US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 3.30 points or 0.07 per cent higher at 4,432.40, Dow Jones Industrial Average Index surged by 116.15 points or 0.33 per cent higher at 35,180.40, and the technology benchmark index Nasdaq Composite traded lower at 14,820.30, down by 74.80 points or 0.50 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after the release of US employment data. Among the gaining stocks, DraftKings (DKNG) shares rose by about 1.44% after the sports betting Company had raised the full-year revenue guidance. Canopy Growth (CGC) shares grew by about 0.11% after reporting unexpected quarterly profit boosted by growing marijuana demand. Among the declining stocks, Novavax (NVAX) shares went down by around 18.54% after the Company stated that it would delay seeking emergency use authorization for the Covid-19 vaccine until the fourth quarter. Beyond Meat (BYND) shares dropped by about 0.75% after the Company reported a wider-than-expected quarterly loss.

UK Market News: The London markets traded on a mixed note after the release of the UK housing data. According to the latest survey from Halifax, the average house prices had witnessed a modest growth of around 7.6% on an annual basis during July 2021. Moreover, it got ticked up by approximately 0.4% during July 2021 when compared with the prior month.

FTSE 100 listed London Stock Exchange Group shares surged by about 5.54% after the Company had reported remarkable growth of more than 100% in first-half profit. Moreover, the Company got benefitted from the synergies achieved through the acquisition of Refintiv.

Hikma Pharmaceuticals shares plunged by around 6.21%, despite showing decent growth in top-line revenue and bottom-line profitability during the first half. Furthermore, the Company had raised full-year guidance.

FTSE 250 listed ContourGlobal had raised the full-year guidance after reporting a significant increase in the first-half revenue and adjusted EBITDA. Furthermore, the shares grew by around 0.51%.

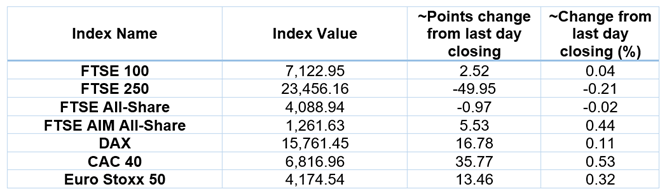

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 6 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Financials (+1.82%), Utilities (+0.55%) and Basic Materials (+0.37%).

Top 3 Sectors traded in red*: Healthcare (-1.48%), Real Estate (-1.16%) and Industrials (-1.01%).

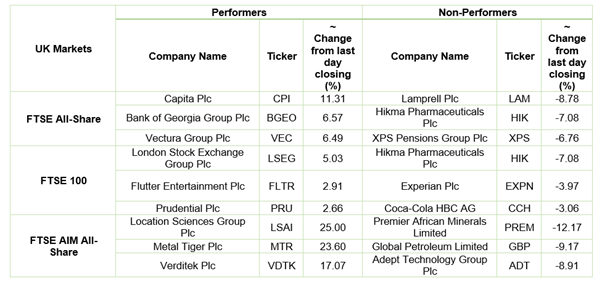

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $70.73/barrel and $68.30/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,764.85 per ounce, down by 2.44% against the prior day closing.

Currency Rates*: GBP to USD: 1.3874; EUR to GBP: 0.8478.

Bond Yields*: US 10-Year Treasury yield: 1.285%; UK 10-Year Government Bond yield: 0.6120%.

*At the time of writing