The JPMorgan Equity Premium Income ETF (JEPI) and the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) are some of the biggest boomer candy funds, thanks to their high dividend returns. JEPI has a dividend yield of 9.5%, while JEPQ yields 9.53%, higher than most dividend funds and US government bonds. So, are these ETFs good investments in 2025?

How JEPI and JEPQ ETFs work

JEPI and JEPQ are popular funds with over $40 billion and $23 billion in assets, respectively. Launched a few years ago, these funds aim to reward their shareholders with regular high dividends and price appreciation.

They achieve this using the covered call approach, where they invest in stocks and then sells or writes call options of the index. JEPI ETF has invested in about 100 companies in the S&P 500 index and then sold call options of the index itself. The biggest companies in the fund are the likes of Apple, NVIDIA, and Microsoft.

The JEPQ ETF, on the other hand, has invested in the 100 companies that make up the Nasdaq 100 index and then sold the Nasdaq 100 call options.

These funds generate returns in three key ways. First, they benefit from the dividends paid by the constituent companies. Third, the funds make money from the share price appreciation. JEPQ benefits when the Nasdaq 100 index is rising, while JEPI rises when the S&P 500 does well.

Further, the two funds make money from the call option, whereby, they receive a premium for writing the call option. They then return these premiums to shareholders through monthly dividend distributions.

Are JEPI and JEPQ good investments?

A common question is whether the JEPI and JEPQ are good investments, especially for dividend investors.

JEPI and JEPQ ETFs seem like good investments because of their high dividend yields and a reasonable expense ratio of 0.35%. Besides, these funds yield much more than the average ETFs like the VOO and QQQ.

As such, a $100,000 invested in the JEPI ETF means that it will bring in about $9,500 a year in dividend payouts. Excluding fees and taxes, it means that the fund would bring in about $8,500 a year in dividends or $708 a month, which is a good number. The return will also be higher if the underlying asset prices increase.

However, despite their lower yields, investing in pure S&P 500 and Nasdaq 100 indices has been a better long-term cash allocation strategy.

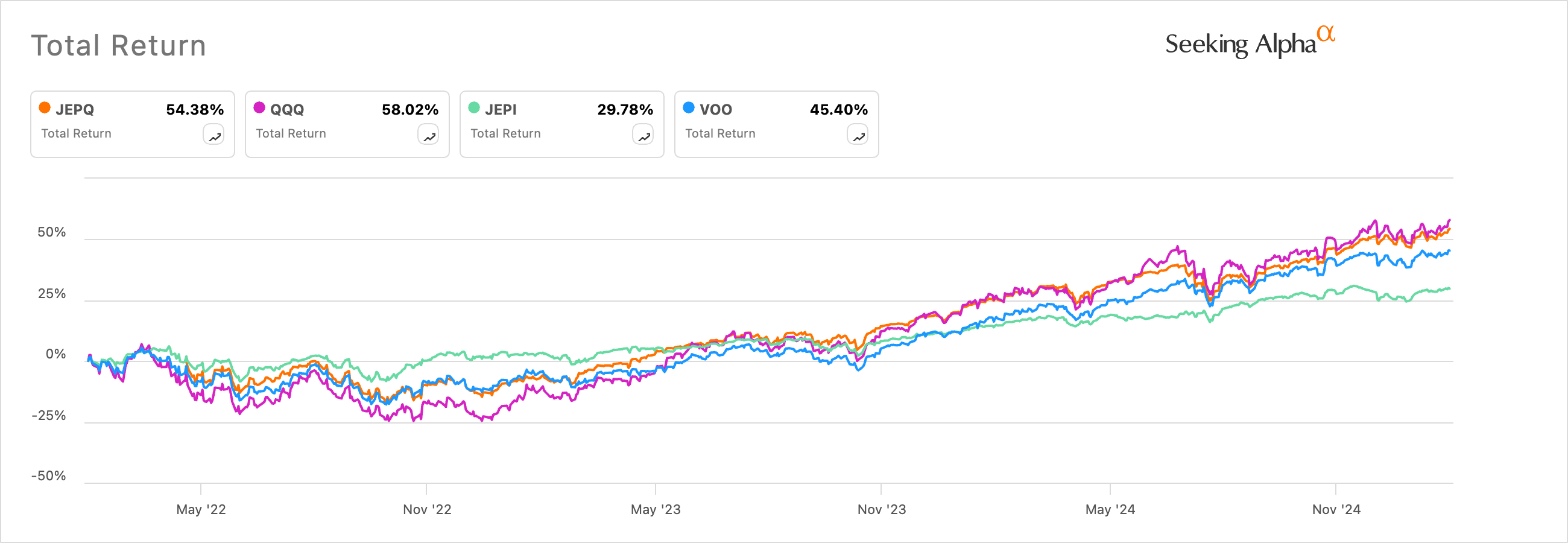

This view is based on the total return, which includes the price and dividend return. The JEPQ ETF’s total return in the last three years stood at 54%, while the Invesco QQQ returned 58%. Similarly, the JEPI ETF returned 29%, while the Vanguard S&P 500 ETF (VOO) returned 45%.

The same performance occurred in the last 12 months: JEPQ returned 22% vs. QQQ’s 25%. JEPI’s 13% return was lower than VOO’s 22%.

Better buy between JEPI and JEPQ

While the JEPI and JEPQ have lower returns than their benchmarks, historical data shows that the latter is a better buy. It has a higher dividend yield and similar performance to that of the Nasdaq 100 index.

For an investor with a long-term view, the vanilla S&P 500 and Nasdaq 100 indices are the best funds to invest in. They have lower expense ratios and have a long track record of beating inflation and the broader market.

The S&P 500 index has soared from 44 in 1950s to over $6,100 today. Similarly, the Nasdaq 100 index has jumped from less than $300 in 1980s to $22,200 today. These funds have contended with wars, recessions, and other geopolitical issues.

The post JEPQ vs JEPI: Are these boomer candy ETFs good buys in 2025? appeared first on Invezz