Global Markets: Equity indices at the Wallstreet were zooming in green, with the Dow Jones Industrial Average Index tops 27,000 and added approximately 190.99 points or 0.71% and quoting at 27,051.19, the S&P 500 index added 7.0 points or 0.24% and quoting at 3,000.17 and the technology benchmark index Nasdaq Composite surged by 16.31 points or 0.20% and quoting at 8,218.12 respectively, at the time of writing.

Global News: Following dovish remarks by Fed chief Jerome Powell, investors raised their expectations of a rate cut, helping S&P 500 to hover around near record highs on Thursday and the Dow Industrials to cross 27,000 points for the first time. Core consumer price index rose 0.3% last month, the most in nearly 1-1/2 years, while weekly jobless claims fell by 13,000 to 209,000. The rise in inflation was brushed aside by bond investors as it did not change investorsâ expectation of rate cut.

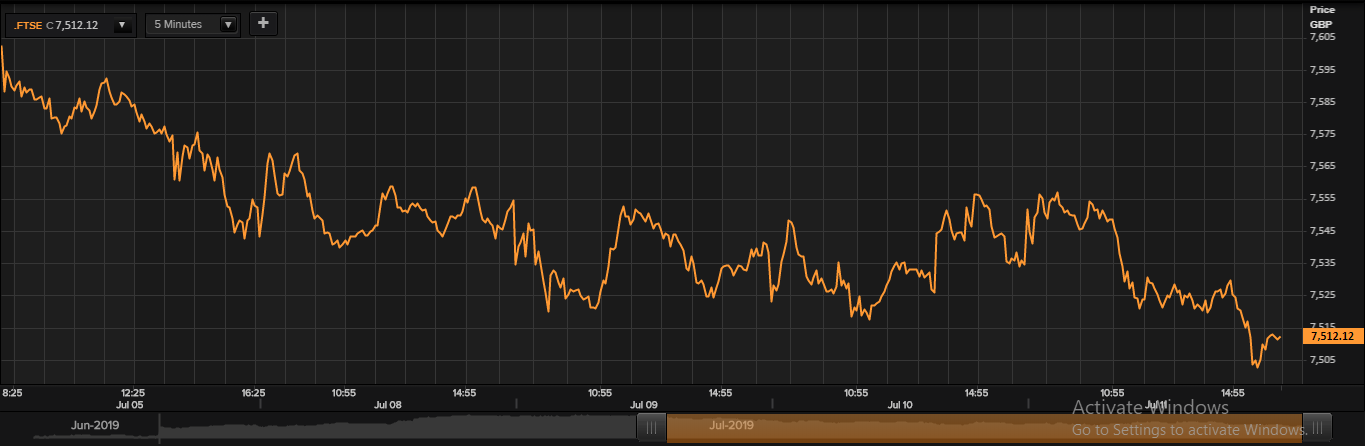

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 20.87 points or 0.28% lower at 7,509.82, the FTSE 250 index snapped 23.78 points or 0.12% higher at 19,443.16, and the FTSE All-Share Index ended 8.38 points or 0.20% lower at 4,093.50 respectively. Another European benchmark index STOXX 600 ended 0.45 points or 0.12% lower at 386.70 respectively

European News: Escalating the already strained relations between Iran and the West, British Navy warships confronted three Iranian vessels which were trying to block an oil tanker operated by BP from passing through the Strait of Hormuz, a charge Iran denies. Bank of England Governor Mark Carney said on Thursday that although economy would not be unscathed if the country left the European Union without a transition agreement, British banks hold enough capital to deal with a no-deal Brexit and a global trade war simultaneously.

London Stock Exchange (LSE)

Top Performers Stocks: THOMAS COOK GROUP PLC (TCG), DIPLOMA PLC (DPLM), and PORVAIR PLC (PRV) surged by 10.40 per cent, 8.05 per cent and 6.86 per cent respectively.

Top Laggards Stocks: MCBRIDE PLC (MCB), OCADO GROUP PLC (OCDO), and PALACE CAPITAL PLC (PCA) decreased by 12.18 per cent, 6.17 per cent and 6.15 per cent respectively.

FTSE 100 Index

FTSE100 Index: 5-days Price Chart (as on July 11, 2019), after the market closed. (Source: Thomson Reuters)

Top Risers Stocks: BARRATT DEVELOPMENTS PLC (BDEV), RECKITT BENCKISER GROUP PLC (RB.) and SMITH (DS) PLC (SMDS) rose by 5.17 per cent, 2.52 per cent and 1.98 per cent respectively.

Top Fallers Stocks: OCADO GROUP PLC (OCDO), JUST EAT PLC (JE.) and EVRAZ PLC (EVR) reduced by 6.17 per cent, 2.25 per cent and 2.11 per cent respectively.

Top Active Volume Leaders: LLOYDS BANKING GROUP PLC, VODAFONE GROUP PLC, and BT GROUP PLC.

Top Risers Sectors: Telecommunications Services (+0.17%) and Industrials (+0.08%).

Top Fallers Sectors: Healthcare (-1.06%), Utilities (-0.85%) and Basic Materials (-0.66%).

Recent News

The recent rally in Bitcoin which was fuelled by a renewed interest in bitcoin and cryptocurrencies has come to a halt after Federal Reserve Chairman Jerome Powell flagged concerns regarding the plan by Facebook to build a digital currency called Libra. He said that until serious concerns are addressed, the currency cannot go forward, urging a careful look at it.

British consumer goods company Reckitt Benckiser agreed to pay a $1.4bn fine to settle investigations by the Department of Justice and the Federal Trade Commission into sales and marketing of Suboxone Film, an opioid-based drug. While the settlement is higher than the $400 million the company had set aside, the stock rose by 2.52 per cent as investors anticipate it will allow the company to focus on its turnaround plan.

Foreign Exchange and Fixed Income

FX Rates*: GBP/USD and EUR/GBP were exchanging at 1.2527 and 0.8988 respectively.

10-Year Bond Yields*: US 10Y Treasury and UK 10Y Bond yields were trading at 2.117% and 0.837% respectively.Â

*At the time of writing