Highlights

- Hurricane Energy’s revenues from four liftings of Lancaster crude stood at $124.5 million for H1 2021 ended 30 June, compared to $81.9 million from seven liftings in H1 2020.

- ValiRx research and developments cost was £166,500 for H1 2021 compared to £99,879 in H1 2020.

AIM stocks are small-cap stocks with a possibility of offering a high return. Investors have been actively seeking out interesting investment opportunities on this platform post the pandemic. There are many stocks from varied industry segment that have offered robust returns to the AIM investors.

AIM stocks with over 100% return at a discount: Buy alert?

Pharma shares such as ValiRx gained from the progression of research and drug development activities. While small-cap oil and gas stocks such as Hurricane Energy benefited from the reopening of the economy.

Let us discuss the investment prospect of 2 AIM listed stocks - Hurricane Energy and ValiRx, which returned over 100% to shareholders in the last one year and are trading lower today.

(Data source: Refinitiv)

Hurricane Energy Plc (LON: HUR)

Hurricane Energy is an oil and gas exploration and production company. It is mainly focused on hydrocarbon resources in fractured basement reservoirs. In H1 2021, the company’s crude oil production from the Lancaster field was 2,004 Mbbl in H1 2021 compared to 2,658 Mbbl in H1 2020. As of 12 October 2021, Lancaster produced 10,450 bopd from the P6 well.

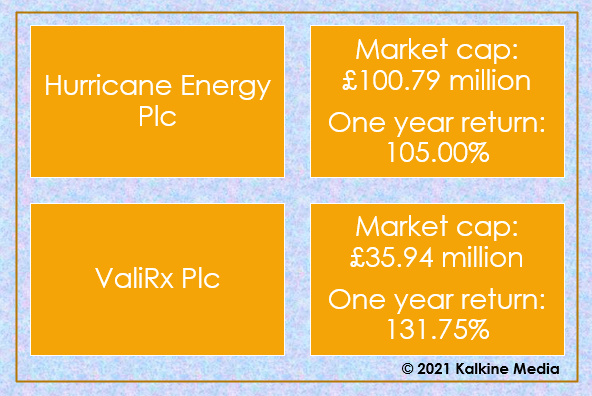

The shares of Hurricane Energy are trading at GBX 4.80, down by 5.10% at 11:15 AM BST on Thursday, 28 October 2021. The market cap of the company currently stands at £100.79 million, and the shares of the company gave a return of 105.00% to shareholders in the last one year.

For H1 2021 ended 30 June, Hurricane Energy’s revenues from four liftings of Lancaster crude stood at $124.5 million compared to $81.9 million from seven liftings in H1 2020. The company recorded a profit after tax of $42.8 million in H1 2021 compared to a loss after tax of $307.8 million in H1 2020.

Hurricane Energy announced annual production guidance of 8,500 - 10,500 bopd for 2021.

ValiRx Plc (LON:VAL)

ValiRx is a life science firm focused on the development of therapeutics targeted at women’s health and early-stage cancer. The company inked an evaluation agreement with a leading university in London to investigate the treatment of Triple Negative Breast Cancer. Under the agreement, ValiRx will conduct preclinical tests on the drug candidate for nine months to determine its viability for commercialisation.

The shares of Valirx are trading at GBX 53.25, down by 3.62% at 11:27 AM BST on Thursday, 28 October 2021. The market cap of the company currently stands at £35.94 million, and the shares of the company gave a return of 131.75% to shareholders in the last one year.

The research and development costs of ValiRx was £166,500 for H1 2021 compared to £99,879 in H1 2020. Its loss before taxation was £785,434 in H1 2021 compared to £884,523 in H1 2020. The total loss for the period was recorded as £743,178 compared to £805,082 loss in the previous year.