Summary

- Penny stocks are either traded below the value of £1 per share or have very low share prices

- Characterised by high volatility, penny stocks may pose possibility of significant growth

The uncertainty posed by the coronavirus-led pandemic has crippled the hopes of many people investing in the stock market, especially the small investors. Due to high volatility, many investors are opting for penny stocks which do not require large sums of money as investment. However, the penny shares are suitable only for people with a higher appetite for risk as they are much more volatile than traditional blue-chip stocks and liquidity levels are often quite low.

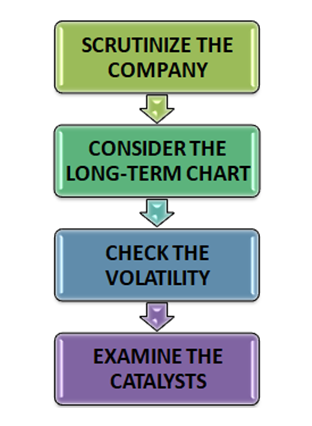

Things to keep in mind before opting to invest in penny stocks

Let us now analyse 5 best penny stocks that have been able to generate a good percentage of return. Let’s have a look:

Alien Metals Ltd: 1 year return - 1,166.67 per cent

An exploration and development company, Alien Metals Ltd (LON: UFO) has a total assets of US$1.6 million (2019: US$1.2 million) and the cash position of the company stood at US$0.7 million (2019: US$0.4 million) for H1 2020 ending 30 June.

Alien Metals has recently acquired a 200 plus sq km exploration property in the northern Greenland region. The company has completed recent field work at Hamersley Iron Ore projects with 95 samples taken and more detailed mapping.

The company’s one-year return (from 26 October 2019 to 26 October 2020) was recorded to be a whooping 1166.67 per cent.

On 27 October, at the time of writing, 10:09 AM, UFO shares were trading at GBX 1.73, down by 9.21 per cent against the previous day closing price of GBX 1.90. The year-to-date return (from 1 January 2020 till 27 October 2020 at the mentioned time) on price of 763.64 per cent was recorded by the company.

Do Read: Alien Metals Reveals Autumn Exploration Plans

Redx Pharma plc: 1 year return - 812.25 per cent

Pharmaceutical company Redx Pharma plc’s (LON:REDX) cash position stood at £1.9 million (31 March 2019 £3.3 million) for six months ending 31 March.

The company had generated new revenue of £1.2 million with the announcement of a new research collaboration with Jazz Pharmaceuticals in order to discover and develop two targeted cancer therapies.

Dr. Jane Robertson has been appointed by Redx Pharma as the new chief medical officer, who will be taking charge from 1 March 2021.

On 27 October, at the time of writing, 10:31 AM, REDX shares were trading at GBX 69.90, up by 3.56 per cent against the previous day closing price of GBX 67.50. The year-to-date return on price of 743.75 per cent was recorded by the company.

Eurasia Mining plc: 1 year return - 1,571.35 per cent

Mineral exploration company Eurasia Mining PLC (LON:EUA) recorded a revenue of £48,012 (30 June 2019 £13,316) for six months ending 30 June. The company’s Definitive Feasibility Study for the West Kytlim's resources is on schedule and the new Tipil license Area (24.5 square kilometre) is aimed at further increasing the life of mine.

Eurasia Mining has also announced the appointment of James Nieuwenhuys as the Chief Executive Officer and Executive Director.

On 27 October, at the time of filing the report, EUA shares were trading at GBX 28.55, down by 4.20 per cent against the previous day closing price of GBX 29.75. The year-to-date return on price of 704.05 per cent was recorded by the company.

7digital Group plc: 1 year return - 594.44 per cent

UK-based B2B digital music and radio service company 7digital Group plc (LON:DIG) commenced the operations of FY 2020 on a positive note with new contract wins, contract renewals and a strong pipeline.

The company recorded an increase of 66 per cent in the gross margin (H1 2019: 64 per cent) in H2 2020 for the period ending 30 June.

Later in August, 7digital announced a deal with Triller to enable a social music video application. It also partnered with eMusic to launch virtual concerts etc.

On 27 October, at the time of writing, 7DIG shares were trading at GBX 1.28, up by 2.00 per cent against the previous day closing price of GBX 1.25. The year-to-date return on price of 657.58 per cent was recorded by the company.

Maestrano Group plc: 1 year return - 720.00 per cent

Software company Maestrano Group plc (LON:MNO) witnessed strong growth in the core Airsight business units, Corridor and Nextcore with the cash position standing at £1,584,891 on 30 June.

The Airsight division’s standalone revenue for the period for the full year grew 68 per cent (74 per cent in constant currency). The group also announced the appointment of Nicholas Smith as its CEO of Maestrano, who would take charge on 11 January 2021.

On 27 October, at the time of writing, MNO shares were trading at GBX 10.00, down by 2.44 per cent against the previous day closing price of GBX 10.25. The year-to-date return on price of 540.63 per cent was recorded by the company.

Also Read: Which Penny Stocks To Look For In The Current Situation?

As we know, penny stocks are very volatile in nature and can also generate catastrophic losses. Hence, it should be the investor’s responsibility to keep this in mind before making trading decisions. Decisions regarding investing should always be based on skilled analysis and risk management.