Summary

- Softcat PLC's business performance in between May 2020 and July 2020 was above the management's expectation.

- In H1 FY2020, the gross invoiced income increased by 19.7 percent year on year to £727.7 million.

- Kainos Group stated that the business performance was steady in between 1 April 2020 and 3 September 2020, which was supported by demand from the public sector and NHS.

- In FY2020, the Company reported an increase in revenue by 18 percent year on year.

Softcat PLC (LON:SCT) and Kainos Group PLC (LON:KNOS) are two FTSE-250 listed technology stocks. The revenue of SCT grew at a CAGR of 13.8 percent between FY2016 and FY2019. The revenue of KNOS grew at a CAGR of 24 percent between FY2016 and FY2020. Both companies do not have any debt on their balance sheet. Shares of Softcat were down by about 0.86 percent, and shares of Kainos Group were up by around 1.78 percent from the previous closing price (as on 10 September 2020, before the market close at 1:00 PM GMT+1).

Softcat PLC (LON:SCT) - Balance sheet remains debt-free

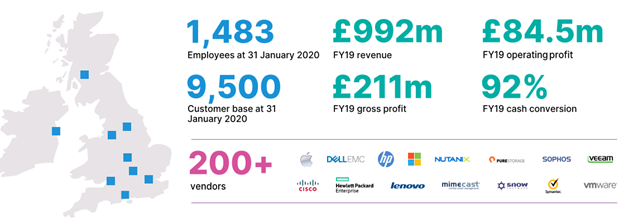

Softcat PLC is a UK based technology company that provides infrastructure technology solutions. The Company provides services including hybrid infrastructure, digital workspace, cybersecurity and IT infrastructure. Softcat is included on the FTSE 250 index.

Glimpse of Softcat

(Source: Company website)

FY2020 trading update (ended 31 July 2020) as reported on 19 August 2020

In between May 2020 and July 2020, the business performance of Softcat was above management's expectation. The cash generation remained robust, and in light of that, it intends to resume the dividend policy. The Company would pay the interim dividend payment for FY20 that was cancelled in March 2020. The cancelled interim dividend was 5.4 pence per share. The decision over the final dividend payment for FY20 would be announced in October 2020. However, the reinstatement of dividend is dependent on no further disruption in the market conditions.

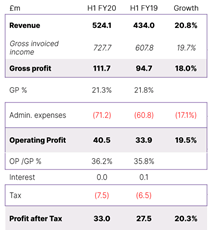

H1 FY2020 results (ended 31 January 2020) as reported on 17 March 2020

(Source: Company website)

In H1 FY20, the gross invoiced income increased by 19.7 percent year on year to £727.7 million from £607.8 million in H1 FY19. The invoiced income was driven by demand for cloud computing and digital transformation. Softcat generated revenue of £524.1 million in H1 FY20, which increased by 20.8 percent year on year from £434.0 million in H1 FY19. The operating profit increased from £33.9 million in H1 FY19 to £40.5 million in H1 FY20. The earnings per share were 16.7 pence. The cash conversion was 100 percent. During the reported period, the customer base grew by 4.2 percent year on year, and the average gross profit per customer increased by 12.2 percent year on year. As on 31 January 2020, Softcat had cash of £49.4 million.

Performance by Segment in H1 FY2020

Software division reported revenue of £252.9 million in H1 FY20, which increased by 25.9 percent year on year from £200.9 million in H1 FY19. Hardware segment revenue was up by 12.2 percent year on year from £195.0 million in H1 FY19 to £218.8 million in H1 FY20. Services division revenue was £52.4 million in H1 FY20, which grew by 37.5 percent year on year from £38.1 million in H1 FY19.

Strategy update of Softcat

(Source: Company website)

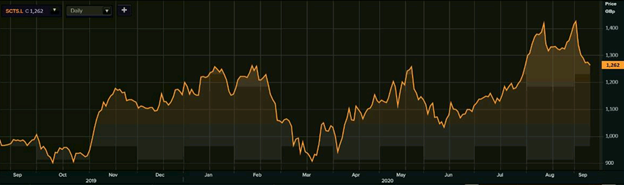

Share Price Performance Analysis

1-Year Chart as on September-10-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Softcat PLC's shares were trading at GBX 1,262.00 and were down by close to 0.86 percent against the previous closing price (as on 10 September 2020, before the market close at 1:00 PM GMT+1). SCT's 52-week High and Low were GBX 1,464.00 and GBX 832.17, respectively. Softcat had a market capitalization of around £2.53 billion.

