Benchmark US indices noted strong gains on Tuesday, October 25, marking their third consecutive session of gains, as declining Treasury yields have lifted the market spirits. In addition, the investors have turned their focus to the third quarter earnings, with several companies reporting strong results.

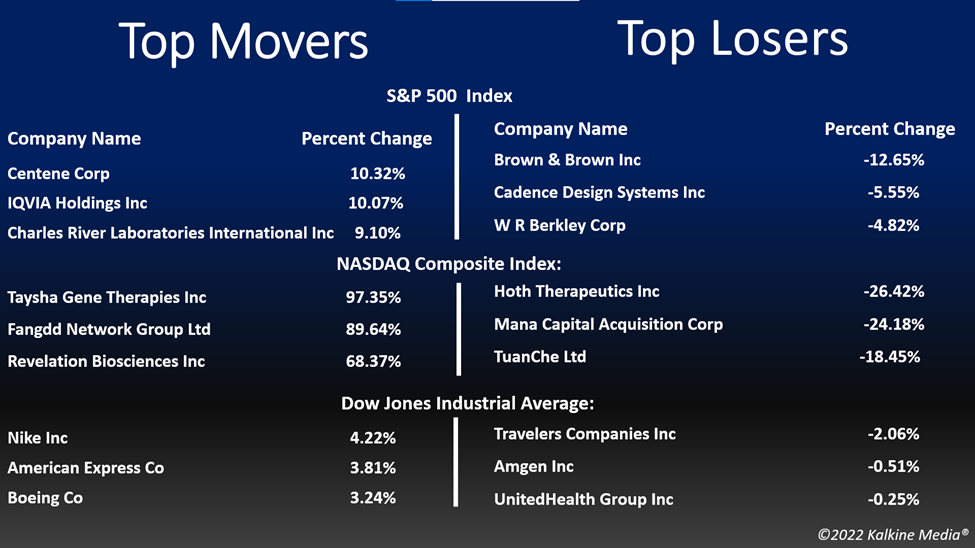

The S&P 500 rose 1.63 per cent to 3,859.11. The Dow Jones was up 1.07 per cent to 31,836.74. The NASDAQ Composite added 2.25 per cent to 11,199.12, and the small-cap Russell 2000 rose 2.73 per cent to 1,796.16.

The market participants are also looking at the downbeat earnings and gloomy guidance from some companies, which is usually a negative catalyst for market performance. But the trimmed guidance and negative earnings showed signs that Fed's aggressive effort has proved to be effective.

The signs that the central bank's effort in bringing down the inflation has been effective also raised hopes that the Federal Reserve may ease its hawkish stance after their November meeting. Meanwhile, companies like Microsoft Corporation (NASDAQ:MSFT) and Alphabet Inc. (NASDAQ:GOOG) would release their financial results after the market close.

The real estate and materials sectors were the top percentage gainers in the S&P 500 index on Tuesday, while the technology sectors provided the highest boost. 10 of the 11 segments of the index stayed in the positive territory. The energy sector was the laggard.

Shares of General Motors Company (NYSE:GM) advanced over three per cent on Tuesday, after the automotive manufacturing firm reported strong financial results for the latest quarter while maintaining its annual guidance.

The leading beverage firm, Coca-Cola Company (NYSE:KO) surged over two per cent in the intraday session on October 25, after it reported its latest quarter earnings results before the opening bell while raising its annual guidance due to steady demand despite the price increases.

In the real estate sector, Prologis, Inc. (PLD) increased by five per cent, American Tower Corporation (AMT) rose 5.53 per cent, and Crown Castle Inc. (CCI) soared by 3.32 per cent. Public Storage (PSA) and Equinix, Inc. (EQIX) advanced 3.05 per cent and 4.47 per cent, respectively.

In materials stocks, BHP Group Limited (BHP) surged 1.33 per cent, Linde plc (LIN) jumped 3.63 per cent, and Rio Tinto Group gained 1.78 per cent. The Sherwin-Williams Company (SHW) and Air Products and Chemicals, Inc. (APD) were up 3.61 per cent and 3.11 per cent, respectively.

Futures & Commodities

Gold futures were up 0.21 per cent to US$1,657.55 per ounce. Silver increased by 0.77 per cent to US$19.337 per ounce, while copper fell 0.81 per cent to US$3.4028.

Brent oil futures decreased by 0.01 per cent to US$91.20 per barrel and WTI crude was up 0.40 per cent to US$84.92.

Bond Market

The 30-year Treasury bond yields were down 3.17 per cent to 4.224, while the 10-year bond yields fell 3.86 per cent to 4.069.

US Dollar Futures Index decreased by 1.03 per cent to US$110.757.