British Columbia, Canada.

For the fiscal year ended December 31, 2021, its net income was CA$2.87 billion (US$2.29 billion) compared to the net loss of US$0.864 billion (US$0.690 billion) in FY 2020. Its revenue was CA$13.48 billion (US$10.77 billion) for fiscal 2021 compared to CA$8.94 billion (US$7.15 billion) for the previous fiscal year.

The company aims to achieve net-zero Scope 2 (purchased electricity) greenhouse gas emissions by 2025 and plans to achieve net-zero Scope 3 (value chain) emissions by 2050.

Its market capitalization is US$21.86 billion, the P/E ratio is 9.71, and the forward P/E for one year is 5.75. The dividend yield is 1%, and the annualized dividend is US$0.394.

The stock traded in the price range of US$42.38 to US$18.84 in one year.

Also Read: Top cloud stocks to explore in 2022: GOOGl, MSFT, ORCL, IBM & NTAP

Halliburton Company (NYSE:HAL)

Closing Price on March 30, 2022: US$38.52

ESG score: A

Halliburton is an oilfield services company headquartered in Texas. Starting with oil and gas well cementing in 1920, the company is now a premier wellbore engineering company and has added drilling services as its second key area of focus.

It reported total revenue of US$15.3 billion, a 6% increase YoY for the fiscal year of 2021. The company posted a net income attributable to the company of US$1.45 billion or US$1.63 per share diluted versus a net loss of US$2.95 billion or US$3.34 per share diluted in the previous fiscal year.

The company has a market capitalization of US$34.6 billion and a P/E ratio of 23.62. The dividend yield is 1.27%, and the annualized dividend is US$0.48.

The stock traded in the price range of US$39.38 to US$17.82 in the last 52 weeks.

Also Read: Top blockchain stocks to explore: COIN, CME, RIOT, MARA & BITF

Baker Hughes Company (NASDAQ:BKR)

Closing Price on March 30, 2022: US$37.35

ESG score: A

Baker Hughes and GE Oil and Gas merged in 2017 to create the present-day Baker Hughes. The company is based in Houston, Texas, and offers a full spectrum of services, from upstream to downstream, to the oil and gas companies. It will declare first-quarter results on April 20, 2022.

The company posted a net loss of US$219 million or US$0.27 per share diluted in the fiscal year 2021 compared to the net loss of US$9,940 million or US$14.73 per share diluted for fiscal 2020. Its revenue for FY 2021 and 2020 were US$20.5 billion and US$20.7 billion, respectively.

Its market capitalization is US$35.60 billion, and the forward P/E ratio for one year is 28.95. The dividend yield is 1.96%, and the annualized dividend is US$0.72.

BKR stock traded in the price range of US$39.78 to US$18.75 in one year.

Also Read: Corebridge Financial IPO: Know key details of AIG's retirement business

Also Read: Top healthcare stocks to watch in Q2: ABBV, BMY, ABC, VRTX & MCK

Chevron Corporation (NYSE:CVX)

Closing Price on March 30, 2022: US$165.48

ESG score: A

Chevron is an integrated energy company headquartered in San Ramon, California. The company is engaged in the exploration, production, and refining operations globally.

Also Read: Why is Helium (HNT) crypto changing its name?

The energy company generated revenue of US$162.5 billion in fiscal 2021 compared to US$94.69 billion in the previous fiscal. Its net income attributable to Chevron grew to US$15.62 billion or US$8.14 per diluted share against the net loss of US$5.53 billion or US$2.96 per diluted share in the fiscal ended December 31, 2020.

Chevron’s market capitalization is US$322 billion, and the P/E ratio is 20.33. The dividend yield is 3.46%, and the annualized dividend is US$5.68.

The stock traded in the price range of US$174.76 to US$92.86 in the last 52 weeks.

Also Read: GOOGL, Microsoft & IBM: Top 5 quantum computing stocks to watch in Q2

Bottom line:

ESG goals are related to the environment, employees, communities etc. However, strong financials is a must to promote good governance. The stock market is volatile; hence, investors must carefully analyze the company's fundamentals before investing in stocks.