Business Outlook

Softcat is confident about the resilience of its business model in the current situation. It has a substantial liquidity headroom and does not have any debt of the balance sheet. It would continue to invest in the business and drive growth over the long-term. The Company is hopeful over the cash generation and its ability to reinstate the cancelled dividend.

Kainos Group PLC (LON:KNOS) - No final dividend for FY2020

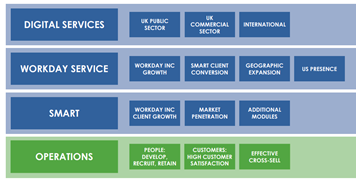

Kainos Group PLC is a UK based technology company that provides digital services and digital platforms. The Company is partner of Workday Inc and it responsible for Software as a Service (SaaS) platform. The Company has eleven offices in Europe and the US.

Trading update for FY2021 as reported on 3 September 2020

The Company stated that its business performance was steady as it was supported by existing customers and revenue from diverse end markets. Digital Services segment was underpinned by the demand from the Public sector and National Health Service. New consulting contracts supported Workday Practice division. An automated testing platform, Smart, drove growth and new client win. As on 24 July 2020, Kainos Group had net cash of £62 million and did not have any debt on the balance sheet. The Company did not declare the final dividend for FY20, but it announced a special dividend of 6.7 pence per share for FY20. During the lockdown, the Company continued to provide important service such as NHS home testing service, Concardis smart pay in Germany and Workday deployment in Denmark. Kainos Group availed the job retention scheme of the UK Government, but it has decided to pay back the payments related to government support.

FY2020 results (ended 31 March 2020) as reported on 26 May 2020

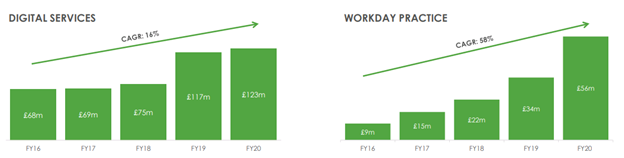

(Source: Company website)

The Company generated revenue of £178.8 million in FY20, which increased by 18 percent year on year from £151.2 million in FY19. The gross profit was £83.9 million in FY20, which improved from £69.1 million in FY19. The earnings per share increased from 13.9 pence in FY19 to 15.1 pence in FY20. The sales orders increased by 42 percent year on year to £243.6 million in FY20. The Company had a backlog of £180.0 million in FY20. As on 31 March 2020, Kainos Group had cash of £40.8 million. Based on the business segment, Digital Services division revenue was £122.5 million, which increased by 4 percent year on year. Workday Practice revenue was £56.3 million, and it grew by 66 percent year on year.

Growth drivers for the Company

(Source: Company website)

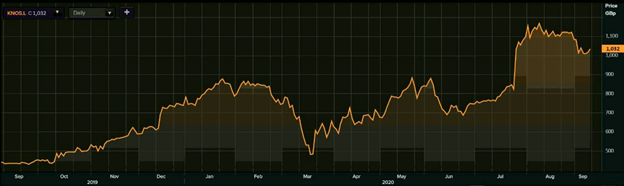

Share Price Performance Analysis

1-Year Chart as on September-10-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Kainos Group PLC's shares were trading at GBX 1,032.00 and were up by close to 1.78 percent against the previous closing price (as on 10 September 2020, before the market close at 1:00 PM GMT+1). KNOS's 52-week High and Low were GBX 1,198.00 and GBX 415.53, respectively. Kainos Group had a market capitalization of around £1.24 billion.

Business Outlook

Kainos Group stated that based on the current performance, the results for FY21 is in line with the expectation. The Company highlights that it has a strong pipeline and backlog; however, it is mindful of the current economic situation. The performance of the Company is supported by clients such as the UK Public sector, NHS and Workday division.