Summary

- The dynamic growth of the digital and technology businesses has been one of the UK’s economic success stories over the last one and a half-decade.

- The prevalent uncertainties pertaining to Brexit could certainly impact the future performance of the IT majors in the UK as it can face severe challenges with respect to workforce.

- Aveva Group recently acquired US based OSIsoft LLC for an enterprise value of $5 billion

The onslaught of the novel coronavirus has led to carnage in most of the sectors. From job redundancies to business closures, a lot has transpired due to the economic impact of the coronavirus pandemic. Most of the sectors are witnessing turbulences due to liquidity crunch and rising debt; some businesses have collapsed while others are seeking consolidation.

The software industry, on the other hand, seems to be unfazed from the catastrophe caused by the deadly virus. However, prevalent uncertainties pertaining to Brexit could certainly impact the future performance of the IT majors in the UK as it can face severe challenges with respect to the workforce.

Consolidation was also witnessed in the UK’s tech sector. UK’s leading software provider, Footsie listed Aveva Group recently acquired US based OSIsoft LLC for an enterprise value of $5 billion, which specialises in real-time industrial data capture, storage, analysis and sharing of real-time industrial sensor-based data across all operations in an efficient and cost-effective way. OSIsoft's PI System empowers businesses to draw insights and improve their decision-making.

This acquisition by Aveva would bolster its position as a global player in the realm of industrial software. The conventional industries are in dire need of digital transformation through sustainable development, and Aveva has the ability to help them in this transformation. This deal would provide the company with enough headroom to grow while adding significant scale and industry diversification.

Brexit finally happened in January 2020, and the UK has entered the implementation period under the withdrawal deal, which has a deadline of 31 December 2020. During this period, the UK would like to forge a future relationship agreement with the European Union. This would mean devising new agreements for trade, immigration, security, defence, and a lot of other things.

Do read: UK’s Supercharging Tech Sector That Hit the Ground Running Amid Health and Economic Crisis

Is London no longer the ‘Silicon Valley’ of UK?

The dynamic growth of the digital and technology businesses has been one of the UK’s economic success stories over the last one and a half-decade.

A major chunk of workforce operating in the UK sector hails from EU. The uncertainties with respect to Brexit has been a major deterrent for investors in the tech sector, and Brexit is perceived as a shock to the tech sector. London shall now face stiff competition from rival European tech hubs such as Dublin, Paris, and Lisbon. However, Berlin, capital of Germany, is supposed to be the London’s closest tech rival. London is expected to witness a crisis of skilled workers in a post Brexit scenario. Also, it would be difficult to attract the best talent in the sector.

During the unprecedented crisis, the technology sector has been an important cog in the wheel for driving the UK’s economy. Most of the businesses made a paradigm shift by working remotely. This was all possible because of the technological advancement and infrastructure we have today. The onslaught of the pandemic has taught businesses to upgrade their existing systems for the digital age and gain immunity against pandemics as they seem to be inevitable.

While businesses are learning to acquire and service customers online, they must also look to hedge against online security threats. UK would need a strong workforce to implement, upgrade, and maintain the IT infrastructure. Brexit is likely to degrade the quality of talent pool available in the UK’s tech sector.

Despite the unprecedented crisis, job postings increased to 1.25 million by mid of July, according to REC (Recruitment & Employment Confederation). IT professionals jobs were in demand last month.

Let us discuss recent highlights for some UK Tech stocks

- Avast Plc

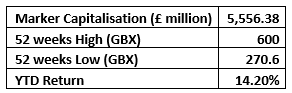

Avast Plc (LON:AVST) is the world’s biggest cybersecurity company, which use advanced technologies against cyber-attacks. The company has developed a scalable cloud-based security structure that can oversee everything that happens on the internet.

Avast Plc has high cash generative business model, and organic revenue for 2020 is expected to be ahead of set guidance. In the first half of 2020, the Group’s adjusted billings increased by 2.1 per cent year-on-year to US$469.1 million, with organic growth of 9.2 per cent year-on-year. Avast passed the milestone of 13 million paying customers, during the first half of 2020. The company’s business is resilient, strongly cash-generative, and has significant capacity to harness new growth opportunities in the long term.

CMP - GBX 535.00

(Source: London Stock Exchange, 28 August 2020 before the market close at GMT 11:27 AM+1)

- Aveva Group Plc

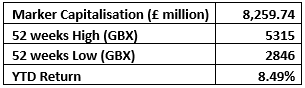

Aveva Group (LON:AVV) is £8.23 billion market-cap company that is engaged in providing engineering, design, and information management software in three geographical segments; the Asia Pacific, Americas, and Europe, Middle East, and Africa (EMEA). The outstanding market capitalisation of the group ranks it among the large caps listed and traded stock on the main market of the London Stock Exchange.

Aveva Group Plc in the first quarter of 2021 period, the Company continues to deliver robust growth in recurring revenue, with 30 per cent growth in Subscription revenue. The Maintenance revenue remained flat, and revenue from Perpetual licences and Services declined significantly, due to the disruption caused by a coronavirus and the transition to a subscription business model. The Company experienced strong demand for software despite disruption related to Covid-19.

Aveva won multiple orders in multiple markets such as life sciences, water, power generation, food, marine and oil & gas. The Company’s order pipeline for the remaining financial year is strong, driven by large contract renewals. Overall, the Company has shown solid performance in the first quarter of the financial year 2021, with robust Subscription revenue. The company is well poised to deliver solid results in 2021.

CMP - GBX 5070.00

(Source: London Stock Exchange, 28 August 2020 before the market close at GMT 11:29 AM+1)

- Sage Group Plc

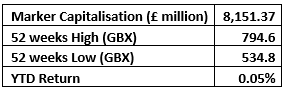

The Company expects its recurring revenue to show growth between 7-8 per cent, while organic operating margin is expected to increase by 22 per cent in 2020. Sage businesses have witnessed the minimal impact of the coronavirus pandemic. FTSE 100 listed tech company would continue to invest in cloud computing solutions.

Driven by a software subscription growth of 22.6 per cent to £885 million, the recurring revenue for the nine months ending 30 June 2020 surged by 9 per cent to £1,247 million. The Group’s total organic revenue saw an increase of 4.1 per cent to £1,395 million in the first nine months ending 30 June 2020 with a 1.1 per cent increase in revenue for the third quarter of 2020 to £460 million (Q3 2019: £455 million).

The provider of the integrated accounting, payroll and payments solutions Sage Group Plc (LON:SGE) is headquartered in Newcastle upon Tyne, the United Kingdom. Its bookkeeping arrangements are Sage One, Sage X3 and Sage Live; its instalments arrangements are Sage Payments and Sage Pay; and its finance arrangements are Sage One Payroll, Sage X3 People and Sage 50 Payroll.

CMP - GBX 742.60

(Source: London Stock Exchange, 28 August 2020 before the market close at GMT 11:35 AM+1)

Brexit is likely to impact the software and tech sector. Market experts suggest that there could be a shortage of skilled workers. Moreover, signs of consolidation in the tech sector have started appearing, there could be a few more deals like OSIsoft in the times to come, and all will depend on how the tech sector replenishes its talent pool amid all the challenges.