As the UK braces up for a relaxed lockdown from 4th July 2020, the Prime Minister latest tweet asked the citizens to stay vigilant and to maintain social distancing. The Prime minister also said that the UK is ready to leave the European Union “on Australian terms” if no conclusion on the future deal is reached.

Meanwhile, the London markets’ surged on 29th June 2020 (before the market close). The following factors can also dominate the market today:

- As per the data from the Bank of England, mortgage approvals in Britain plunged to the lowest on record in May, reflecting the massive hit to the housing market from the coronavirus lockdown.

- Britain’s government has ramped up the bond issuance and intend to sell GBP 275 billion of government debt between April to August.

Given the recent developments, we will discuss two stocks - Goco Group PLC (LON:GOCO) and Studio Retail Group PLC (LON:STU). As on 29th June 2020 (before the market close at 11.27 AM GMT+1), the stock price of GOCO was down by 2.02 per cent whereas STU was down by 0.45%, against the previous day closing price. Let’s go through their operational and financial updates.

Goco Group PLC (LON:GOCO) – Growth propelled by AutoSave, likely to reach 460,000 customers by the end of June

Goco Group PLC is into the business of online price comparison. The Group operates under three business segments, namely Price Comparison, Rewards and Autosave. In the price comparison segment, Goco operates GoCompare, a website for price comparison of financial services, utilities and home services. Autosave brands include ‘We flip’ and ‘Look after my bills’.

Q1 FY2020 Update (for the three months period ended 31st March 2020) as reported on 21st April 2020

The price comparison business generated revenue of GBP 36.1 million, up by 1% year on year. The AutoSave business added GBP 4.2 million, and the growth was almost double compared to the same period last year. Autosave now constitutes 10% of the total Group revenue. Rewards reported revenue of GBP 1.2 million down by 29% year on year, as multiple industries suspended their marketing activity. Still, there were few industries, such as home & garden retailers and homeware retailers who used the channel for marketing.

A Shift in Consumer Dynamics - The visitor volume on the price comparison website declined, and customers switched to social media and entertainment platforms to spend time during lockdown. Because of the distressing situation, customers went for auto-renewal, suspension or lapse of their existing policies and deferred the use website for price comparison and buying new products.

Balance Sheet Headroom

As on 31st March 2020, the Group had a cash balance of GBP 27.4 million and an undrawn revolving credit facility of GBP 22.0 million. Given the strength of the balance sheet, GOCO did not seek any final assistance from the government. The Group will pay a final dividend of 0.5 pence per share for FY2019.

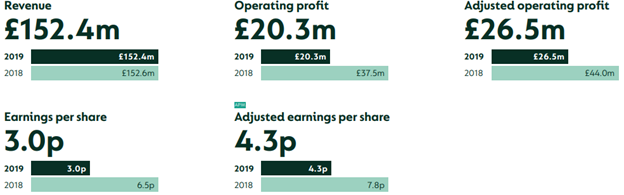

KPIs for FY2019

(Source: Company Website)

Trading Update as Reported on 3rd June 2020

Autosave is likely to have more than 460,000 customers by the end of June. In April the domestic energy service switching was down by 29% year on year. The marketing expense of the Group was in line with the previous guidance provided. Goco explored Direct response television (DRTV) to expand customer outreach in May. The car insurance search volume on Google dropped by around 25% post-lock-down in the period from 21st March 2020 to 18th April 2020; however, the search volume improved in May. The motorbike insurance search volumes also grew in May. The Group has currently suspended their travel insurance price comparison until the UK’s travel guidance is received.

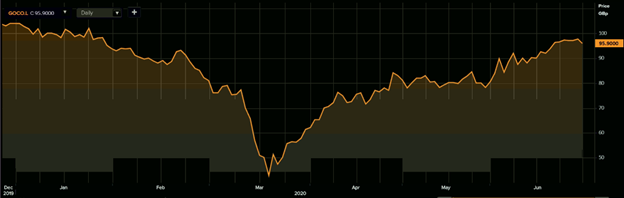

Share Price Performance

1-Year Chart as at June-29-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Goco Group PLC shares were trading at GBX 95.90, on 29th June 2020 (before the market close at 12.02 PM GMT+1). Stock 52 week High and Low were GBX 107.60 and GBX 42.80, respectively. The Company had a market capitalization of GBP 411.29 million.

