Devro PLC

Devro Plc (LON: DVO) is a United Kingdom-based manufacturer and distributor of collagen products which is used in the food industry. The company operates in the Americas, Asia-Pacific and Europe segments. The company's products mainly used in the sausage preparation of different varieties. It sells its products directly and via agents to the food companies. The company's products include edible casings, non-edible casings, and plastics. Devro is among the leading suppliers of collagen. Devro has an employee strength of around 2,000 people. Over 100 staff communicate with more than 1,000 customers on a daily basis, providing technical advice and support for food manufacturing operations in more than 100 countries.

DVOâ News Updates

On 12th December 2019, the company announced that Dr Paul Withers, a Non-Executive Director of the Company, has been appointed a Non-Executive Director of Tyman Plc with effect from 1 February 2020.

DVOâ Trading Update

On 22nd October 2019, the company announced its trading update and outlook for the company. The companyâs sales improved during Q3 2019 with 1% volume growth in collagen casings against -1 per cent in H1 FY2019 due to good trading in North America, where it has benefited from the continued growth in snacking categories, and in China, due to continued strong growth albeit at margins below the average for the Group. In Europe, a further deterioration in market conditions caused declined in sales. The company also witnessed weaker than expected sales in Japan due to the challenging market and economic slowdown. The company expected recovery of volume growth in Q4 2019 with full-year volume growth expected at 1%. The company expected to achieve its guidance of £7 million volume in FY 2019. It expected the net debt to underlying EBITDA ratio to be around 2x at the end of FY2019.

DVO-Stock price performance

Daily Chart as on 27th December 2019, before the market closed (Source: Thomson Reuters)

On December 27th, 2019, Devro PLC shares were trading at GBX 172.95 at the time of writing before the market close (at 10:40 AM GMT), up by 3.60 per cent against the last day closing price. Stock's 52 weeks High and Low are GBX 223.08/GBX 152.80. The stock price has delivered 5.84 per cent return in the last one year, and negative 14.56 per cent return in the last three months.

The company made its 52-week high of GBX 223.08 on 4th July 2019 and made its 52-week low of GBX 152.80 on 4th November 2019.

The average volume of the Devro Plc shares is 121.32 thousand, and it has a market cap of GBP 278.14 million.

ContourGlobal Plc

ContourGlobal PLC (GLO) is a power generation company with operations in 18 countries across three core regions, namely Europe, Latin America and Sub-Saharan Africa. The company seeks to acquire wholesale power generation projects with a long-term contract diversified across fuel types and develop those through applying technical and management expertise in traditional and innovative technologies. The company is a growth platform for power generation projects and has a strong track record of creating value through developing greenfield assets.

GLOâ News Updates

On 16th December 2019, the company announced the currency conversion rate for the third-quarter 2019 Dividend. The sterling equivalent of the announced Third Quarter dividend, of 3.6901 US cents per share, will be 2.8047 pence per share, based on an exchange rate of £1 = US$1.31570.

On 2nd December 2019, the company announced that John Smelt would be their new Senior Vice President Investor Relations.

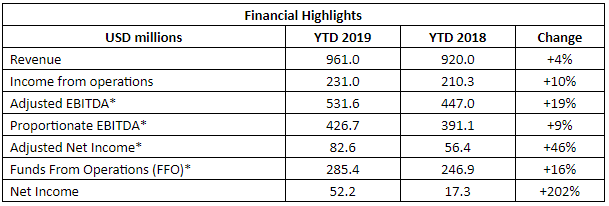

GLO â Financial Highlights Nine Months Financial year 2019

(Source: Interim Report, Company Website)

During the nine months of the FY2019, the companyâs revenue grew by 4 per cent to $961 million as compared to the same period in the FY2018 due to the impact of the Spanish Concentrated Solar Power ("CSP") acquisition. Adjusted EBITDA increased by 19 per cent to $531.60 million against $447 million in the same period of FY2018. Income from operations grew by 10 per cent to $231 million against the same period in FY2018 due to lower acquisition costs. Quarterly dividend as declared by the company stood at 3.6901 cents per share. The Company expected the 2019 full-year Adjusted EBITDA to be below the bottom end of the earlier given guidance of $720-$770 million.