Business Outlook

The Group experienced fundamental changes in the consumer preferences post-lockdown, but they expect that to return to normal in some time. The Group wants to change how people save their money and want consumers to come out of loyalty pricing trap. The Group expects the purchase of insurance policies to bounce back in some time. Goco is fully equipped to meet changing customer preference and thus confident of generating positive cash flow despite challenging conditions.

Studio Retail Group PLC (LON:STU) – Sale of Findel Education reaches Phase 2 review

Studio Retail Group PLC (formerly known as Findel PLC) is an Online Retail Company based in Accrington, Lancashire. The Company sells clothing, gifts, toys and home items on the online platform under the Studio brand. The Company also provides a credit option to the buyers shopping on the website. Studio Retail was founded in the year 1962, and the Company is listed on the FTSE-All Share index.

Trading Update as Reported on 19th June 2020

The sales of Studio were up by 55 per cent in eleven weeks since 31st March 2020 compared to the same period last year. The sales were driven by strong demand for products such as toys, games, electricals, fitness and garden products. The Company believes that it has catered close to 2 million customers based on rolling 12-months, which include new and repeated customers. The Company has slashed the marketing expense and has rolled back advertisements broadcasted on television and media channels post-lock-down as traffic on the websites are well ahead of the last year.

The Company had clarified Findel Education as a discontinued operation for reporting purpose and stated that the demand for educational resources was subdued due to the closure of the schools. The sales of products under Findel Education in June were close to half of what the Company did in the same period last year.

Liquidity Position

As on 12th June 2020, the Company had a net debt of GBP 30.0 million which was GBP 52.3 million at the end of March 2020. The net debt was reduced as a result of better cash flow due to good Studio sales and further supported by a cut in discretionary expenses. The Company had a credit facility of close to GBP 55.0 million.

Sale of Findel Education

The Company entered into a conditional agreement with Yorkshire Purchasing Organisation (YPO) for sale of Findel Education for a gross proceed of GBP 50 million. The announcement about the deal was made on 16th December 2019, and the transaction was expected to be complete by April 2020 pertaining to shareholder approval. The sale which is currently being reviewed by the Competition and Markets Authority (CMA) has reached Phase 2 of review. The transaction was delayed due to the COVID-19 situation.

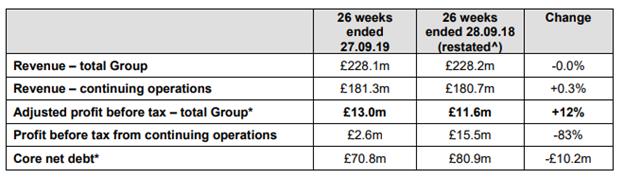

Financial Summary – H1 FY2020

(Source: Company Website)

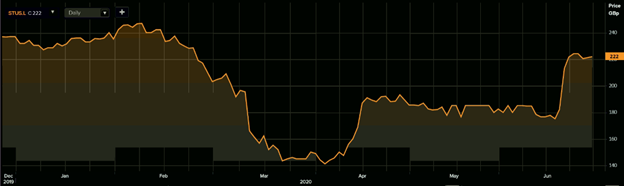

Share Price Performance

1-Year Chart as at June-29-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Studio Retail Group PLC shares were trading at GBX 222.00 per share on 29th June 2020 (before the market close at 11.52 AM GMT+1). Stock 52 week High and Low were GBX 257.00 and GBX 140.00, respectively. The Company had a market capitalization of GBP 191.04 million.

Business Outlook

The Company has refrained from providing guidance for FY2021. The exact timing for completion of the sale of Findel education is uncertain; however, the Company expects the transaction to be completed by August 2020. The Company will continue to focus on becoming a leading digital value retailer. The Company is confident of meeting any change in the online retail demand, considering the difference in the customer behavioural change. The studio provides credit option to the buyers, the customer repayment remained strong since lockdown, but customer payment may worsen going forward if people lose the job.