GLO â Stock price performance

Daily Chart as on 27th December 2019, before the market closed (Source: Thomson Reuters)

On December 27th, 2019, ContourGlobal Plc shares were trading at GBX 199.40 at the time of writing before the market close (at 11:40 AM GMT), down by 0.8 per cent against the last day closing price. Stock's 52 weeks High and Low are GBX 226.50/GBX 155.80. The stock price has delivered 12.10 per cent return in the last one year, and 9.36 per cent return in the last three months.

The company made its 52-week high of GBX 226.50 on 4th November 2019 and made its 52-week low of GBX 155.80 on 5th August 2019.

The average volume of the ContourGlobal Plc shares is 182.49 thousand, and it has a market cap of GBP 1.34 billion.

Â

Avon Rubber Plc

Avon Rubber Plc (LON: AVON) is a technology group, which designs and manufactures products and services for its customers. The company operates in Chemical, Biological, Radiological and Nuclear (âCBRNâ) and milking point solutions. The company mainly has two businesses Avon Protection and milkrite InterPuls. Avon protection is used by military and fire markets. It is an advanced system used for CBRN respiratory protection. The milkrite InterPuls is providing solutions related to complete milking point to farmers across the world.

AVON â News Updates

On 23rd December 2019, the company announced that it had received approval to close the acquisition of 3M's ballistic protection business from the Committee on Foreign Investment in the United States.

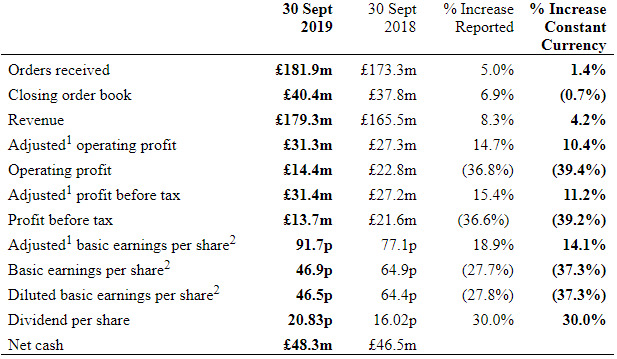

AVON â Financial Highlights Financial year 2019

(Source: Interim Report, Company Website)

During the financial year 2019, the companyâs revenue grew by 4.2% to GBP 179.3 million as compared to GBP 165.5 million in FY2018 due to an excellent growth across its military business. Operating profit and basic earnings per share declined by 36.8 per cent and 27.7 per cent on reported basis, respectively due to the Fire SCBA exit and acquisition costs. Avonâs Protection revenue accelerated by around 5.9% with Military revenue surged by 26.1%. Total order received was up by 5 per cent on a reported basis from GBP 173.3 million in FY2018 to GBP 181.90 million in FY2019. The company declared a dividend of 20.83p in FY2019 as compared to 16.02p in FY2018, up by 30 per cent.

AVONâ Stock price performance

Daily Chart as on 27th December 2019, before the market closed (Source: Thomson Reuters)

On December 27th, 2019, Avon Rubber Plc shares were trading at GBX 2,100 at the time of writing before the market close (at 12:40 PM GMT), down by 2.33 per cent against the last day closing price. Stock's 52 weeks High and Low are GBX 2,295/GBX 1,050. The stock price has delivered 79.17 per cent return in the last one year, and 24.71 per cent return in the last three months.

The company made its 52-week high of GBX 2,295 on 27th December 2019 and made its 52-week low of GBX 1,050 on 31st January 2019.

The average volume of the Avon Rubber Plc shares is 33.70 thousand, and it has a market cap of GBP 667 million.